Most Repetitive JAIIB PPB MCQs

Most Repetitive JAIIB PPB MCQs: The Most Repetitive JAIIB PPB MCQs often cover key banking concepts like the banker-customer relationship, anti-money laundering (AML) rules, and different banking operations. Topics such as KYC norms, types of accounts, and banking technology also appear frequently. Other areas like financial inclusion, payment systems, and customer service are commonly tested. These subjects are essential to the exam, and focusing on them can help candidates perform well in the JAIIB PPB exam.

Importance of MCQs in JAIIB PPB Preparation

- Quick Learning and Revision: MCQs help revise vast topics quickly and reinforce active recall.

- Conceptual Understanding: Tests your ability to apply concepts practically, not just memorize facts.

- Time Management: Helps practice pacing yourself, ensuring you can manage time during the exam.

- Improves Accuracy: Regular MCQ practice boosts both speed and accuracy in answering questions.

- Identifies Weak Areas: Helps highlight areas where you need more focus and improvement.

- Boosts Confidence: Familiarity with MCQs reduces exam anxiety and builds confidence.

- Comprehensive Coverage: MCQs ensure all topics in the syllabus are covered, leaving no gaps.

- Simulates Real Exam Environment: Provides a timed practice experience, mimicking the actual exam.

- Enhances Analytical Thinking: Encourages critical thinking and decision-making, improving overall performance.

50 Most Repetitive JAIIB PPB MCQs

Here are the 50 MCQs for the JAIIB PPB (Principles and Practices of Banking) exam along with their correct answers:

- Which of the following is NOT a function of a commercial bank?

- a) Accepting deposits

- b) Providing loans

- c) Printing currency

- d) Offering remittance services

Answer: c) Printing currency

- Which of the following is NOT a type of deposit account in commercial banks?

- a) Fixed Deposit

- b) Recurring Deposit

- c) Current Account

- d) Debit Account

Answer: d) Debit Account

- In banking, what does ‘KYC’ stand for?

- a) Know Your Credit

- b) Know Your Customer

- c) Keep Your Credit

- d) Know Your Corporation

Answer: b) Know Your Customer

- Which of the following is a key function of the Reserve Bank of India (RBI)?

- a) Issuing currency

- b) Supervising banks

- c) Managing inflation

- d) All of the above

Answer: d) All of the above

- What is the minimum period for a Fixed Deposit in a bank?

- a) 6 months

- b) 3 months

- c) 1 year

- d) No minimum

Answer: a) 6 months

- Which type of account is most suitable for frequent withdrawals?

- a) Fixed Deposit

- b) Recurring Deposit

- c) Savings Account

- d) Current Account

Answer: d) Current Account

- Which of the following is an example of a non-fund based business?

- a) Granting loans

- b) Accepting deposits

- c) Providing guarantee services

- d) Investment services

Answer: c) Providing guarantee services

- What does the term ‘overdraft’ refer to?

- a) A type of loan

- b) A withdrawal of funds exceeding the balance

- c) Deposit into the account

- d) None of the above

Answer: b) A withdrawal of funds exceeding the balance

- Which of the following is a characteristic of a Savings Account?

- a) No minimum balance required

- b) Limited withdrawal facilities

- c) Higher interest rate than Fixed Deposit

- d) All of the above

Answer: b) Limited withdrawal facilities

- The term ‘Nominee’ in a bank account refers to:

- a) Person authorized to operate the account

- b) Person whose name is on the cheque

- c) Person entitled to receive funds in the event of the account holder’s death

- d) None of the above

Answer: c) Person entitled to receive funds in the event of the account holder’s death

- What is the primary function of a commercial bank?

- a) Lend money to the government

- b) Accept deposits and provide loans

- c) Issue currency notes

- d) None of the above

Answer: b) Accept deposits and provide loans

- What is the rate at which banks borrow from the Reserve Bank of India known as?

- a) Repo rate

- b) Reverse repo rate

- c) Bank rate

- d) Base rate

Answer: a) Repo rate

- Which of the following best describes ‘risk management’ in a bank?

- a) Minimizing fraud

- b) Ensuring compliance with laws

- c) Identifying, assessing, and mitigating risks

- d) All of the above

Answer: c) Identifying, assessing, and mitigating risks

- Which of the following is a type of negotiable instrument?

- a) Demand draft

- b) Letter of credit

- c) Cheque

- d) All of the above

Answer: d) All of the above

- What is ‘AML’ in banking?

- a) Asset Management List

- b) Anti-Money Laundering

- c) Automatic Loan Management

- d) Asset Maintenance Ledger

Answer: b) Anti-Money Laundering

- What is the full form of RTGS?

- a) Real-Time Gross Settlement

- b) Real-Time General Settlement

- c) Reversal Transaction Growth Settlement

- d) Rapid Transaction General Settlement

Answer: a) Real-Time Gross Settlement

- What does ‘recurrent deposit’ in a bank refer to?

- a) A type of fixed deposit

- b) A type of recurring loan

- c) A deposit in which monthly installments are made

- d) A deposit without any tenure

Answer: c) A deposit in which monthly installments are made

- Which of the following is the responsibility of a bank’s internal auditor?

- a) Supervising daily operations

- b) Reviewing compliance with laws and regulations

- c) Issuing loans

- d) Approving deposits

Answer: b) Reviewing compliance with laws and regulations

- Which type of loan is provided against gold as collateral?

- a) Personal Loan

- b) Gold Loan

- c) Home Loan

- d) Education Loan

Answer: b) Gold Loan

- Which of the following is an example of a time deposit?

- a) Savings Account

- b) Current Account

- c) Fixed Deposit

- d) Demat Account

Answer: c) Fixed Deposit

- Which of the following is the essential feature of a current account?

- a) High-interest rates

- b) Unlimited deposits and withdrawals

- c) No minimum balance required

- d) Used primarily for saving

Answer: b) Unlimited deposits and withdrawals

- Which of the following is the legal tender in India?

- a) Promissory note

- b) Banknote

- c) Demand draft

- d) Letter of credit

Answer: b) Banknote

- Which of the following is true for a Post-dated Cheque (PDC)?

- a) It is payable immediately

- b) It is dated for a future date

- c) It can be cashed immediately if it is signed

- d) It cannot be cancelled

Answer: b) It is dated for a future date

- Which of the following are the primary objectives of banking regulation?

- a) Ensuring the safety of depositor’s funds

- b) Preventing financial crimes

- c) Promoting transparency in operations

- d) All of the above

Answer: d) All of the above

- Which of the following accounts allows unlimited withdrawals?

- a) Recurring Deposit

- b) Fixed Deposit

- c) Savings Account

- d) Current Account

Answer: d) Current Account

- What is the function of the ‘base rate’ in banking?

- a) To regulate the exchange rate

- b) To determine the interest rate on loans

- c) To set the minimum deposit requirement

- d) To determine the tax rate on financial transactions

Answer: b) To determine the interest rate on loans

- What is the tenure of a typical recurring deposit?

- a) 1-3 years

- b) 5-10 years

- c) 1 year

- d) 6 months

Answer: a) 1-3 years

- Which of the following is a non-banking financial company (NBFC)?

- a) LIC

- b) ICICI Bank

- c) HDFC

- d) Bajaj Finance

Answer: d) Bajaj Finance

- What is the primary function of the ‘base rate’ in banking?

- a) To regulate the exchange rate

- b) To determine the interest rate on loans

- c) To set the minimum deposit requirement

- d) To determine the tax rate on financial transactions

Answer: b) To determine the interest rate on loans

- Which of the following is true regarding ‘cheque dishonour’?

- a) It occurs when the cheque is not signed properly

- b) It occurs when there are insufficient funds in the account

- c) It occurs when the cheque is post-dated

- d) All of the above

Answer: b) It occurs when there are insufficient funds in the account

- What is a ‘bank guarantee’?

- a) A loan from the bank to an individual

- b) A promise by the bank to pay a third party if the borrower defaults

- c) A deposit made by the customer with the bank

- d) A type of insurance offered by the bank

Answer: b) A promise by the bank to pay a third party if the borrower defaults

- Which of the following is used to facilitate electronic payment of utility bills?

- a) ECS (Electronic Clearing System)

- b) NEFT

- c) RTGS

- d) IMPS

Answer: a) ECS (Electronic Clearing System)

- What does the acronym ‘SWIFT’ stand for in banking?

- a) Secure Wide International Financial Transactions

- b) Society for Worldwide Interbank Financial Telecommunication

- c) System for Worldwide Interbank Fund Transfers

- d) None of the above

Answer: b) Society for Worldwide Interbank Financial Telecommunication

- Which of the following is an example of a government-backed financial scheme?

- a) Fixed Deposit

- b) PPF (Public Provident Fund)

- c) Personal Loan

- d) Education Loan

Answer: b) PPF (Public Provident Fund)

- Which of the following is the correct definition of a ‘cheque’ in banking terms?

- a) A promissory note

- b) A demand for payment

- c) A draft issued by the bank

- d) A guarantee of payment

Answer: b) A demand for payment

- What does the term ‘overdraft facility’ refer to in banking?

- a) A loan provided against fixed assets

- b) A facility that allows withdrawal exceeding the account balance

- c) A type of credit card

- d) A loan for purchasing assets

Answer: b) A facility that allows withdrawal exceeding the account balance

- Which of the following is NOT a financial product provided by banks?

- a) Fixed Deposit

- b) Life Insurance

- c) Savings Account

- d) Debit Card

Answer: b) Life Insurance

- What is the primary function of a commercial bank in the economy?

- a) To print currency

- b) To accept deposits and lend money

- c) To regulate monetary policy

- d) To manage government funds

Answer: b) To accept deposits and lend money

- Which of the following is considered as a negotiable instrument?

- a) Bonds

- b) Shares

- c) Bills of Exchange

- d) All of the above

Answer: c) Bills of Exchange

- What is the full form of ECS in banking?

- a) Electronic Clearing System

- b) Electronic Credit System

- c) Emergency Clearing System

- d) None of the above

Answer: a) Electronic Clearing System

- Which of the following is the correct form of a non-negotiable instrument?

- a) Promissory note

- b) Demand draft

- c) Fixed Deposit Receipt

- d) All of the above

Answer: c) Fixed Deposit Receipt

- Which of the following is an example of a time deposit?

- a) Fixed Deposit

- b) Savings Account

- c) Recurring Deposit

- d) Current Account

Answer: a) Fixed Deposit

- In the banking sector, what is meant by ‘asset management’?

- a) Management of bank’s cash flow

- b) Management of investment portfolio

- c) Management of customer loan portfolios

- d) Management of bank’s financial assets

Answer: b) Management of investment portfolio

- Which of the following is a component of the monetary policy in India?

- a) Open market operations

- b) Repo rate adjustments

- c) Cash reserve ratio (CRR)

- d) All of the above

Answer: d) All of the above

- What does the term ‘subordinate debt’ refer to?

- a) The money borrowed by the bank from other institutions

- b) A debt that ranks lower than other debts in case of liquidation

- c) A loan given to an employee

- d) An unsecured loan

Answer: b) A debt that ranks lower than other debts in case of liquidation

- Which of the following is NOT a reason for cheque dishonour?

- a) Insufficient balance in the account

- b) Signature mismatch

- c) Post-dated cheque

- d) Overdraft facility

Answer: d) Overdraft facility

- Which of the following is a liability for a bank?

- a) Deposits from customers

- b) Loans given to customers

- c) Bank’s capital

- d) None of the above

Answer: a) Deposits from customers

- What is the difference between ‘cheque’ and ‘demand draft’?

- a) A cheque is payable on demand, but a demand draft is payable after a fixed period

- b) A cheque can be dishonoured, but a demand draft cannot

- c) A cheque is issued by banks only to customers

- d) None of the above

Answer: b) A cheque can be dishonoured, but a demand draft cannot

- What does the acronym ‘NPA’ stand for in banking?

- a) Non-Performing Asset

- b) Non-Processing Asset

- c) New Payment Agreement

- d) None of the above

Answer: a) Non-Performing Asset

- Which of the following is a role of the RBI?

- a) Control inflation

- b) Regulate currency supply

- c) Supervise the banking system

- d) All of the above

Answer: d) All of the above

JAIIB PPB Syllabus 2025

The JAIIB PPB Syllabus 2025 covers important topics in banking, including general banking operations, the roles of banks, banking technology, and ethics in financial institutions.

| Module | Description |

| Module A: General Banking Operations | Covers essential banking functions, such as banker-customer relationship, anti-money laundering (AML), KYC norms, account management, and foreign exchange services. |

| Module B: Functions of Banks | Focuses on key banking roles including customer relationships, regulatory compliance, lending principles, credit monitoring, and managing government schemes. |

| Module C: Banking Technology | Delves into banking technologies like core banking systems, electronic banking, payment systems, and data security considerations. |

| Module D: Ethics in Banks and Financial Institutions | Addresses the importance of ethical practices in banking, workplace behavior, employee responsibilities, and data security in the digital age. |

Also Check,

| Related Topics | Link |

| 50 Most Repetitive JAIIB AFMB MCQs | Click here to Check |

| 50 Most Repetitive JAIIB RBWM MCQs | Click here to Check |

| 50 Most Repetitive JAIIB IE & IFS MCQs | Click here to Check |

Conclusion

Preparing for the JAIIB PPB 2025 exam requires dedication, practice, and a focused approach. By concentrating on the 50 Most Repetitive JAIIB PPB MCQs, you can ensure that you are well-prepared for the exam. Remember to cover all key areas, practice regularly, and stay updated with the latest developments in the banking sector. With consistent effort, you can excel in the JAIIB PPB exam and take your banking career to new heights.

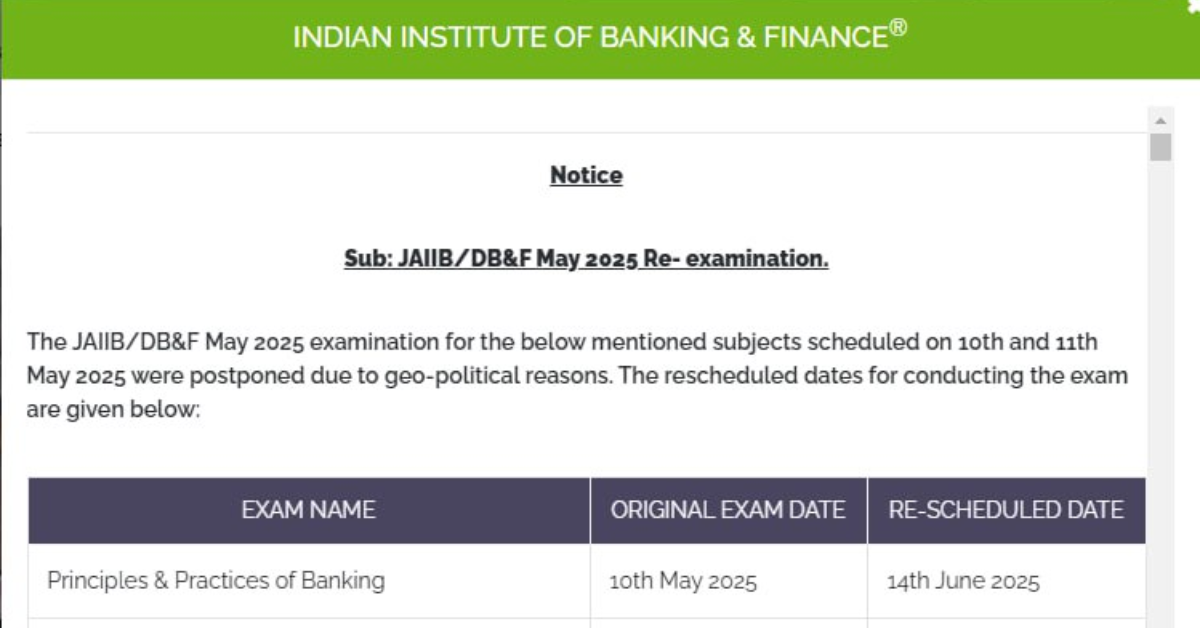

- JAIIB PPB and AFM New Exam Dates Out for Affected Areas, May Cycle

- JAIIB RBWM Exam 2025 Analysis for Shift 1, 2 & 3 – 18th May 2025

- JAIIB Exam Analysis 2025, May Cycle, All Shifts Covered

- JAIIB AFM Exam Analysis 2025, May All Shifts Review

- JAIIB PPB Exam Analysis 2025, May All Shifts Review

- JAIIB IE and IFS Exam Analysis 2025, 4th May 2025 Detailed Analysis

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!