Union Budget 2025-26: The Finance Minister Nirmala Sitharaman has presented Union Budget 2025-26 in Parliament on 1st February 2025. This was the 8th budget presented by FM Nirmala Sitharaman. This year brought a series of key announcements for the middle class. From rebating tax to affordable housing, this year’s budget is unique and provided relief to large number of people. This article will take you through all the new reforms, schemes and highlights of Union Budget 2025-26 that will help you ace in the upcoming UGC NET Economics exam 2025.

The UGC NET Economics Syllabus 2025 has a proper coverage of Public Budget and every year number of questions are asked from Union Budget in the exam. Aspirants who want to clear the UGC NET Economics exam must go through the Economic Survey and Union Budget for the particular year in which they are appearing in the exam to ace the Economics subject of UGC NET exam.

Historical Insights and Facts of Union Budget of India

- Constitutional Provision:

- The Union Budget is presented under Article 112 of the Indian Constitution.

- Budget in constitution is known as “Annual Financial Statement”

- Purpose: It outlines the government’s revenue, expenditure, and fiscal policies for the upcoming financial year.

- First Budget Outlay: The first Union Budget (1947-48) had an outlay of ₹197 crore.

- First Indian to Present: R.K. Shanmukham Chetty, India’s first Finance Minister, presented the first budget on November 26, 1947.

- Impact: The budget influences economic growth, taxation policies, and welfare schemes, shaping the country’s financial roadmap.

Theme of Union Budget 2025-26

Major Theme of Union Budget 2025-26: Viksit Bharat

The theme of Budget was further categorized into the following:

- Zero-poverty

- Hundred per cent good quality school education

- Access to high-quality, affordable, and comprehensive healthcare

- Hundred per cent skilled labour with meaningful employment

- Seventy per cent women in economic activities

- Farmers making our country the ‘food basket of the world

Budget Estimates 2025-26

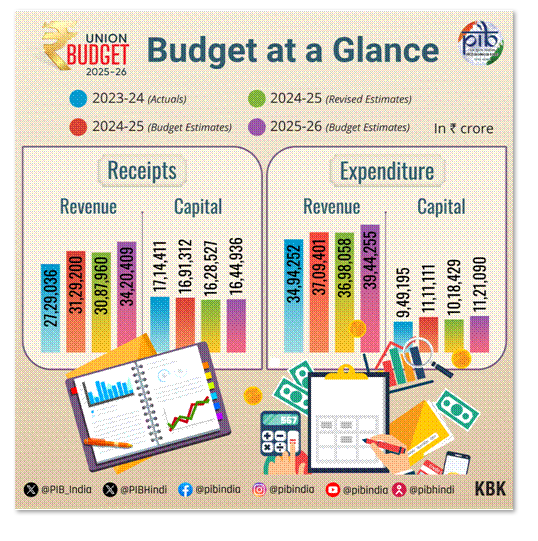

This Financial Year’s Budget has something for every segment of the society. We have come up with the estimates of Union Budget 2025-26:

- Total Expenditure:

- The Union Govt is estimated to spend Rs 50,65,345 crore in 2025-26, 7.4% higher than the revised estimate of 2024-25.

- Total Receipts:

- The receipts (excluding borrowings) for 2025-26 are projected at ₹34,96,409 crore, marking an 11.1% increase compared to the revised estimate for 2024-25.

- Tax revenue is also expected to increase by 11% in 2024-25.

Main Direct Tax Proposals in the Budget 2025-26

The new tax regime has undergone modifications in its tax slabs. The new tax regime has undergone modifications in its tax slabs. Under the proposed structure, individuals earning up to ₹12 lakh annually will now receive a 100% rebate. Meanwhile, the old tax regime remains unchanged. Let’s dig deep inside to understand the changes and reforms:

| Income Slab (₹) | New Tax Slab (2025-26) | Old Tax Regime (2024-25) |

| Up to 3 lakh | No Tax | No Tax |

| 3 – 4 lakh | No Tax | 5% |

| 4 – 7 lakh | 5% | 5% |

| 7 – 8 lakh | 5% | 10% |

| 8 – 10 lakh | 10% | 10% |

| 10 – 12 lakh | 10% | 15% |

| 12 – 15 lakh | 15% | 20% |

| 15 – 16 lakh | 15% | 30% |

| 16 – 20 lakh | 20% | 30% |

| 20 – 24 lakh | 25% | 30% |

| Above 24 lakh | 30% | 30% |

Tax Exemption on Income Up to ₹12 Lakh

Under the new tax regime, individuals earning up to ₹12 lakh annually (₹1 lakh per month) are exempt from paying income tax, thanks to the rebate under Section 87A. This provision allows taxpayers with a taxable income of up to ₹12 lakh to claim a full tax exemption, effectively eliminating their tax liability. This revised structure provides substantial relief to the middle class, fostering higher savings, consumption, and investment.

Also Read: Union Budget 2025-26, Simplified New Income Tax Slabs & Key Updates

Other Direct Tax Reforms in the Union Budget 2025-26

- Extended Time Limit for Updated Returns: Taxpayers can now file updated returns within four years, up from the previous two-year limit.

- Penalty Structure: A penalty of 60% of the income tax and interest applies for the third year, while 70% applies for the fourth year.

- Higher TDS Limit on Rent: The annual TDS limit on rent has been raised to ₹6 lakh.

- Increased TCS Threshold on Remittances: The TCS threshold for remittances has increased from ₹7 lakh to ₹10 lakh.

- Education Remittances Exemption: No TCS will be levied on education-related remittances up to the amount of a loan taken from a specified financial institution.

- Higher TDS/TCS Threshold for Interest & Dividends: The minimum threshold for TDS and TCS on interest and dividends has also been increased.

- New Addition: Agriculture Infrastructure and Development Cess (AIDC) has been introduced

Indirect Tax Reform in Annual Financial Statement 2025-26

Indirect tax refers to taxes levied on goods and services rather than on income or profits. These taxes are usually passed on to consumers through higher prices. Key examples: Goods and Services Tax (GST), customs duties, and excise taxes.

- Indirect Tax estimation:

- Total indirect tax collections: ₹17,35,100 crore in 2025-26, with the government projecting ₹11,78,000 crore from GST.

- Of the total GST revenue,

- 86% is expected from CGST (₹10,10,890 crore)

- remaining 14% will come from the GST compensation cess (₹1,67,110 crore).

- Corporation tax: Budget expects corporation tax to increase by 10.4% in 2025-26.

- Tariff Rates: Union Budget 2025-26 proposes to remove 7 tariff rates, making the total tariff to be 8 that will have ‘zero’ rate.

- Custom Duty: Budget has rationalized Customs Tariff Structure for Industrial Goods

- 36 lifesaving drugs and medicines fully exempted from Basic Customs Duty (BCD).

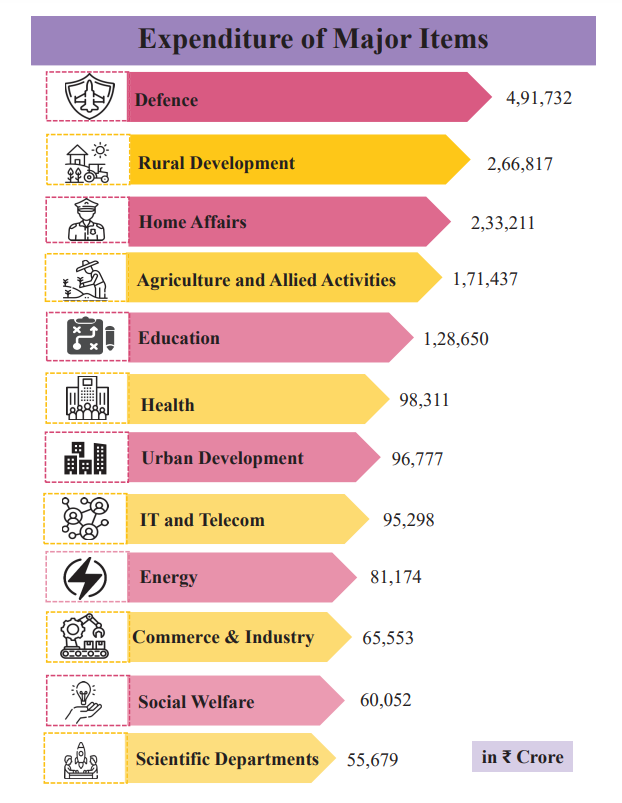

Ministry Wise Expenditure in Budget 2025-26

Here is the ministry wise expenditure of major items, estimated for the 2025-26 financial year:

Highlights of Union Budget 2025-26

The Union Budget 2025-26 has estimated a growth in GDP with decreasing liabilities. Let’s see the major highlights of Union Budget 2025-26:

- GDP Growth: The government has projected a nominal GDP growth rate of 10.1% for 2025-26, which includes both real growth and inflation.

- Deficits:

- The revenue deficit for 2025-26 is targeted at 1.5% of GDP, an improvement from the revised estimate of 1.9% in 2024-25.

- The fiscal deficit for 2025-26 is targeted at 4.4% of GDP, lower than the revised estimate of 4.8% in 2024-25.

- Debt Management:

- The central government aims to reduce its outstanding liabilities to around 50% of GDP by March 2031.

- For 2025-26, these liabilities are projected at 56.1% of GDP.

- Transfer to states:

- The central government will transfer ₹25,59,764 crore to states in 2025-26, marking a 12.5% increase from 2024-25.

- This amount includes ₹14,22,444 crore for tax devolution and ₹11,37,320 crore for grants.

- Additionally, ₹1,50,000 crore has been allocated for capital expenditure loans.

New Schemes Introduced in Union Budget 2025-26

The budget outlay for previous schemes has been increased and some new schemes are also proposed in the Union Budget for financial year 2025-26:

1. Prime Minister Dhan-Dhaanya Krishi Yojana:

- Purpose: Boost agricultural productivity and promote sustainable farming.

- Target Group: 1.7 crore farmers in 100 low-output districts.

- Key Highlights: Crop diversification, eco-friendly techniques, enhanced irrigation, and agricultural credit access.

2. Rural Prosperity and Resilience Programme

- Purpose: Combat rural underemployment and strengthen the rural economy.

- Target Group: Young farmers, rural women, small-scale farmers, and landless families.

- Key Highlights: Investment in agriculture, technology, skill development, and rural entrepreneurship.

3. Aatmanirbharta in Pulses

- Purpose: Achieve self-sufficiency in pulse production.

- Key Highlights: Focus on Urad, Tur, and Masoor pulses, climate-resilient seeds, and improved protein content.

4. Scheme for First-Time Entrepreneurs

- Purpose: Empower first-time entrepreneurs, especially women and SC/ST individuals.

- Key Highlights: Loans up to ₹2 crore for 5 lakh entrepreneurs and capacity-building programs.

5. Saksham Anganwadi and Poshan 2.0

- Purpose: Ensure nutritional support for children, pregnant women, and lactating mothers.

- Target Group: 8 crore children, 1 crore mothers, and 20 lakh adolescent girls.

- Key Highlights: Enhanced nutrition programs in aspirational districts.

6. Bharatiya Bhasha Pustak Scheme

- Purpose: Promote books in Indian languages for educational institutions.

- Key Highlights: Digital books in regional languages to improve subject comprehension.

7. Social Security Scheme for Online Platform Workers

- Purpose: Extend social security benefits to gig and platform workers.

- Key Highlights: ID cards via e-Shram portal, healthcare under PM Jan Arogya Yojana.

8. SWAMIH Fund 2

- Purpose: Support middle-income families in need of housing.

- Target Group: Completion of 1 lakh housing units for middle-class families.

- Key Highlights: ₹15,000 crore fund to complete stalled projects and assist with EMIs and rent relief.

Also Check: UGC NET Economics Previous Year Question Paper

Union Budget 2025-26 Frequently Asked Questions

Ans: The Union Budget is typically presented by the Finance Minister of India. In 2025-26, the budget will be presented by Nirmala Sitharaman.

Ans: The Union Budget is usually presented on February 1st every year, unless otherwise stated.

Ans: The Revenue Budget and the Capital Budget are the two main components of Union Budget. The revenue budget deals with the government’s income and expenditure, while the capital budget focuses on long-term investments and liabilities.

Ans: The budget for 2025-26 is expected to focus on agriculture, tax reforms, rural welfare, and fiscal discipline, as well as support for middle-class families and infrastructure development.

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!