UIIC AO General Awareness Questions: The United India Insurance Company (UIIC) Administrative Officer (AO) exam is one of the most sought-after insurance sector exams in India. The General Awareness (GA) section plays a crucial role in determining your success, as it tests your knowledge of current affairs, banking awareness, and insurance-specific topics.

This blog compiles essential General Awareness questions and preparation tips to help you excel in the UIIC AO exam.

Sample General Awareness Questions for UIIC AO 2024

Here are some sample questions for the UIIC AO Exam.

Banking and Insurance Awareness

- Which institution was recently notified as a Public Finance Institution under Section 2 of the Companies Act, 2013?

- Answer: NAFED

- Explanation: The National Agricultural Cooperative Marketing Federation of India (NAFED) was declared a Public Finance Institution in consultation with the RBI.

- What is the full form of IRDAI?

- Answer: Insurance Regulatory and Development Authority of India

- Explanation: IRDAI oversees and regulates the insurance sector in India, ensuring the growth and sustainability of the industry.

Current Affairs

- Which organization recently launched a scheme for trading Sovereign Green Bonds in the International Financial Services Center (IFSC)?

- Answer: Reserve Bank of India (RBI)

- Explanation: This initiative allows foreign portfolio investors to trade Sovereign Green Bonds, promoting eco-friendly projects.

- Which company topped Forbes’ Global 2000 list of the world’s largest public companies in 2024?

Insurance Sector-Specific Questions

- When was United India Insurance Company (UIIC) established?

- Answer: 18 February 1938

- What is the significance of a ‘Reinsurance Treaty’?

- Answer: It is an agreement between insurance companies to share risks, ensuring financial stability in the case of large claims.

Static General Knowledge

- Where is the headquarters of the United India Insurance Company (UIIC) located?

- Answer: Chennai, Tamil Nadu

- Who is the current chairman of IRDAI?– The current chairman of the Insurance Regulatory and Development Authority of India (IRDAI) is Debasish Panda. He assumed this role in March 2022 after serving as the Secretary of the Department of Financial Services in the Ministry of Finance.

Finance and Banking Awareness

- Which organization increased the reimbursement limit for educational institutions and hospital expenses from ₹1 lakh to ₹5 lakh in December 2023?

- Answer: IRDAI (Insurance Regulatory and Development Authority of India)

- Which bank was recently fined ₹31.8 lakh by RBI for not adopting a uniform external benchmark within the same loan category?

- Answer: BNP Paribas

Agricultural Finance

- What was the all-time high institutional credit to agriculture for the financial year 2023-24, as per RBI?

- Answer: ₹25 lakh crore

- Explanation: RBI’s Deputy Governor Swaminathan Jankiraman highlighted this milestone, emphasizing the role of active Kisan Credit Cards in providing credit for short-term agricultural needs.

Appointments and Organizational Updates

- Who has been recently appointed as the whole-time executive director of Tamil Nadu Mercantile Bank?

- Answer: Vincent D’Souza

- What is the corpus of the Agri Fund for Startups and Rural Enterprises launched by the Ministry of Agriculture?

- Answer: ₹750 crore

- Explanation: It is registered with SEBI as an Alternative Investment Fund (AIF) Category II and managed by Nabard Ventures, a wholly-owned subsidiary of NABARD.

SEBI Regulations

- As per revised SEBI guidelines, what is the minimum average daily delivery value of stocks in the cash market over six months?

- Answer: ₹35 crore

- What is the updated timeline for crediting bonus shares as per SEBI’s new rules, effective October 2024?

- Answer: T+2 days

- Which firm recently became the first FinTech NBFC to list non-convertible debentures with a face value of ₹10,000 on BSE?

- Answer: Akara Capital Advisors Private Limited

Corporate and Regulatory News

- How many depositaries are there in India?

- Answer: Two (NSDL and CDSL)

- What is the authorized share capital of NSE as per its latest updates?

- Answer: ₹500 crore

- Explanation: NSE increased its authorized share capital from ₹50 crore to ₹500 crore to prepare for its upcoming IPO.

Insurance and Risk Management

- Which organization launched the single-window IT platform, SWEET, under the guidance of IFSC?

- Answer: Dev Information Technology Limited

- What is the maximum exposure limit for mutual funds in credit default swaps, as per SEBI’s revised rules?

- Answer: 10% of the scheme’s total assets.

SEBI’s New Guidelines for ESG Disclosures

- What are the key features of SEBI’s new guidelines for ESG disclosures?

Answer: SEBI mandates listed companies to disclose comprehensive ESG data, aligning with global standards like GRI, SASB, and TCFD. - How will these guidelines improve transparency and accountability?

Answer: They standardize ESG reporting, enhancing transparency and allowing investors to assess companies’ sustainability and governance practices. - What impact might these regulations have on sustainable investments?

Answer: They are expected to encourage sustainable investments by providing clearer, more reliable ESG data.

Revised Guidelines for Proxy Advisory Firms

- What changes has SEBI made to the guidelines for proxy advisory firms?

Answer: SEBI now requires proxy advisory firms to disclose their research methodology, conflicts of interest, and voting recommendations. - Why has SEBI made these changes?

Answer: To ensure transparency and accountability, protecting the interests of retail investors. - What will be the effect of these changes on institutional investors?

Answer: They will receive more transparent and informed voting recommendations from proxy advisory firms.

Central Bank Digital Currency (CBDC) Pilot Launch in India

- What is CBDC and why is it being introduced in India?

Answer: CBDC is a digital currency issued by the central bank to improve payment systems, reduce currency printing costs, and enhance financial inclusion. - How will CBDC benefit India’s financial system?

Answer: It will provide a secure, digital alternative to traditional currency, fostering digital transactions and financial inclusion. - What are the expected challenges of implementing CBDC in India?

Answer: Implementation challenges include ensuring cybersecurity, addressing privacy concerns, and managing the impact on traditional banking systems.

| Topic | Link |

| UIIC AO Notification | View Here |

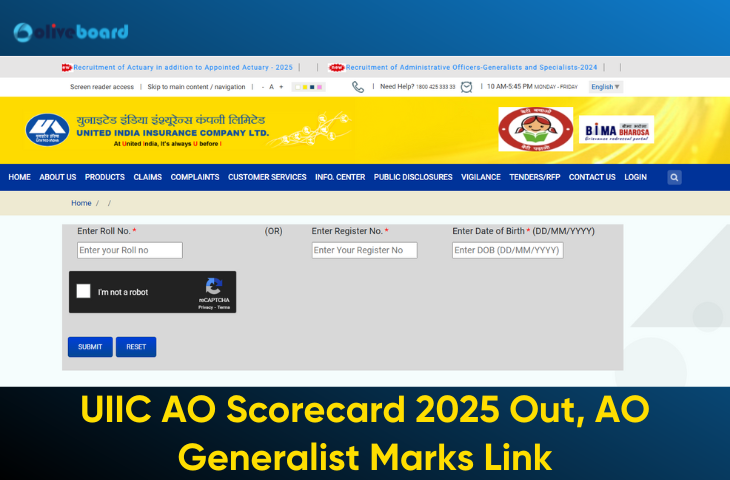

| UIIC AO Result 2025 PDF | View Here |

| UIIC AO Salary | View Here |

| UIIC AO Syllabus | View Here |

| UIIC AO General Awareness Practice Questions | View Here |

| UIIC AO Descriptive Test Pattern | View Here |

| How to Prepare for the UIIC AO Descriptive Test | View Here |

| Tips for Writing Effective Essays in UIIC AO Descriptive Test | View Here |

| Essay Topics for UIIC AO Exam | View Here |

| UIIC AO Descriptive Test Time Management Tips | View Here |

- UIIC AO Descriptive Test Pattern For Essay and Letters, Preparation Tips

- UIICL AO Final Result 2025 Out, Download Merit List PDF

- UIIC AO Cut Off 2025 Out, Category Wise Previous Year Cut Off Marks

- UIIC AO Scorecard 2025 Out, AO Specialist Marks Link

- UIIC AO Admit Card 2024 Out, Call Letter Download Link

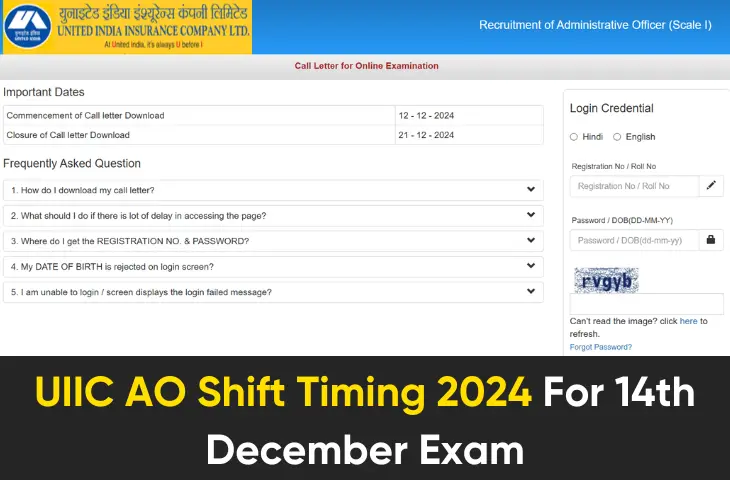

- UIIC AO Shift Timing 2024 For 14th December Exam

Hello, I’m Aditi, the creative mind behind the words at Oliveboard. As a content writer specializing in state-level exams, my mission is to unravel the complexities of exam information, ensuring aspiring candidates find clarity and confidence. Having walked the path of an aspirant myself, I bring a unique perspective to my work, crafting accessible content on Exam Notifications, Admit Cards, and Results.

At Oliveboard, I play a crucial role in empowering candidates throughout their exam journey. My dedication lies in making the seemingly daunting process not only understandable but also rewarding. Join me as I break down barriers in exam preparation, providing timely insights and valuable resources. Let’s navigate the path to success together, one well-informed step at a time.