JAIIB RBWM Mini Mock Test

The JAIIB RBWM Mini Mock Test is a important part of preparation for candidates aspiring to clear the Junior Associate of Indian Institute of Banking (JAIIB) exam. With the October 2024 JAIIB exam approaching, it’s essential to utilize effective strategies for mastering the Retail Banking and Wealth Management (RBWM) module. This article provides valuable practice tips, detailed insights, and a structured approach to excelling in the RBWM Mini Mock Test.

What is the JAIIB RBWM Mini Mock Test?

The JAIIB RBWM Mini Mock Test is designed to simulate the actual exam environment, providing candidates with a focused practice opportunity. These tests cover essential topics from the RBWM syllabus, including retail banking services, wealth management strategies, and financial products. Mini mock tests are shorter versions of full-length exams, offering candidates a concentrated format that helps them fine-tune their knowledge and exam-taking strategies.

JAIIB RBWM Mini Mock Test 2024

Mock Test 1: Retail Banking Basics

- What is the primary function of retail banking?

- a) Investment banking

- b) Providing services to individuals and small businesses

- c) Corporate financing

- d) Stock trading

Answer: b) Providing services to individuals and small businesses

- Which of the following is NOT a type of retail loan?

- a) Personal loan

- b) Home loan

- c) Car loan

- d) Corporate loan

Answer: d) Corporate loan

Mock Test 2: Wealth Management Principles

- Which of the following is a key element of wealth management?

- a) Tax planning

- b) Corporate investments

- c) Mortgage loans

- d) Retail savings accounts

Answer: a) Tax planning

- Which investment product is typically used for long-term wealth creation?

- a) Money market funds

- b) Fixed deposits

- c) Mutual funds

- d) Savings accounts

Answer: c) Mutual funds

Mock Test 3: Banking Products and Services

- A credit card primarily provides which of the following?

- a) Loan facility with fixed interest rates

- b) Revolving line of credit for short-term borrowing

- c) Mortgage loan with low-interest rates

- d) A deposit account offering interest

Answer: b) Revolving line of credit for short-term borrowing

- Which of the following is a type of deposit product offered by banks?

- a) Credit card

- b) Certificate of deposit

- c) Personal loan

- d) Car loan

Answer: b) Certificate of deposit

Mock Test 4: Retail Banking Risk Management

- Which of the following is a common risk in retail banking?

- a) Market risk

- b) Credit risk

- c) Liquidity risk

- d) Both b and c

Answer: d) Both b and c

- What is credit risk in retail banking?

- a) The risk that a borrower will default on their loan

- b) The risk of interest rate fluctuations

- c) The risk of currency depreciation

- d) The risk of reduced demand for banking services

Answer: a) The risk that a borrower will default on their loan

Mock Test 5: Wealth Management Regulations

- Which regulatory body is responsible for overseeing wealth management activities in India?

- a) RBI

- b) SEBI

- c) IRDAI

- d) NABARD

Answer: b) SEBI

- What does SEBI regulate?

- a) Stock market and investment products

- b) Retail banking services

- c) Corporate financing

- d) Insurance policies

Answer: a) Stock market and investment products

Mock Test 6: Retail Banking Products

- Which of the following is a short-term borrowing product in retail banking?

- a) Personal loan

- b) Home loan

- c) Overdraft facility

- d) Fixed deposit

Answer: c) Overdraft facility

- What is the primary function of a savings account?

- a) To offer short-term loans

- b) To allow users to save and earn interest

- c) To provide long-term investments

- d) To facilitate stock trading

Answer: b) To allow users to save and earn interest

Mock Test 7: Investment Options for Clients

- Which of the following is the safest investment option in India?

- a) Mutual funds

- b) Fixed deposits

- c) Stock market

- d) Bonds

Answer: b) Fixed deposits

- What is a key feature of a systematic investment plan (SIP)?

- a) High-risk investments

- b) Regular monthly investment in mutual funds

- c) Investment in government securities

- d) One-time lump sum investment

Answer: b) Regular monthly investment in mutual funds

Mock Test 8: Risk Management in Wealth Management

- Which of the following best describes market risk?

- a) Risk of borrower default

- b) Risk of loss due to market fluctuations

- c) Risk from regulatory changes

- d) Risk of fraud in transactions

Answer: b) Risk of loss due to market fluctuations

- Which of the following is an example of diversification in wealth management?

- a) Investing all money in one stock

- b) Investing in a mix of assets such as stocks, bonds, and real estate

- c) Keeping all funds in a savings account

- d) Borrowing for investment purposes

Answer: b) Investing in a mix of assets such as stocks, bonds, and real estate

Mock Test 9: Banking Products and Customer Service

- What is the primary purpose of KYC (Know Your Customer) regulations in retail banking?

- a) To reduce lending risk

- b) To ensure the bank knows the identity of its customers

- c) To increase loan amounts

- d) To provide higher interest rates

Answer: b) To ensure the bank knows the identity of its customers

- Which of the following is NOT a customer service function in retail banking?

- a) Loan disbursement

- b) Customer complaint resolution

- c) Trading stocks

- d) Account opening

Answer: c) Trading stocks

Mock Test 10: Wealth Management Client Needs

- Which factor is most important in determining a client’s risk tolerance in wealth management?

- a) Age and financial goals

- b) Credit score

- c) Job status

- d) Monthly income

Answer: a) Age and financial goals

- What is a key consideration when advising clients on wealth management?

- a) Only high-risk investments

- b) Investment diversity and long-term financial planning

- c) Minimizing investment fees

- d) Short-term profit maximization

Answer: b) Investment diversity and long-term financial planning

Why is the RBWM Mini Mock Test Important?

The JAIIB RBWM Mini Mock Test is an essential tool for students preparing for JAIIB October 2024.

- Targeted Practice: The mini mock tests focus on critical sections of the RBWM syllabus, making it easier for candidates to concentrate on their weaker areas.

- Time Management: By practicing with timed mock tests, candidates can improve their speed and learn to manage exam time effectively.

- Boost Confidence: Regular practice with mini mock tests helps reduce exam anxiety and boosts confidence.

- Identify Strengths and Weaknesses: Mock tests highlight areas where a candidate excels and areas that need improvement, enabling targeted preparation.

Key Topics Covered in JAIIB RBWM Mini Mock Test

To give you a better understanding of what to expect in the JAIIB RBWM Mini Mock Test, here’s a list of the key topics typically covered:

| Section | Topics Covered |

| Retail Banking | Fundamentals of retail banking, loan products, customer service |

| Wealth Management | Investment options, financial planning, mutual funds |

| Risk Management | Types of financial risks, risk mitigation strategies |

| Regulatory Framework | Compliance, RBI guidelines, consumer protection laws |

| Financial Products | Insurance, bonds, fixed deposits, and other investment instruments |

Essential Practice Tips for JAIIB RBWM Mini Mock Test

Maximizing your performance in the JAIIB RBWM Mini Mock Test requires a combination of smart strategies, consistent practice, and thorough knowledge. Follow these tips to enhance your preparation:

1. Understand the Syllabus and Exam Pattern

Before diving into mock tests, ensure you are well-versed in the JAIIB syllabus for RBWM. The October 2024 exam will assess your understanding of banking products, financial services, and investment strategies. Familiarize yourself with the exam pattern, which typically includes multiple-choice questions (MCQs) based on theoretical concepts and practical application.

2. Solve the Mock Tests Regularly

Consistency is key. Set aside time each week to attempt at least one JAIIB RBWM Mini Mock Test. This will help you develop a habit of working under timed conditions, improving both speed and accuracy. After completing each mock test:

- Review your answers: Identify questions you got wrong and understand the reason behind each mistake.

- Analyze time spent: Track how much time you spent on each section and adjust your strategy accordingly.

- Focus on weak areas: Pay special attention to topics where you struggled and revisit those areas in your study materials.

3. Time Management During the Mock Test

A key aspect of exam preparation is time management. The JAIIB RBWM Mini Mock Test helps you practice managing your time effectively, ensuring that you can attempt all questions within the allocated time. Here’s a strategy you can use:

- Set time limits for each section based on its complexity and your comfort level.

- Don’t dwell too long on difficult questions. If you’re stuck, move on and return to it later if time permits.

4. Focus on Conceptual Understanding

JAIIB is not just about rote learning but understanding concepts. The RBWM Mini Mock Test will often test your ability to apply concepts to real-world banking situations. Make sure you:

- Master the fundamentals of banking and wealth management.

- Understand financial products and how they function in retail and wealth management sectors.

5. Review Performance Post-Test

After each mini mock test, it is important to analyze your performance. This will help you track your progress and make adjustments to your study routine. Focus on:

- Areas of improvement: Focus on questions where you lost marks and understand the concept behind the correct answer.

- Time taken per question: Are you spending too much time on a single question? Practicing speed will be crucial.

6. Use Reliable Study Material

While mock tests are important, using quality study material alongside them will ensure comprehensive preparation. Consider using:

- Books recommended for JAIIB.

- Online courses and video lectures focused on RBWM.

- Previous year’s question papers and RBWM practice papers.

Benefits of Taking Mini Mock Tests for JAIIB RBWM

The JAIIB RBWM Mini Mock Test offers multiple advantages to students:

- Focused practice: You can concentrate on specific sections of the syllabus without feeling overwhelmed by a full-length exam.

- Flexibility: You can take mini mock tests as frequently as needed, making them easy to integrate into your study schedule.

- Improved exam strategy: Frequent practice improves your ability to handle the actual exam’s pressure and time constraints.

JAIIB RBWM Mini Mock Test – FAQs

Ans. The JAIIB RBWM Mini Mock Test is a practice test designed to help candidates prepare for the Retail Banking and Wealth Management section of the JAIIB exam.

Ans. It helps in assessing knowledge, identifying weak areas, and improving time management for the JAIIB RBWM exam.

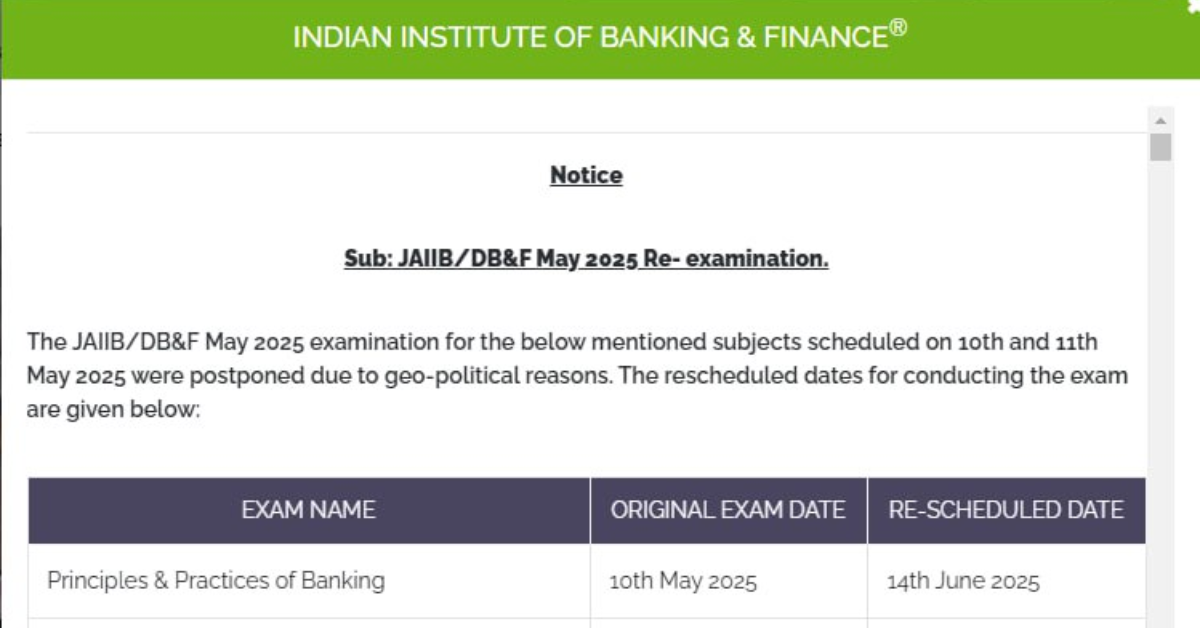

- JAIIB PPB and AFM New Exam Dates Out for Affected Areas, May Cycle

- JAIIB RBWM Exam 2025 Analysis for Shift 1, 2 & 3 – 18th May 2025

- JAIIB Exam Analysis 2025, May Cycle, All Shifts Covered

- JAIIB AFM Exam Analysis 2025, May All Shifts Review

- JAIIB PPB Exam Analysis 2025, May All Shifts Review

- JAIIB IE and IFS Exam Analysis 2025, 4th May 2025 Detailed Analysis

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!