Derivatives being one such complex topic need proper guidance to be able to understand it. Let us go on to learn the basics of derivatives in this eBook. These basics will help you a great deal with the Finance portion of RBI Grade B and SEBI Grade A Exams. Let us get started with the Derivatives. You can use the link given below to download the Derivatives PDF.

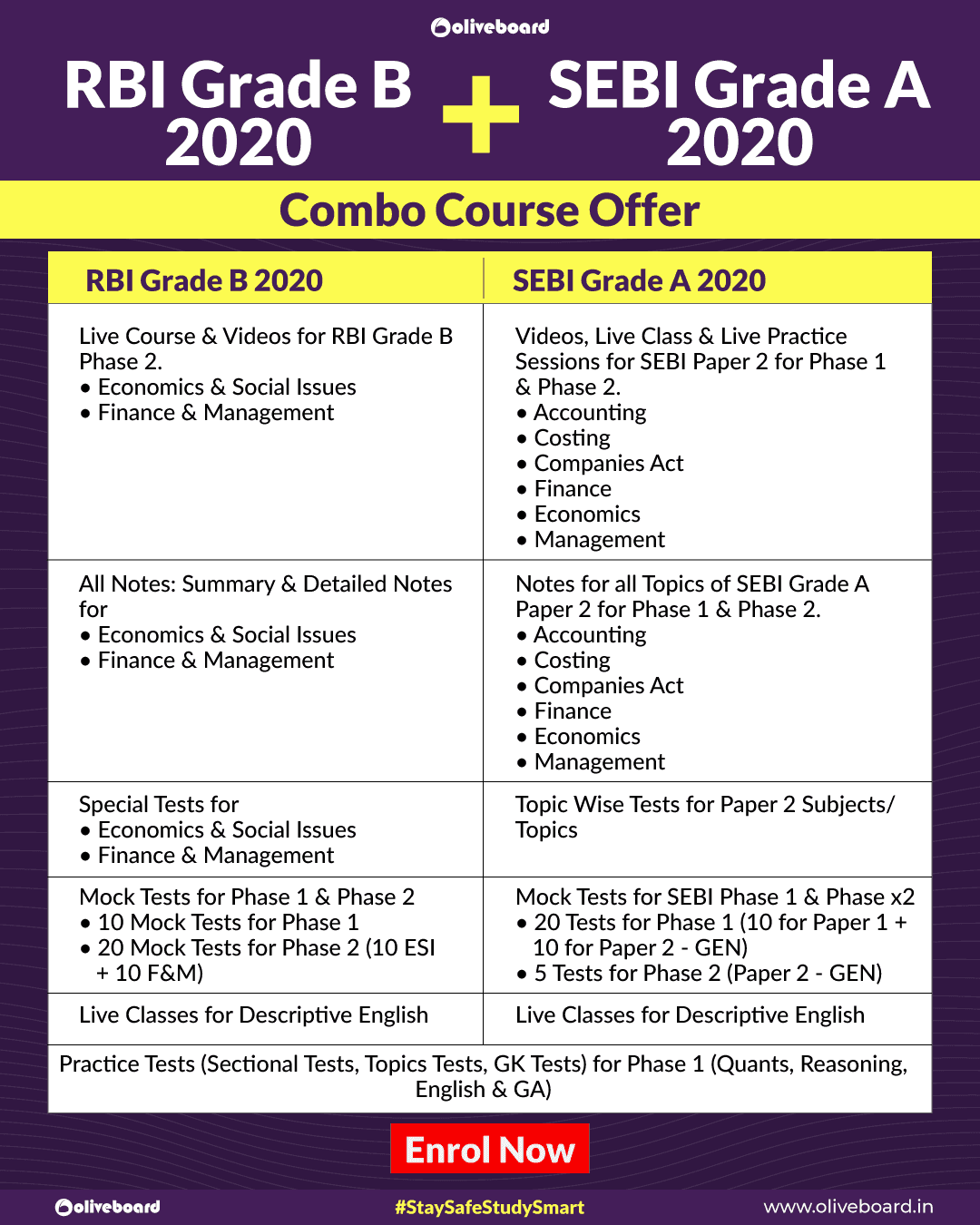

Join RBI Grade B & SEBI Grade A Online Courses Here.

Basics of Derivatives – Derivatives PDF

I. Download Here

Download the Free Basics of Derivatives PDF here:

Join RBI Grade B & SEBI Grade A Online Courses Here for your complete preparation.

Steps to download the Free eBook:

a. Sign in or log in using the ‘Download’ button given above.

b. As you log in, click on the ‘Static GK’ tab.

c. Find the eBook and download it for free.

More eBooks:

- SEBI Grade A Officer Question Paper PDF

- Introduction to Costing

- Financial/Securities Markets

- Financial / Accounting Ratios

- List of Sustainable Development Goals 2030

- Alternate Sources of Finance

II. Take a Sneek Peek into the eBook Here

A. What are Derivatives?

- Derivatives are contracts that derive values from underlying assets or securities.

- The underlying asset or assets from which these contracts derive values can be stocks, bonds, indices, currencies or commodities like gold, silver, oil, natural gas, electricity, wheat, sugar, coffee, and cotton etc.

- The performance of a derivative is dependent on the underlying asset’s performance.

- This underlying asset is simply called an “underlying”. This asset is traded in a market where both the buyers and the sellers mutually decide its price, and then the seller delivers the underlying to the buyer and is paid in return.

- Derivatives contracts can be either over the counter or exchange-traded.

B. What is the purpose that Derivatives serve?

- Derivatives are instruments to manage financial risks.

- Derivatives serve the purpose of risk management. These work on the principle of risk transfer, depending upon the roles donned by different market participants.

- Derivatives are one of the ways to prevent investments against market fluctuations.

- The basic principle behind entering into derivative contracts is to earn profits by speculating on the value of the underlying asset in future.

This is all from us in this Basics of Derivatives PDF. We hope that you like and appreciate it.

Have a look at the provisions of the Online Course

The most comprehensive online preparation portal for MBA, Banking and Government exams. Explore a range of mock tests and study material at www.oliveboard.in