Nomination Facility MCQs

Nomination Facility MCQs – Nominating a family member as a nominee for a bank account is referred to as bank account nomination. This is typically done to make sure that, in the terrible case of the account holder’s passing, the funds in the account are in the possession of the successor that the account holder has designated. According to the law, updating a nominee is not required. To further comprehend the subject, let’s look at some multiple-choice questions about nomination in bank accounts.

Download Nomination Facility MCQs with Case Study E-book:

How to Download Nomination Facility MCQs with Case Study E-book?

Step 1: Click on the download link. You will be redirected to Oliveboard’s FREE E-Books Page.

Step 2: Create a free Oliveboard account or login using your existing Oliveboard account details

Step 3: Download the book by clicking on the link presented on the page.

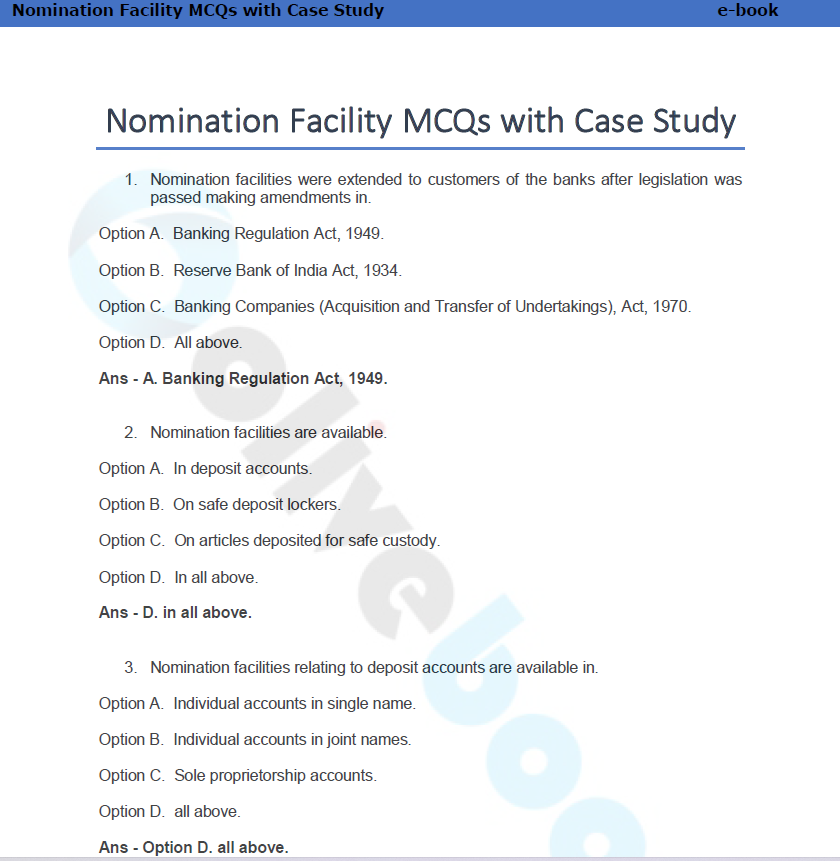

Sneak Peak into E-Book:

What’s there in the Nomination Facility MCQs with Case Study E-Book?

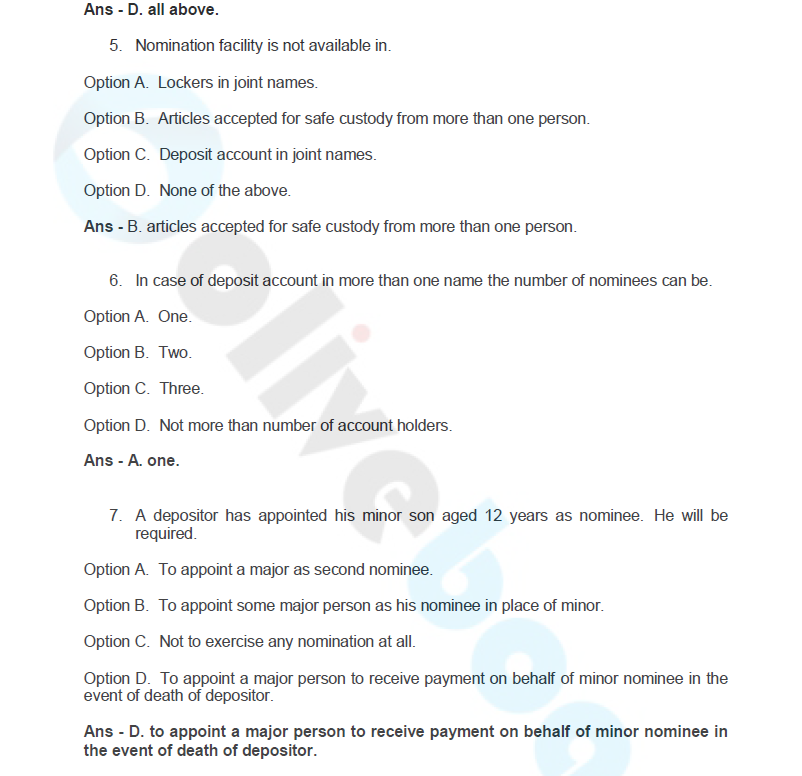

- Nomination facility is not available in.

Option A. Lockers in joint names.

Option B. Articles accepted for safe custody from more than one person.

Option C. Deposit account in joint names.

Option D. None of the above.

Ans – B. articles accepted for safe custody from more than one person.

2. In case of deposit account in more than one name the number of nominees can be.

Option A. One.

Option B. Two.

Option C. Three.

Option D. Not more than number of account holders.

Ans – A. one.

3. A depositor has appointed his minor son aged 12 years as nominee. He will be required.

Option A. To appoint a major as second nominee.

Option B. To appoint some major person as his nominee in place of minor.

Option C. Not to exercise any nomination at all.

Option D. To appoint a major person to receive payment on behalf of minor nominee in the event of death of depositor.

Ans – D. to appoint a major person to receive payment on behalf of minor nominee in the event of death of depositor.

4. A minor above the age of 15 years opened his individual savings account in his single name. in this account nomination facility is:

Option A. Not available as a minor cannot appoint an agent.

Option B. Available as minor has completed 14 years of age.

Option C. Available only if his father indemnifies the bank.

Option D. All of the above

Ans – A. not available as a minor cannot appoint an agent.

5. A literate depositor has exercised nomination in favour of his cousin. This nomination requires.

Option A. No objection certificate from his legal heirs.

Option B. Attestation by notary public.

Option C. Attestation by two witnesses.

Option D. None of the above.

Ans – D. none of the above.

6. A deposit was accepted with instructions ‘either or survivor ‘from two depositors A and B. A died before due date. B approaches the bank to cancel nomination earlier exercised by them. In this case:

Option A. Nomination once exercised is irrevocable.

Option B. It can be allowed as survivor can cancel, change or even exercise fresh nomination.

Option C. Nomination can‘t be cancelled as it requires consent of both the depositors.

Option D. All of the above

Ans – B. it can be allowed as survivor can cancel, change or even exercise fresh nomination.

- RBI SO Syllabus and Exam Pattern 2025 for Grade A and B

- RBI SO Eligibility 2025, Check Qualification & Age Limit

- RBI SO Exam Date 2025, Check Phase 1 Schedule for Grade A/B

- RBI SO Apply Online 2025 Before 31st July for 28 Vacancies

- RBI SO Notification 2025 Out for 28 Vacancies of Grade A & B

| What is DEST and CPT in SSC CGL | SSC CGL Age Calculator |

| Bihar LRC Recruitment 2023 | RBI Grade B Study Material 2023 |

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!