Most Repetitive JAIIB IE & IFS MCQs

Most Repetitive JAIIB IE & IFS MCQs: The Junior Associate of the Indian Institute of Bankers (JAIIB) is a important certification for banking professionals. Among its core subjects, the Indian Economy & Indian Financial System (IE & IFS) is highly significant. To help you prepare efficiently, here is a detailed guide featuring the 50 Most Repetitive JAIIB IE & IFS MCQs. JAIIB IE & IFS questions are designed based on previous trends and exam patterns to enhance your preparation.

Why Focus on Repetitive JAIIB IE & IFS MCQs?

- Covers Core Topics: Repeated MCQs focus on important and frequently tested concepts like monetary policy, financial markets, and regulations.

- Improves Memory: Practicing similar questions helps you remember key facts better.

- Recognizes Patterns: Identifies common question types and high-priority topics.

- Boosts Confidence: Familiar questions in the exam increase accuracy and speed.

- Fixes Weak Areas: Highlights tough topics for better preparation.

- Saves Time: Focuses on exam-relevant material, avoiding unnecessary details.

- Enhances Problem-Solving: Builds adaptability for handling tricky questions.

- Prepares for Exams: Simulates real exam conditions for better readiness.

Pro Tip: Group questions by topic, practice regularly, and review mistakes to strengthen your preparation.

Top 50 JAIIB Indian Economy & Indian Financial System MCQs

- Who is responsible for the preparation and presentation of the Union Budget?

a) Reserve Bank of India

b) Ministry of Commerce

c) Ministry of Finance

d) Planning Commission

Answer: c) Ministry of Finance - What is the current base year for calculating GDP in India?

a) 2011-12

b) 2004-05

c) 2017-18

d) 2019-20

Answer: a) 2011-12 - Which committee recommended the concept of LPG reforms (Liberalization, Privatization, and Globalization)?

a) Narasimham Committee

b) Rangarajan Committee

c) Kelkar Committee

d) Vijay Kelkar Task Force

Answer: a) Narasimham Committee - What is the primary objective of the Insolvency and Bankruptcy Code (IBC), 2016?

a) Recovering loans

b) Streamlining debt restructuring

c) Improving ease of doing business

d) None of the above

Answer: b) Streamlining debt restructuring - Which of the following is NOT a structural reform in the Indian economy?

a) GST Implementation

b) Establishment of SEBI

c) NITI Aayog Formation

d) Introduction of Monetary Policy Committee

Answer: d) Introduction of Monetary Policy Committee

- What is the minimum paid-up capital for Small Finance Banks in India?

a) ₹50 Crore

b) ₹100 Crore

c) ₹200 Crore

d) ₹500 Crore

Answer: b) ₹100 Crore - Which act governs the establishment and functioning of Regional Rural Banks (RRBs)?

a) Banking Regulation Act

b) RRB Act, 1976

c) Companies Act, 2013

d) None of the above

Answer: b) RRB Act, 1976 - What does CRAR stand for in banking?

a) Cash Reserve and Asset Ratio

b) Capital to Risk-Weighted Asset Ratio

c) Current Reserve Asset Ratio

d) Credit Risk Adjustment Ratio

Answer: b) Capital to Risk-Weighted Asset Ratio - The Indian financial system is regulated by all of the following, EXCEPT:

a) SEBI

b) RBI

c) NABARD

d) Ministry of Defense

Answer: d) Ministry of Defense - Which financial instrument is used for raising long-term funds in the capital market?

a) Treasury Bills

b) Commercial Papers

c) Bonds

d) Certificate of Deposits

Answer: c) Bonds

- What is the maximum tenure for External Commercial Borrowings (ECB) under the automatic route?

a) 1 year

b) 3 years

c) 5 years

d) 7 years

Answer: c) 5 years - What does ‘Repo Rate’ refer to in monetary policy?

a) Rate at which banks borrow from each other

b) Rate at which RBI lends to commercial banks

c) Rate at which banks lend to customers

d) Rate at which government borrows from RBI

Answer: b) Rate at which RBI lends to commercial banks - The ‘Housing for All by 2022’ initiative is part of which scheme?

a) PM Awas Yojana

b) Swachh Bharat Abhiyan

c) Make in India

d) Digital India

Answer: a) PM Awas Yojana - What is the main objective of the Monetary Policy Committee?

a) Regulate banking sector compliance

b) Manage inflation and liquidity

c) Oversee foreign exchange reserves

d) Control fiscal deficit

Answer: b) Manage inflation and liquidity - Which of the following is a payment bank in India?

a) ICICI Bank

b) Airtel Payments Bank

c) Bank of Baroda

d) Axis Bank

Answer: b) Airtel Payments Bank

- Which sector contributes the most to India’s GDP?

a) Agriculture

b) Industry

c) Services

d) Manufacturing

Answer: c) Services - What does ‘Fiscal Deficit’ indicate?

a) Revenue expenditure exceeds revenue receipts

b) Total expenditure exceeds total receipts excluding borrowings

c) Revenue receipts exceed revenue expenditure

d) None of the above

Answer: b) Total expenditure exceeds total receipts excluding borrowings - Which of the following is a qualitative tool of monetary policy?

a) Repo Rate

b) Credit Rationing

c) Cash Reserve Ratio

d) Open Market Operations

Answer: b) Credit Rationing - Which organization releases the Human Development Index (HDI)?

a) World Bank

b) International Monetary Fund (IMF)

c) United Nations Development Programme (UNDP)

d) World Economic Forum

Answer: c) United Nations Development Programme (UNDP) - What is the primary function of the NITI Aayog?

a) Regulating the stock market

b) Allocating financial resources to states

c) Providing policy inputs for national development

d) Framing monetary policy

Answer: c) Providing policy inputs for national development - What is the objective of the Pradhan Mantri Jan Dhan Yojana (PMJDY)?

a) Boosting exports

b) Financial inclusion

c) Enhancing foreign exchange reserves

d) Increasing tax collection

Answer: b) Financial inclusion - Which index measures inflation in India at the retail level?

a) Wholesale Price Index (WPI)

b) Consumer Price Index (CPI)

c) GDP Deflator

d) Index of Industrial Production (IIP)

Answer: b) Consumer Price Index (CPI) - What is the full form of FRBM in fiscal policies?

a) Financial Regulation and Budget Management

b) Fiscal Responsibility and Budget Management

c) Foreign Revenue and Banking Mechanism

d) Fiscal Regulation and Banking Management

Answer: b) Fiscal Responsibility and Budget Management - Which scheme is aimed at enhancing skill development in rural India?

a) Skill India Mission

b) Digital India

c) Start-Up India

d) Deen Dayal Upadhyaya Grameen Kaushalya Yojana

Answer: d) Deen Dayal Upadhyaya Grameen Kaushalya Yojana - What does the term ‘Disinvestment’ mean in the Indian context?

a) Reducing investments in foreign securities

b) Selling stakes in public sector enterprises

c) Withdrawing foreign direct investment

d) Curtailing private sector investments

Answer: b) Selling stakes in public sector enterprises

- Which financial market deals with short-term instruments?

a) Capital Market

b) Money Market

c) Derivatives Market

d) Forex Market

Answer: b) Money Market - Which of the following is a liability of commercial banks?

a) Loans

b) Fixed Deposits

c) Reserves with RBI

d) Government Securities

Answer: b) Fixed Deposits - What does the term ‘Non-Performing Asset (NPA)’ refer to?

a) Assets that do not generate income

b) Loans or advances where interest is overdue for 90 days or more

c) Investments with low returns

d) None of the above

Answer: b) Loans or advances where interest is overdue for 90 days or more - Which is the nodal agency for implementing financial literacy programs in India?

a) RBI

b) SEBI

c) NABARD

d) IRDAI

Answer: c) NABARD - What does ‘Priority Sector Lending’ aim to achieve?

a) Focus on urban infrastructure

b) Promote economic equality

c) Support weaker sections of society

d) Both b and c

Answer: d) Both b and c - Which of the following is a credit rating agency in India?

a) NPCI

b) CRISIL

c) SEBI

d) NABARD

Answer: b) CRISIL - Which instrument is issued by companies to raise short-term funds?

a) Bonds

b) Treasury Bills

c) Commercial Papers

d) Equity Shares

Answer: c) Commercial Papers - What is the primary function of the Payments and Settlements Systems Act, 2007?

a) Regulate payment gateways

b) Ensure smooth functioning of payments systems

c) Oversee monetary policy implementation

d) Facilitate bank mergers

Answer: b) Ensure smooth functioning of payments systems - Which organization supervises mutual funds in India?

a) NABARD

b) RBI

c) SEBI

d) IRDAI

Answer: c) SEBI - What does SLR stand for in banking?

a) Statutory Liquidity Ratio

b) Standard Lending Rate

c) Sovereign Lending Reserve

d) Sustainable Liquidity Rate

Answer: a) Statutory Liquidity Ratio

- Which instrument represents ownership in a company?

a) Debentures

b) Bonds

c) Equity Shares

d) Mutual Funds

Answer: c) Equity Shares - What does UPI stand for in the payments system?

a) Unified Payments Interface

b) Universal Payments Integration

c) Unique Payments Infrastructure

d) Unified Product Interaction

Answer: a) Unified Payments Interface - What is the primary purpose of Treasury Bills?

a) Long-term capital funding

b) Short-term borrowing by the government

c) Financing private sector projects

d) International trade settlements

Answer: b) Short-term borrowing by the government - Which body is responsible for the regulation of NBFCs in India?

a) Ministry of Finance

b) SEBI

c) RBI

d) IRDAI

Answer: c) RBI - Which scheme is launched for direct benefit transfers in LPG subsidy?

a) PAHAL

b) Jan Dhan Yojana

c) UDAY

d) SAUBHAGYA

Answer: a) PAHAL - Which of the following is NOT a function of a development bank?

a) Providing term loans to industries

b) Accepting demand deposits

c) Supporting industrial growth

d) Facilitating long-term infrastructure development

Answer: b) Accepting demand deposits - What is the full form of SARFAESI?

a) Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest

b) Security and Risk Assessment of Financial Assets and Equity Investments

c) Secured Assets Reconstruction for Finance and Investments

d) None of the above

Answer: a) Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest - Which committee recommended the establishment of NABARD?

a) Rangarajan Committee

b) Narasimham Committee

c) Shivraman Committee

d) Kelkar Committee

Answer: c) Shivraman Committee - What is the validity of a KYC document under RBI norms for low-risk customers?

a) 5 years

b) 8 years

c) 10 years

d) Indefinite

Answer: c) 10 years - Which is the apex institution for agriculture credit in India?

a) NABARD

b) RBI

c) SIDBI

d) IRDAI

Answer: a) NABARD - Who issues Sovereign Gold Bonds in India?

a) RBI

b) SEBI

c) Ministry of Finance

d) NABARD

Answer: a) RBI - What is the maximum limit for a scheduled bank to lend to a single borrower under priority sector?

a) ₹25 Crore

b) ₹50 Crore

c) ₹75 Crore

d) ₹100 Crore

Answer: b) ₹50 Crore - Which bank was the first to introduce mobile banking services in India?

a) ICICI Bank

b) HDFC Bank

c) SBI

d) Axis Bank

Answer: a) ICICI Bank - What is the purpose of FEMA, 1999?

a) Regulate foreign trade

b) Manage foreign exchange

c) Promote export subsidies

d) Oversee import quotas

Answer: b) Manage foreign exchange - Which financial service is provided by Payment Banks?

a) Issuing loans

b) Offering fixed deposits

c) Providing basic savings accounts

d) None of the above

Answer: c) Providing basic savings accounts

JAIIB IE & IFS Syllabus 2025

The first paper of the JAIIB Syllabus 2025 covers the Indian Economy and Indian Financial System. It consists of four modules such as Indian Economic Architecture, Economic Concepts Related to Banking, Indian Financial Architecture, and Financial Products and Services. Each module includes key topics related to India’s economy and financial systems.

| Module | Topics |

| Module A: Indian Economic Architecture | Overview of Indian Economy, Economic Planning in India, Sectors of the Indian Economy, Role of Priority Sector and MSME, Infrastructure including Social Infrastructure, Globalisation – Impact on India, Economic Reforms, Foreign Trade Policy, Foreign Investments, International Economic Organizations, Climate change, Sustainable Development Goals (SDGs), Issues facing Indian Economy |

| Module B: Economic Concepts Related to Banking | Fundamentals of Economics, Microeconomics, Macroeconomics, Types of Economies, Supply and Demand, Money Supply and Inflation, Theories of Interest, Business Cycles, Monetary Policy and Fiscal Policy, National Income and GDP Concepts, Union Budget |

| Module C: Indian Financial Architecture | Indian Financial System Overview, Indian Banking Structure, Banking Regulation Act 1949 and RBI Act 1934, Development Financial Institutions, Micro Finance Institutions, Non-Banking Financial Companies (NBFCs), Insurance Companies, Financial System Regulators (RBI, SEBI, IRDA, PFRDA), Reforms & Developments in Banking Sector |

| Module D: Financial Products and Services | Overview of Financial Markets, Money Markets and Capital Markets, Fixed Income Markets – Debt/Bond Markets, Capital Markets and Stock Exchanges, Forex Markets, Interconnection of Financial Markets, Merchant Banking Services, Derivatives Market including Credit Default Swaps, Factoring, Forfaiting & TReDS, Venture Capital, Leasing and Hire Purchase, Credit Rating Agencies & their functions, Mutual Funds, Insurance Products, Pension Funds, Guidelines on Para Banking & Financial Services |

Highlights of JAIIB IE & IFS Topics

Indian Economy Key Points

- Economic Reforms: LPG (Liberalization, Privatization, and Globalization) introduced in 1991.

- Fiscal Policy: Managed by the Ministry of Finance.

- Monetary Policy: Controlled by the Reserve Bank of India (RBI).

Indian Financial System Key Points

- Payment Systems: NEFT, RTGS, IMPS, and UPI are integral parts.

- Financial Markets: Divided into capital markets and money markets.

- Regulatory Bodies: RBI, SEBI, IRDAI, and PFRDA play crucial roles.

Important Terms in JAIIB IE & IFS

| Term | Definition |

| CRR (Cash Reserve Ratio) | The percentage of a bank’s total deposits that must be kept with RBI. |

| SLR (Statutory Liquidity Ratio) | The percentage of net demand and time liabilities banks must maintain in liquid assets. |

| Repo Rate | The rate at which RBI lends money to commercial banks. |

| Reverse Repo Rate | The rate at which RBI borrows money from commercial banks. |

Study Tips for JAIIB IE & IFS Preparation

- Understand Key Concepts: Focus on the basics of the Indian Economy and Financial Systems.

- Practice MCQs Regularly: Solve at least 10-15 MCQs daily to strengthen your preparation.

- Review Previous Papers: Analyze past year questions to identify repetitive patterns.

- Use Study Materials: Refer to JAIIB-specific books and online courses for detailed insights.

- Time Management: Allocate dedicated time for each topic to ensure thorough coverage.

Also Check,

| Related Topics | Link |

| 50 Most Repetitive JAIIB AFMB MCQs | Click here to Check |

| 50 Most Repetitive JAIIB RBWM MCQs | Click here to Check |

| 50 Most Repetitive JAIIB PPB MCQs | Click here to Check |

Conclusion

The 50 Most Repetitive JAIIB IE & IFS MCQs are important for your exam preparation. By focusing on these, you can maximize your score and build confidence. Stay consistent, practice regularly, and utilize quality resources for success.

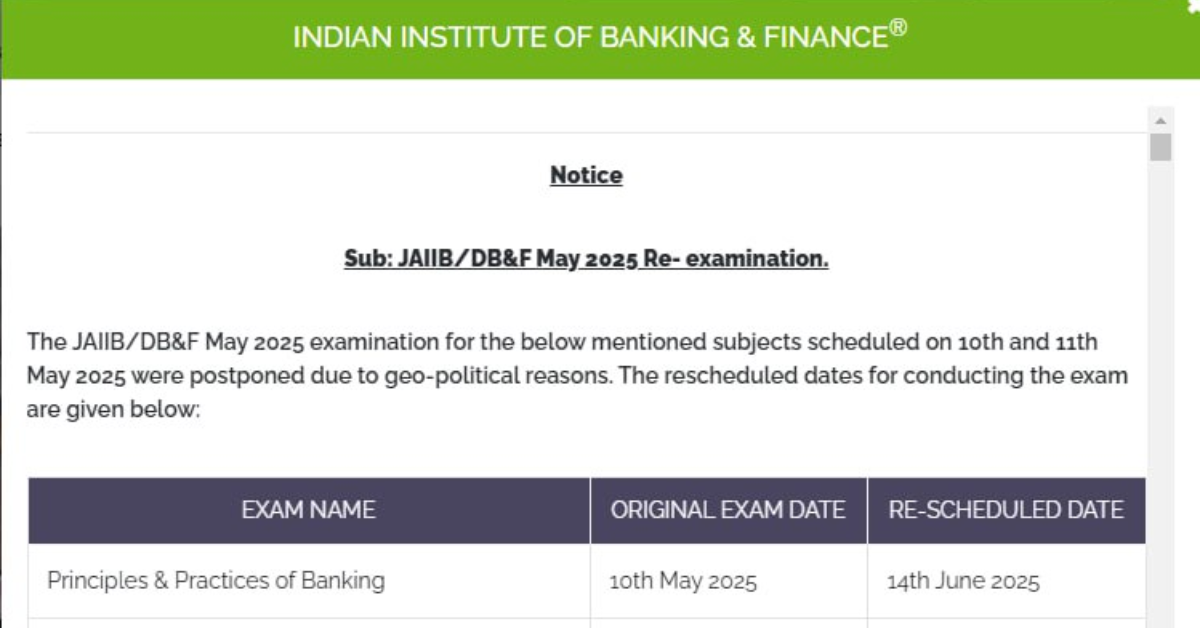

- JAIIB PPB and AFM New Exam Dates Out for Affected Areas, May Cycle

- JAIIB RBWM Exam 2025 Analysis for Shift 1, 2 & 3 – 18th May 2025

- JAIIB Exam Analysis 2025, May Cycle, All Shifts Covered

- JAIIB AFM Exam Analysis 2025, May All Shifts Review

- JAIIB PPB Exam Analysis 2025, May All Shifts Review

- JAIIB IE and IFS Exam Analysis 2025, 4th May 2025 Detailed Analysis

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!