The Bank of Baroda LBO Group Discussion (GD) is an important part of the BOB LBO selection process for candidates who qualify the online exam and the Language Proficiency Test. The GD round helps the panel evaluate communication skills, clarity of thoughts, leadership qualities, teamwork, and suitability for the Local Bank Officer role. Since the LBO job involves customer handling, sales, and frequent public interaction, this stage is crucial for shortlisting candidates for the final interview.

What is the purpose of the GD in the Bank of Baroda LBO Selection Process?

The Group Discussion is the major screening stage to assess whether a candidate is suitable for a customer-facing role where communication, clarity of thought, and confidence are essential. Unlike written tests, GD evaluates how well a candidate can express ideas, interact in a team, handle disagreements, and logically defend a point of view. These skills reflect how the candidate will communicate with customers, understand their needs, and represent the bank professionally.

How is the GD conducted at Bank of Baroda for LBO post?

The format is simple and structured to assess both communication and cooperation. Candidates are seated in a semi-circular formation, usually 8–12 per group. A panel of two officers introduces the topic, gives one minute to think, and then allows each candidate to speak. After every participant adds their initial point, the discussion is opened for free exchange of ideas for 10–12 minutes. The session concludes when the panel asks for a final summary or closes the discussion themselves.

What does the panel observes during GD?

- The clarity of your thoughts

- Relevance of your points

- Your knowledge of the topic

- Confidence without being aggressive

- Ability to listen and respond politely

- Professional attitude and body language

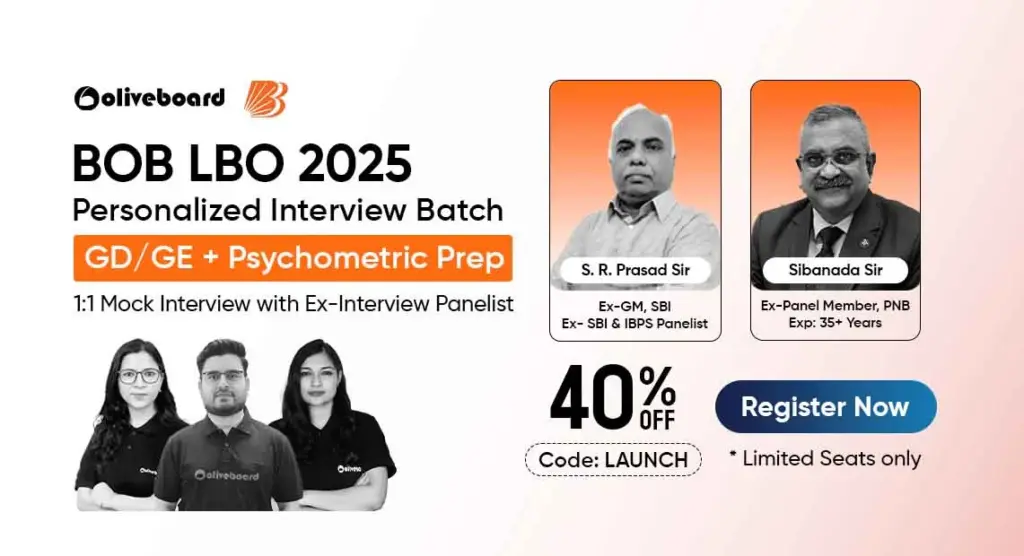

Prepare for the BOB LBO Interview and GD with our FREE GUIDE and expert-interview batch.

Is GD conducted before the Interview?

Yes, GD is generally conducted before the personal interview. Only candidates who perform well in the GD are shortlisted for the interview. Although the interview carries more weight, the GD acts as a qualifying filter. If your communication, confidence, and awareness are weak, you may not reach the interview stage even if your academic background is strong.

What kind of Topics are asked in the Bank of Baroda LBO GD?

The GD topics usually come from banking, economy, government policies, finance, social issues, and emerging technologies. Topics are chosen to test your awareness and your ability to form balanced opinions.

GD Topics from Banking & Economy

These topics test your understanding of how banks operate and how the economy affects the banking system.

- Privatization of Public Sector Banks – Is it the right move?

- Digital Banking vs Traditional Banking – What is the future?

- Cryptocurrency: Threat to financial stability or innovation?

- RBI’s role in controlling inflation – Effective or not?

- Financial Inclusion – Progress, challenges, and future

- Impact of UPI and FinTech on Indian Banking

- Merger of Banks – Has consolidation strengthened Indian banking?

- Impact of rising NPAs on banking stability

- How safe is India’s digital banking ecosystem?

- Impact of global crude oil prices on India’s banking sector

Tip to Prepare:

Revise basics of Indian banking, RBI roles, digital payments, and major economic reforms. Use facts and examples to support your points.

GD Topics from Current Affairs & Government Policy

These topics test your general awareness and ability to connect events with economic impact.

- India as a $5 Trillion Economy – Dream or Reality?

- One Nation, One Election – Pros and Cons

- Impact of global conflicts (Israel–Hamas, Russia–Ukraine) on India’s inflation

- Budget 2025 – Key takeaways and impact

- De-dollarization and India’s push for local currency trade

- India’s exports, manufacturing, and PLI schemes

- Red Sea crisis and its impact on Indian trade

- New RBI guidelines on personal loans – Needed or excessive?

Tip to Prepare:

Read economic news daily. Understand how policies affect banking, inflation, investments, and customer behavior.

GD Topics from Social Issues

These topics check your ability to understand societal challenges and propose balanced solutions.

- Is India prepared for a cashless economy?

- Reservation in jobs and education – Should it be based on economic status?

- Role of women in financial and economic growth

- Social media – A boon or a bane?

- Unemployment among youth – Causes and solutions

- Financial awareness in rural India – Need of the hour

Tip to Prepare:

Maintain a balanced viewpoint. Combine data, examples, and simple language for clarity.

GD Topics from AI & Technology in BFSI Sector

With digital banking expanding rapidly, BOB panels increasingly focus on technology-driven topics.

- Will AI replace human jobs in the banking sector?

- AI and Automation – Boon or bane for customer service in banks?

- Are Indian banks ready for an AI-driven future?

- Cybersecurity challenges in India’s digital banking ecosystem

- Will digital lending replace traditional branch banking?

Tip to Prepare:

Understand AI applications in banking: chatbots, fraud detection, automation, digital KYC, etc

GD Topics from Geopolitical & International Topics

These usually connect global events to India’s economy.

- Russia–Ukraine conflict and its effect on India

- Middle East tensions and rising oil prices

- How global recession fears impact developing countries?

- India’s growing role in BRICS

GD Topics from Social and General Topics

These evaluate general awareness and thinking ability.

- Should social media be regulated?

- Importance of financial literacy

- Remote work vs office work: Which is better for productivity?

- Is online education replacing traditional learning?

- Should voting be mandatory in India?

- Are electric vehicles the future of Indian transportation?

Sample Situational GD Scenarios for BOB LBO

Bank of Baroda sometimes gives role-based GD situations to assess your customer-handling approach.

- Your branch has low loan sourcing. Suggest ways to increase business.

- A customer is upset about hidden charges. How should the bank handle it?

- Competitors are attracting customers with lower rates. How can BOB retain them?

- A borrower earns well but has a low credit score. Should the bank approve his loan?

These require both logical thinking and practical understanding of banking.

How to prepare for the Bank of Baroda LBO GD?

Preparing for the BOB LBO Group Discussion requires a smart mix of awareness, communication skills, and controlled confidence. First-time candidates often feel confused about what to study, how to speak, and how the GD panel evaluates them. The points below break down the preparation in a simple and practical manner.

Build Awareness (Banking, Economy, and Current Affairs)

To perform well in a GD, you must be aware of the major developments in the banking sector and the Indian economy. This helps you speak confidently and give meaningful examples instead of generic statements.

- Basic Banking Terms: Understand savings account, current account, NPA, repo rate, CASA, EMI.

- RBI Updates: Stay aware of recent monetary policy changes, lending norms, digital payment regulations.

- Economic Indicators: Know the basics of GDP, inflation, fiscal deficit, unemployment trends.

- Government Schemes: Learn key features of Jan Dhan Yojana, PMAY, Mudra, PMFBY, PLI, Stand-Up India.

- Digital Payments: Update yourself on UPI, AePS, RuPay, credit cards, digital fraud safeguards.

- Banking Reforms: Be aware of Bank Mergers, priority sector lending rules, Financial Inclusion efforts.

- Geopolitical Developments: Understand how global conflicts, oil prices, and recession trends impact India.

How to structure your contribution in the BOB LBO GD?

Using a clear structure makes you sound confident and organized. This is extremely helpful for first-time candidates who feel nervous or lose track while speaking.

- Introduction: Start with 1–2 lines explaining the overall issue or relevance of the topic.

- Discussion: Add 2–3 logical points backed by examples or basic reasoning.

- Conclusion: Briefly summarize the key ideas discussed without adding new points.

What body language should be maintained during the BOB LBO GD?

Your non-verbal communication forms a large part of your impression. Since LBO is a customer-facing role, the panel expects you to appear calm, polite, and approachable.

- Sit Straight: Good posture shows confidence and professionalism.

- Avoid Pointing: Use open hand movements instead of pointing fingers.

- Maintain Eye Contact: Look at all participants, not just the panel.

- Polite Expressions: A slight smile shows you are engaged and comfortable.

- No Interruptions: Wait until a speaker finishes before adding your point.

How to show Leadership without dominating in GD?

Leadership in a GD is subtle. It is about guiding the discussion, not overpowering others. First-time candidates often misunderstand leadership as speaking the most, but BOB values balanced behavior.

- Start Confidently: Open the discussion if you are comfortable doing so.

- Add Logical Points: Share ideas that move the conversation forward.

- Encourage Others: Invite quieter members by saying, “We would like to hear more views.”

- Summarize Clearly: If given a chance, conclude the discussion in a crisp manner.

How to put your point right during the GD round?

Most fresh candidates get stuck at the first line. Using a simple and natural opening helps you begin smoothly and confidently.

- Starting the GD: “I believe this topic is important because it affects both customers and banks. In my opinion…”

- Adding a Point: “To add another perspective, we should also consider…”

- Redirecting the Discussion: “Let’s connect this to the main issue, which is…”

- Summarizing: “To conclude, we discussed several strong viewpoints. The key ideas were…”

What should you avoid during the Bank of Baroda LBO GD?

Knowing what not to do is just as important as preparation. These mistakes can reduce your score even if your content is good.

- Avoid Shouting: Stay calm even if the discussion gets heated.

- Avoid Repetition: Don’t repeat points already made unless adding something new.

- Avoid Long Speeches: Keep your points short and structured.

- Avoid Ignoring Others: Acknowledge others’ views when responding.

- Avoid Staying Silent: Speak multiple times to show active participation.

- Avoid Wrong Facts: Share only information you are sure about.

FAQs

Q1: Is the Bank of Baroda LBO GD mandatory for all candidates?

A1: Yes, if conducted for the recruitment cycle. Only candidates who qualify GD will proceed to the interview and final selection stages.

Q2: What is the qualifying mark for the BOB LBO GD?

A2: The minimum score required is 60% for General category and 55% for Reserved categories.

Q3: What are common topics asked in the Bank of Baroda LBO GD?

A3: Topics usually include banking awareness, current affairs, economic issues, digital banking, financial literacy, and social themes.

Q4: How long does the BOB LBO Group Discussion last?

A4: Typically, a GD lasts 15–20 minutes, depending on the number of candidates and the topic assigned.

Q5: What skills are evaluated during the Bank of Baroda LBO GD?

A5: The panel evaluates communication, teamwork, leadership, clarity of thought, awareness, and how respectfully you engage in a group.

- SBI Clerk Mains Answer Key 2026 Response Sheet Date

- Bihar State Cooperative Bank Clerk Final Result 2025 Out

- SBI Clerk Document Verification, List of Documents Required

- SBI Clerk LPT 2025-26, Check Types of Questions Asked

- RBI Office Attendant Exam Analysis 2026, 28th Feb & 1st March 2026

- Nainital Bank SO Final Result 2026 Out for 74 Posts, Download Link

Hi, I’m Tripti, a senior content writer at Oliveboard, where I manage blog content along with community engagement across platforms like Telegram and WhatsApp. With 3+ years of experience in content and SEO optimization related to banking exams, I have led content for popular exams like SSC, banking, railway, and state exams.