Preparing for the SEBI Grade A exam is incomplete without mastering Economics. Along with finance and securities laws, Economics is a core part of both Phase 1 (objective) and Phase 2 (descriptive + objective) papers. Unlike school-level theory, here the focus is on application-oriented concepts: how inflation affects markets, how RBI’s policy rates influence capital flows, or how fiscal deficits shape investor sentiment.

This blog will cover the most important economics topics for SEBI Grade A, supported with explanations, examples, tables, and preparation insights to make revision easier.

Why Economics Matters for SEBI Grade A

Economics is not just a scoring subject it’s a decision-making tool for SEBI officers. Financial markets move daily based on economic data: a sudden rise in inflation may cause bond yields to surge, while higher FDI inflows can lift equity markets. SEBI needs officers who can understand these signals and regulate markets accordingly.

For example:

- When the RBI hikes repo rate, bond prices fall and stock markets may react negatively. SEBI officers must monitor such volatility.

- Fiscal deficits can affect investor confidence and trigger capital outflows.

- International trade disputes can hit India’s exports, indirectly affecting listed companies.

Key Macroeconomics Topics

Macroeconomics explains the economy as a whole and is heavily tested in SEBI Grade A.

Must-revise topics:

- National Income Accounting: GDP, GNP, NNP, and methods (production, income, expenditure). Focus on India’s recent GDP growth trends.

- Inflation: CPI vs WPI, core vs food inflation, causes (demand-pull, cost-push), and RBI’s inflation-targeting framework (4% ± 2%).

- Unemployment: Types (cyclical, structural, disguised) and recent PLFS (Periodic Labour Force Survey) data.

- Monetary Policy: Repo rate, CRR, SLR, Open Market Operations. Also revise MPC’s role in inflation targeting.

- Fiscal Policy: Deficits (fiscal, revenue, primary), FRBM targets, and fiscal consolidation debates.

- Balance of Payments (BoP): Current account deficit, capital account, forex reserves.

Important Microeconomics Concepts

Though weightage is lower than macro, microeconomics concepts appear in conceptual MCQs.

Topics to focus on:

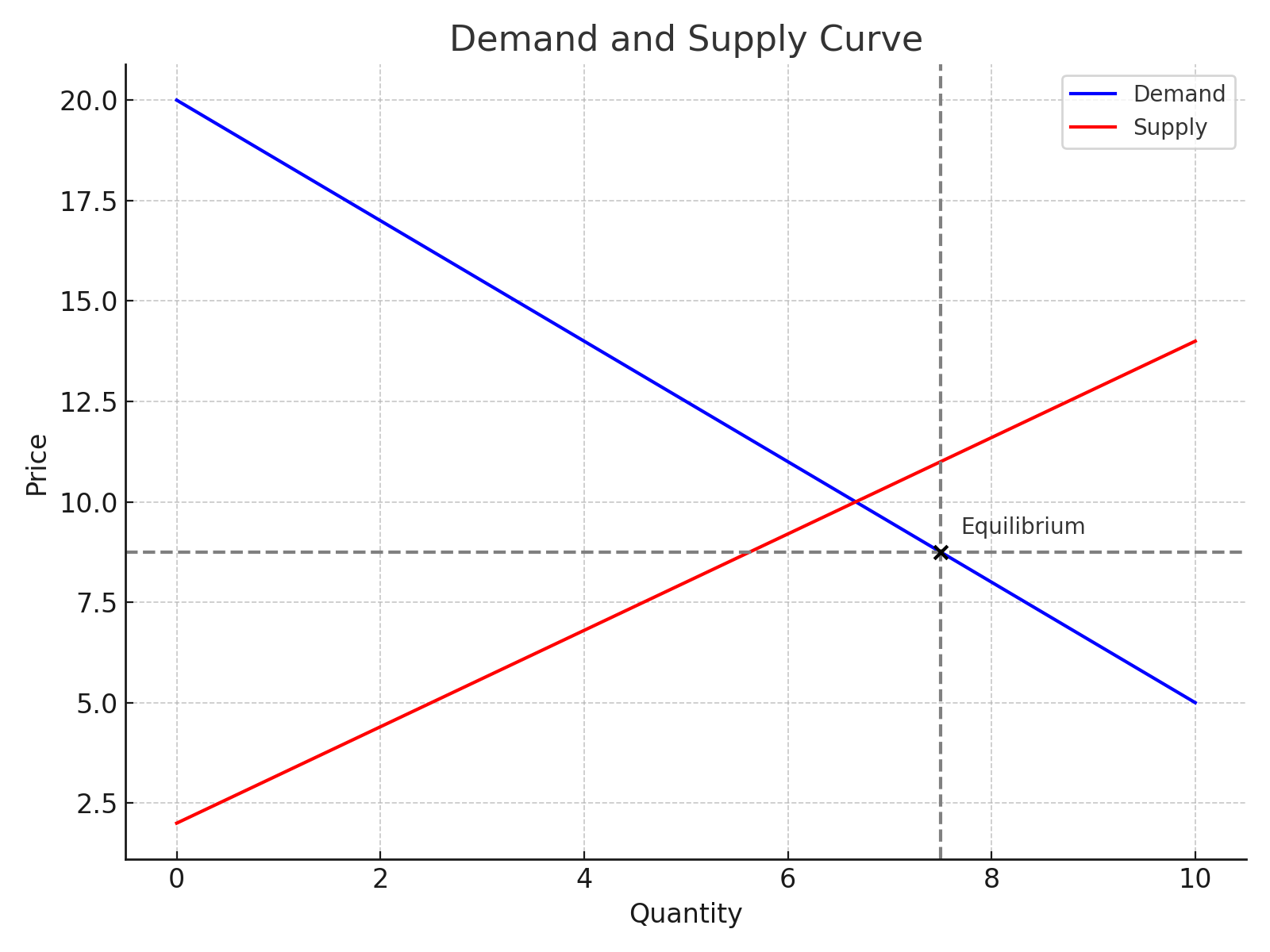

- Demand & Supply: Elasticity of demand (price, income, cross). Expect graph-based questions.

- Cost & Revenue: Short-run vs long-run cost curves, marginal cost, economies of scale.

- Market Structures: Perfect competition, monopoly, oligopoly (with examples like Indian telecom sector).

- Pricing Mechanisms: How equilibrium price is determined; impact of government price controls.

Indian Economy Focus Areas

The Indian Economy is a high-priority area because SEBI officers directly work in the Indian financial ecosystem.

Focus points:

- GDP Growth: Recent quarterly growth data, sectoral contributions (agriculture, industry, services).

- Economic Survey & Union Budget: Questions often directly reference schemes, fiscal measures, and reforms.

- Government Schemes: PLI, PM-Kisan, Atmanirbhar Bharat, financial inclusion schemes.

- Inflation Trends: Why food inflation is sticky, RBI’s inflation outlook.

- Fiscal Health: India’s fiscal deficit trend, debt-to-GDP ratio.

- Financial Reforms: 1991 reforms, GST, Insolvency and Bankruptcy Code, banking sector changes.

International Economics for SEBI Grade A

India’s markets are deeply tied to global economics. International topics get tested through both theory and current affairs-driven questions.

Must-revise topics:

- Trade Theories: Comparative advantage, absolute advantage, Heckscher-Ohlin.

- Global Trade Issues: Supply chain disruptions, trade wars, tariff disputes.

- International Organizations: IMF, World Bank, WTO, BRICS Bank — their role in India’s economy.

- Exchange Rate Systems: Managed float, purchasing power parity.

- Global Economic Trends: Rising protectionism, global inflation, oil price shocks.

FAQs

No. With conceptual clarity and focus on current affairs, it’s one of the most scoring sections.

Prioritize Indian Economy since most questions link policies to Indian markets, but don’t ignore global trade and IMF/WTO-related topics.

They’re good for basics, but Economic Survey, Budget, and Ramesh Singh are must for exam-level prep.

Not deeply. Revise only applied concepts relevant to markets and policy.

Usually 15–20 questions in Phase 1 and descriptive essays/case-based questions in Phase 2.

- SEBI IT Officer Syllabus 2026, Exam Pattern, Download PDF

- SEBI Law Officer Recruitment 2026, Download Notification PDF

- SEBI IT Officer Recruitment 2026 Notification, Download PDF

- SEBI Legal Officer Syllabus 2026 & Exam Pattern, Download PDF

- ESI & ARD Practice Questions for NABARD Grade A 2026

- RBI Grade B 2026 Practice Quiz, Download Free PDF

Priti Palit, is an accomplished edtech writer with 4+ years of experience in Regulatory Exams and other multiple government exams. With a passion for education and a keen eye for detail, she has contributed significantly to the field of online learning. Priti’s expertise and dedication continue to empower aspiring individuals in their pursuit of success in government examinations.