JAIIB Case Studies

JAIIB Case Studies: The Indian Institute of Banking and Finance (IIBF) conducts courses and exams for banking professionals. The Junior Assistant for the Indian Institute of Banking and Finance is one of IIBF’s flagship courses. The IIBF conducts JAIIB twice a year.

Case studies are an important part of JAIIB. In this blog, you will understand what case studies mean, how useful they are as questions, and how you can train yourself and learn to solve them for JAIIB. Let’s begin!

What are Case Studies?

A case study is basically a study of one particular case or situation. This situation can be fictional or based on real life. The case study helps the learners apply theoretical concepts to real-life problems. But also, helps take in the different factors that apply to a real-life situation.

JAIIB Case Studies 2023

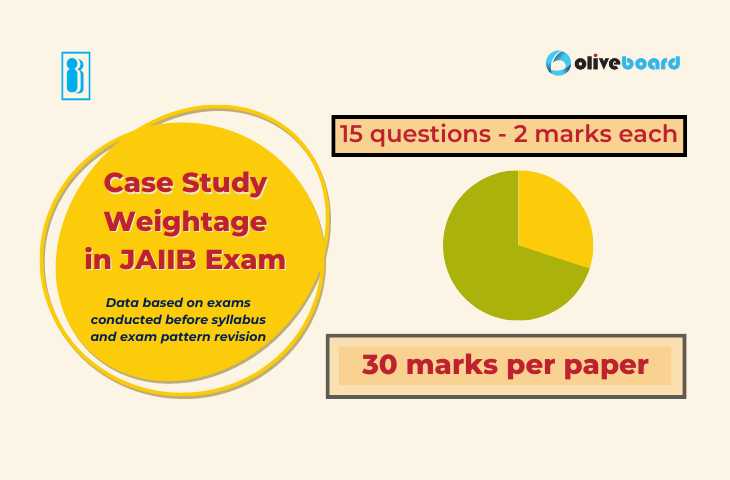

For JAIIB, case studies are important in all papers, but especially for Accounting and Financial Management for Bankers. The graphic below shows the weightage given to case studies till 2022.

Let us see a few examples of these questions and how they’re framed.

Indian Economy and Indian Financial System Case Studies

The basic features of an economy and the basic modes of functions of the Indian Economy and Financial System is the focus of this paper. While this paper does not have many topics for case studies, simple situations based on functions and rules can also be questions. Let’s see an example of a small situation:

Q. A customer has a balance in his savings bank account. In which of the following cases, the bank can use its Right of Set for recovery of a loan?

a. A bank guarantee issued by the bank

b. A term loan has been sanctioned and the installment is still to fall due

c. A cash credit limit is sanctioned to the party and it is running regularly

d. The customer is a guarantor in a loan account of another person and that person has defaulted in repayment of the loan

Explanation and Solution:

Right of Set refers to the bank’s right to recover a defaulted loan by seizing funds from either the guarantor or the debtor. So knowledge of the rights that the bank themselves have is necessary for a situation like this. And in this case, the answer is:

d. The customer is a guarantor in a loan account of another person and that person has defaulted in repayment of the loan

Principles and Practices of Banking Case Studies

PPB deals with a lot more in-depth knowledge of the economic systems and functions in place, especially with lending, technology and ethics. Financial inclusion, customer protection, KYC/AML/CFT norms, banking technology, banking ethics, etc. are all topics that can include case studies. Let’s look at an example:

Q. X is maintaining a SB account with Popular Bank and wrongly credited an amount of Rs.12500 to his account. This was entered in his pass book also. Later on when the mistake came to bank’s notice it debited customer’s account but did not inform the customer. Meanwhile the customer issued a cheque on the basis of this balance which was dishonoured by the bank.

a. Customer can ask for damages for return of his cheque although amount was recoverable

from him, had the cheque been paid

b. Customer cannot ask for damages as bank has only rectified the mistake.

c. It was customer’s duty to check the pass book for bringing the error to bank’s notice. Hence customer cannot claim any damages

d. None of the above

Explanation and Solution:

When an action is a mistake on part of the bank and results in a loss to the customer without their knowledge, the customer is entitled to damages. This situation requires a thorough knowledge about bank policies when it comes to cheques, lending and credit/debit. And in this case the answer is:

a. Customer can ask for damages for return of his cheque although amount was recoverable from him, had the cheque been paid.

Accounting and Financial Management for Bankers Case Studies

Case studies hold a great importance in AFM. Most of the questions pertain to different cases of accounts, balance sheets, financial management, taxes and costs. The questions usually detail the balance sheet of expenses, investments, assets of a corportation/business or company and carry a set of questions to solve. These questions are usually numericals which require the knowledge of various formulae used in accounting and finance. Let’s take a look at an example:

Q. A financial services company offers investment vehicles to its clients. Investment A pays an amount of Rs. 8,000 in 2 years, and has an annual interest of 6% compounded semi-annually. Investment B pays an amount of Rs. 12,000 in 4 years, and has an annual interest of 8% compounded quarterly. Investment C pays an amount of Rs. 15,000 in 8 years, and has an annual interest of 10% compounded quarterly. Investment D pays an amount of Rs. 20,000 in 12 years, and has an annual interest of 6% compounded monthly. Investment E pays an amount of Rs. 25,000 in 15 years, and has an annual interest of 4% compounded semi-annually.

- What is the present value of Investment A?

a. Rs. 7,102

b. Rs. 7,108

c. Rs. 7,120

d. Rs. 7,180 - What is the present value of Investment B?

a. Rs. 8,741

b. Rs. 8,417

c. Rs. 8,768

d. Rs. 8,820 - What is the present value of Investment C?

a. Rs. 6,872

b. Rs. 6,906

c. Rs. 6,508

d. Rs. 6,807

- What is the present value of Investment D?

a. Rs. 9,838

b. Rs. 9,787

c. Rs. 9,752

d. Rs. 9,275 - What is the present value of Investment E?

a. Rs. 13,802

b. Rs. 13,812

c. Rs. 13,761

d. Rs. 13,882

Explanation and Solution:

Here we have a simple situation of a financial services company that provides it’s clients with different products for investment. We are given 5 cases- of A, B, C, D, and E. We have been provided with the amounts paid, the annual interest rate and the frequency at which it is compounded. And we have been asked 5 basic questions – the present value of each investment. In this scenario,

- Calculate the Present Value Interest Factor (PVIF)

- Multiply the amount being paid with the PVIF

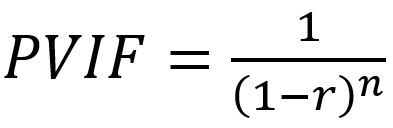

For this, you need to know the formula for PVIF, which is:

Where,

PVIF = Present Value Interest Factor

r = interest/discount rate

n = number of time periods

Using this formula we get:

- b. The PVIF is 0.8885. The present value is Rs. 8,000 * 0.8885 = Rs. 7,108

- a. The PVIF is 0.7284. The present value is Rs. 12,000 * 0.7284 = Rs. 8,741

- d. The PVIF is 0.4538. The present value is Rs. 15,000 * 0.4538 = Rs. 6,807

- c. The PVIF is 0.4876. The present value is Rs. 20,000 * 0.4876 = Rs. 9,752

- a. The PVIF is 0.5521. The present value is Rs. 25,000 * 0.5521 = Rs. 13,802

Hence, AFM requires thorough knowledge of the various formulae and calculation techniques required in accountancy and finance.

Retail Banking and Wealth Management Case Studies

This is a paper introduced with the new JAIIB 2023 syllabus. Retail banking is actually an elective for CAIIB. It mainly deals with the retail side of banking and finance, from how products are developed based on consumer study to marketing of banking products and services. Wealth management deals with the different methods of planning when it comes to investments, insurance, etc. So in this paper, case studies will be based around these concepts. Let’s see an example:

Q. An individual took a loan of Rs. 10.00 Lakhs for purchasing a plot of land during F.Y.

2005-06 & has paid around Rs. 1,10,000 towards Interest & around Rs. 57,000 towards

principal during F.Y. 2006-07. He has not made any other contribution under Sections 80C, 80CCC, or 80CCD. He will be able to claim deduction of …… towards principal.

a. Rs. 1,50,000

b. Rs. 1,10,000

c. Rs. 57,000

d. Rs. 0

The above case requires in-depth knowledge of taxes, tax deductions and general ways to manage wealth. In this case, the person has taken loan to purchase a plot of land. The following are the sections mentioned in the questions:

1. Section 80C

Section 80C provides deductions on various investments up to ₹ 1.5 lakh per year from your taxable income.

2. Section 80CCC

Section 80CCC of the Income Tax Act of 1961 provides deductions of up to Rs. 1.5 lakhs per annum for contributions made by an individual towards specified pension funds that are offered by a life insurance.

3. Section 80CCD

Section 80CCD of the Income Tax Act, 1961 allows individuals to get tax deduction by investing in the National Pension System (NPS) and the Atal Pension Yojana (APY). The maximum tax deduction that an individual can claim u/s 80CCD is ₹2 lakh in a financial year.

As per the above sections, the answer for our question is:

d. Rs. 0

JAIIB Case Studies – Test Yourself

With the way case studies make up a significant chunk of questions, it is imperative that you test yourself on a variety of case studies. For this purpose, Oliveboard has introduced a Mock Test Series exclusively for the JAIIB Case Studies, with the following features:

- 50 JAIIB Case Studies Mock Tests

- Complete + Topic-Wise Syllabus Covered

- Free Topic-Wise Pdf Notes

- AI-based Analysis

Sign up for JAIIB Case Study Mock Tests Right here:

JAIIB Case Studies – Conclusion

Case studies hold a lot of importance in JAIIB. The simple reason for this is because banking and finance is a career where customer interaction and issues are prominent. The knowledge of rules, procedures, policies is important. What is equally important is knowing where this knowledge can be successfully applied.

With the new JAIIB syllabus, it remains to be seen how the weightage of case studies changes. However, it will be for the best if candidates focus on these as they prepare because case studies will definitely be a part of the exam.

For more information, make sure to keep an eye on our official JAIIB YouTube channel:

All the best!

JAIIB Case Studies: Frequently Asked Questions

Case study questions help in understanding the application of various concepts. This includes procedures, rules and regulations that banks have set in place.

You can prepare for case studies only through practice. Every question may vary to reflect the different situations encountered in real life. To build an awareness of questions practice more questions.

Oliveboard offers an exclusive JAIIB Case Studies mock test series. You can find the mock tests here.

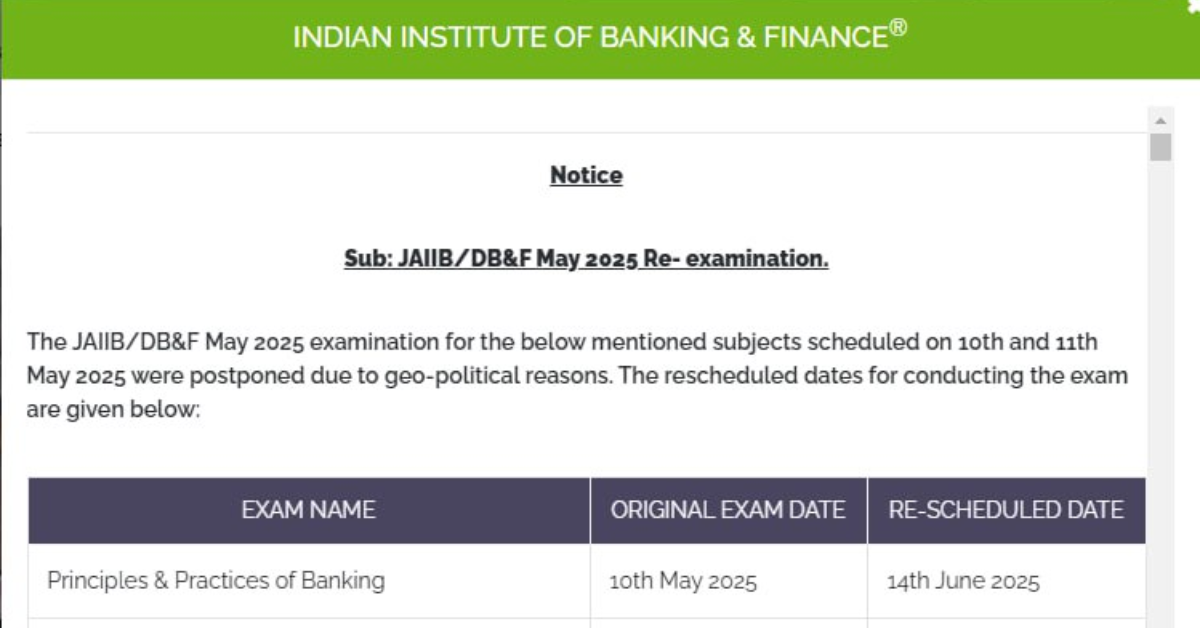

- JAIIB PPB and AFM New Exam Dates Out for Affected Areas, May Cycle

- JAIIB RBWM Exam 2025 Analysis for Shift 1, 2 & 3 – 18th May 2025

- JAIIB Exam Analysis 2025, May Cycle, All Shifts Covered

- JAIIB AFM Exam Analysis 2025, May All Shifts Review

- JAIIB PPB Exam Analysis 2025, May All Shifts Review

- JAIIB IE and IFS Exam Analysis 2025, 4th May 2025 Detailed Analysis

Hi, I’m Tripti, a senior content writer at Oliveboard, where I manage blog content along with community engagement across platforms like Telegram and WhatsApp. With 3 years of experience in content and SEO optimization, I have led content for popular exams like SSC, Banking, Railways, and State Exams.