Reserve Bank of India being the central bank of the country is a great organisation to work for. Every year Lakhs of aspirants apply for the RBI Grade B posts as it offers great career opportunities as well as impressive perks & allowances to its officers. The Grade B recruitment notification is expected to be announced in the month of June-July 2019 most probably. It is highly advisable to start with your preparations from now on itself so that when you are suddenly notified of the recruitment notification, you have already covered a prominent portion of the syllabus. The Grade B Exam is conducted in three stages namely Phase I, Phase 2 and the Interview round.

Toppers of the exam have always suggested to carry on the preparations and study for both Phase 1 and Phase 2 simultaneously because the syllabus of Phase 2 of RBI Grade B is vast and requires thorough knowledge and persistence in studies. The subjects asked in the Phase 2 Exam are Economics & Social Issues, Finance & Management and Descriptive English. So to give you a helping hand in your studies for the Grade B Exam, we at Oliveboard would be providing you study notes on important topics from the syllabus of Phase 2. In this blog, we will cover the topic of Time Value of Money – RBI Grade B Study Notes.

Enrol here for the RBI Grade B Course Here & Use S10 to Get 10% Off

Time Value of Money PDF Notes – Download Here

Download the free PDF Notes Here:

Time Value of Money

“A rupee today is more valuable than a year later.” This is the “time value of money” concept based on. The consideration of the time value of money and risk is extremely important in making important financial decisions.

Time value of money is central to the concept of finance. It recognises that the value of money is different at different points of time. Since money can be put to productive use, its value is different depending upon when it is received or paid. In simpler terms, the value of a certain amount of money today is more valuable than its value tomorrow.

Factors Affecting Value of Money:

- Risk and Uncertainty

- Inflation

- Consumption

- Investment Opportunities

The time value of money draws from the idea that rational investors prefer to receive money today rather than the same amount of money in the future because of money’s potential to grow in value over a given period. For example, money deposited into a savings account earns a certain interest rate and is therefore said to be compounding in value.

Valuation:

It establishes that there is a preference for having money at present than a future point of time.

- A person should pay more in future for a rupee received today.

- A Person may accept less today for a rupee received in future.

Methods in adjusting the time value of money:

- Compounding Techniques/Future Value Techniques

- Discounting/Present Value Techniques

1. Compounding Techniques/Future Value Techniques:

- It is similar to a compound interest calculation. The interest earned on the initial principal amount becomes a part of the principal at the end of the compounding period.

- The process of investing money as well as reinvesting interest earned thereon is called Compounding.

FVn=PV(1+r)n

In this equation (1 + r)n is called the future value interest factor (FVIF).

where,

FVn = Future value of the initial cash flow n year hence

PV = Initial cash flow

r = Annual rate of Interest

n = number of years

2. Discounting or Present Value Concept

- The process of determining the present value of a future payment or receipts or a series of future payments or receipts is called discounting.

- The compound interest rate used for discounting cash flows is also called the discount rate.

Future Value of an annuity:

- An annuity is a stream of constant cash flows (payments or receipts) occurring at regular intervals of time. The premium payments of a life insurance policy, for example, are an annuity. When the cash flows occur at the end of each period, the annuity is called an ordinary annuity or a deferred annuity.

- When the cash flows occur at the beginning of each period, the annuity is called an annuity due.

Present Value of an Annuity:

- PVA is the present value of an annuity which has a duration of n periods,

- A is the constant periodic flow, and

- r is the discount rate.

PVAn = A [| 1 – (1/1 + r)”}/ r]

Uses:

- How much amount one can borrow,

- Period of Loan Amortization,

- Determine the Periodic withdrawal and finding the interest rates.

Present Value of Perpetuity:

A perpetuity is an annuity of infinite duration.

P∞ = Ax PVIFAr∞

where is the present value of perpetuity and A is the constant annual payment?

PVIFAr∞ = 1/r

Effective versus Stated Rate

The general relationship between the effective interest rate and the stated annual interest rate is as follows:

Effective interest rate = (1 +Stated annual interest rate/m)m – 1

where m is the frequency of compounding per year.

When compounding becomes continuous, the effective interest rate is expressed as follows:

Effective interest rate =e r – I

where e is the base of natural logarithm and r is the stated interest rate

Rule of 72:

According to the rule of 72, the doubling period under compounding is obtained by dividing 72 by the interest rate.

Time Value and Purchasing Power:

- The time value of money is also related to the concepts of inflation and purchasing power. Both factors need to be taken into consideration along with whatever rate of return may be realized by investing the money.

- Inflation and purchasing power must be factored in when you invest money because to calculate your real return on investment, you must subtract the rate of inflation from whatever percentage return you earn on your money.

- If the rate of inflation is higher than the rate of your investment return, then even though your investment shows a nominal positive return, you are losing money in terms of purchasing power.

Take a Free Oliveboard Mock Test for RBI Grade B Prelims

Sample Questions:

Q.1 What are Treasury bills?

(a) Issued on a premium basis and pay a fixed annual interest rate

(b) Issued on a discount basis and mature at par

(c) Issued on a premium basis and mature at par

(d) Issued on a discount basis and pay a fixed annual interest rate

Answer: (b)

Explanation: Treasury bills are presently issued in three maturities, namely, 91 days, 182 days and 364 days. Treasury bills are zero-coupon securities and pay no interest. Rather, they are issued at a discount (at a reduced amount) and redeemed (given back money) at the face value at maturity.

Q.2 Time value of money supports the comparison of cash flows recorded at different time period by?

a) Discounting all cash flows to a common point of time

b) Compounding all cash flows to a common point of time

c) Using either a or b

d) None of the above.

Answer: (c)

Q.3. Heterogeneous cash flows can be made comparable by?

a) Discounting technique

b) Compounding technique

c) Either a or b

d) None of the above

Answer: (c)

Time Value of Money has both Conceptual and numerical importance which finds its place in the Finance and Management Paper. Here a summary of the topic has been presented to give the students a glimpse of the topic and its importance.

Students should read the concepts and practice as many problems a possible. Herewith practice one can earn easy marks as numerical can’t go wrong if solved with conceptual clarity.

This was all from us in this blog of “Time Value of Money – RBI Grade B Study Notes“. We hope that you find the information given above in the blog of “Time Value of Money – RBI Grade B Study Notes” useful. For more study notes for RBI Grade B, stay tuned to Oliveboard.

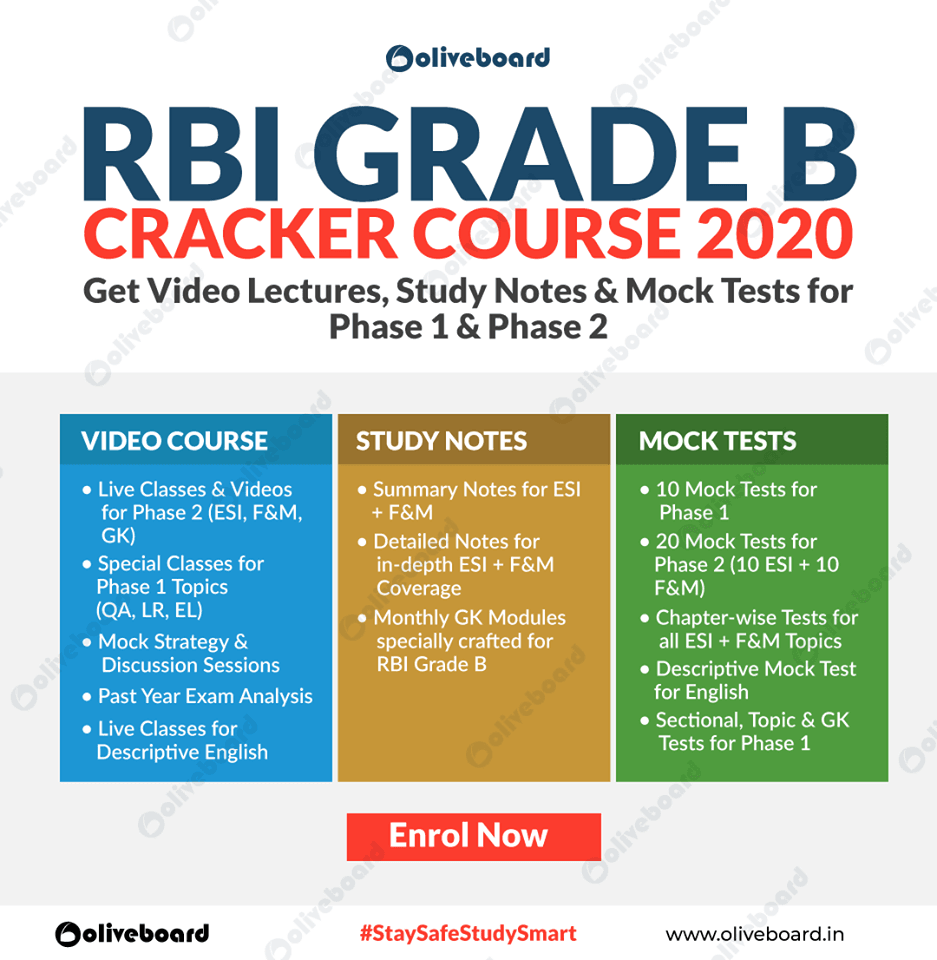

Study material for RBI Grade B 2020 by Oliveboard

Oliveboard’s RBI Grade B Online Course 2020 will be your one-stop destination for all your preparation needs

1. Course Details

RBI Grade B Cracker is designed to cover the complete syllabus for the 3 most important subjects: GA for Phase 1 and ESI + F&M for Phase 2 exam. Not just that, it also includes Mock Tests & Live Strategy Sessions for English, Quant & Reasoning for Phase 1. The course aims to complete your preparation in time for the release of the official notification.

1.1. Features:

| Phase I | Phase II |

|

|

1.2. How to enrol for the RBI Grade B Online Course 2020?

Step 1 – Login/Sign in RBI Grade B Exam Page.

Step 2 – After your login/sign in, click on “Edge (Live Class) on the top left corner.

Step 3 – As you click you will be redirected to the page where you would find the RBI Grade B Cracker Course 2020.

Now that you are aware of the RBI Grade B Online Classes, why wait?

Subscribe & Join the RBI Grade B 2020 Online Coaching here.

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!