The 15th Finance Commission (FC-XV) was constituted by the President of India under Article 280 of the Constitution on 27 November 2017 to make recommendations on center-state financial relations for a period of five years commencing 1 April 2020.

The 15th Finance Commission (Chairman: Mr. N. K. Singh) was required to submit two reports. The first report, consisting of recommendations for the financial year 2020-21, was tabled in Parliament on February 1, 2020. The final report with recommendations for the 2021-26 period will be submitted by October 30, 2020.

Have a look at the RBI Grade B 2021 Online Course Offerings

Finance Commission

The Finance Commission was established by the President of India in 1951 under Article 280 of the Indian Constitution. It was formed to define the financial relations between the central government of India and the individual state governments. The Finance Commission (Miscellaneous Provisions) Act, 1951 additionally defines the terms of qualification, appointment, and disqualification, the term, eligibility, and powers of the Finance Commission. As per the Constitution, the Commission is appointed every five years and consists of a chairman and five other members.

Functions of Finance Commission

- Distribution of net proceeds of taxes between Center and the States, to be divided as per their respective contributions to the taxes.

- Determine factors governing Grants-in-Aid to the states and the magnitude of the same.

- To make recommendations to the president as to the measures needed to augment the Fund of a State to supplement the resources of the panchayats and municipalities in the state on the basis of the recommendations made by the finance commission of the state.

- Any other matter related to it by the president in the interest of sound finance.

Qualification of Members of Finance Commission

The Chairman of a finance commission is selected from people with experience in public affairs. The other four members are selected from people who:

- Are, or have been, or are qualified, as judges of a high court,

- Have knowledge of government finances or accounts, or

- Have had experience in administration and financial expertise; or

- Have special knowledge of economics

15th Finance Commission

The 15th Finance Commission has been set up in November 2017, under the leadership of N.K Singh with two full-time members – Shaktikanta Das and Anoop Singh. In addition, also Ramesh Chand and Ashok Lahiri are the two part-time members. The commission will be giving recommendations for 5 years which will be starting from April 2020. The main tasks of the commission can be broadly categorized into:-

1) Strengthen cooperative federalism

2) Improve the quality of public spending

3) Protecting fiscal stability

For achieving the above, it will be recommending various aspects like devolution of central pool taxes to states, the whole fiscal consolidation roadmap for the govt. finances, the definition of populist measure, monitoring criteria for the state’s performance (eg. Ease of doing business), the decision regarding revenue deficit grants, etc.

Recommendations in the Report for FY 2020-21

Interim report of 15th FC: Devolution of Taxes to States:

- Devolution of taxes to states: The share of states in the centre’s taxes is recommended to be decreased from 42% during the 2015-20 period to 41% for 2020-21. The 1% decrease is to provide for the newly formed union territories of Jammu and Kashmir, and Ladakh from the resources of the central government.

- The commission also tweaked the criteria and weights under which funds are allocated to states. It assigned 15% weight to the population of a state, down from the 17.5% allocated by the 14th Finance Commission but raised the weight under demographic performance from 10% to 12.5%.

- The FFC report has introduced a new criterion, the “tax effect”, for states, with 2.5% weightage, while significantly reducing the weight for income distance from 50% to 45%.

- The term of the N.K. Singh-headed FFC was extended by a year in November and the panel is expected to present the final report covering financial years 2021-22 to 2025-26 by 30 October.

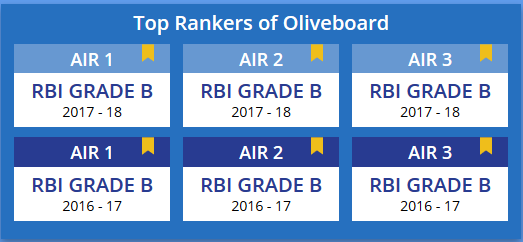

Oliveboard users have confirmed that on an average there is a 16+ increase in Mock Test scores after a user takes 9 Mock Tests on Oliveboard Platform. Take a Mock Test Now.

Criteria for Devolution

|

Criteria |

14th FC

2015-20 |

15th FC 2020-21 |

| Income Distance | 50.0 | 45.0 |

| Population (1971) | 17.5 | – |

| Population (2011) | 10.0 | 15.0 |

| Area | 15.0 | 15.0 |

| Forest Cover | 7.5 | – |

| Forest and Ecology | – | 10.0 |

| Demographic Performance | – | 12.5 |

| Tax Effort | – | 2.5 |

| Total | 100 | 100 |

Impact of the Recommendations

1. The tax share of most southern states, including Andhra Pradesh, Kerala, and Karnataka, has come down, while the share of Bihar, Madhya Pradesh, Punjab, Maharashtra, and Gujarat has gone up.

2. 10 states have seen a reduction in their share in central tax devolution, according to the interim report and these states will need to carefully assess their revenue situation.

Recommendations On Fiscal Roadmap

1. Fiscal deficit and debt levels:

The Commission noted that recommending a credible fiscal and debt trajectory roadmap remains problematic due to uncertainty around the economy. It recommended that both central and state governments should focus on debt consolidation and comply with the fiscal deficit and debt levels as per their respective Fiscal Responsibility and Budget Management (FRBM) Acts.

2. Off-budget borrowings:

The Commission observed that financing capital expenditure through off-budget borrowings detracts from compliance with the FRBM Act. It recommended that both the central and state governments should make full disclosure of extra-budgetary borrowings. The outstanding extra-budgetary liabilities should be clearly identified and eliminated in a time-bound manner.

3. The statutory framework for public financial management:

The Commission recommended forming an expert group to draft legislation to provide for a statutory framework for the sound public financial management system. It observed that an overarching legal fiscal framework is required which will provide for budgeting, accounting, and audit standards to be followed at all levels of government.

4. Tax capacity:

In 2018-19, the tax revenue of state governments and central government together stood at around 17.5% of GDP. The Commission noted that tax revenue is far below the estimated tax capacity of the country. Further, India’s tax capacity has largely remained unchanged since the early 1990s. In contrast, tax revenue has been rising in other emerging markets. The Commission recommended: (i) broadening the tax base, (ii) streamlining tax rates, (iii) and increasing capacity and expertise of tax administration in all tiers of the government.

5. GST implementation:

The Commission highlighted some challenges with the implementation of the Goods and Services Tax (GST). These include (i) large shortfall in collections as compared to original forecast, (ii) high volatility in collections, (iii) accumulation of large integrated GST credit, (iv) glitches in invoice and input tax matching, and (v) delay in refunds. The Commission observed that the continuing dependence of states on compensation from the central government (21 states out of 29 states in 2018-19) for making up for the shortfall in revenue is a concern. It suggested that the structural implications of GST for low consumption states need to be considered

Other Recommendations

Financing of security-related expenditure: The ToR of the Commission required it to examine whether a separate funding mechanism for defence and internal security should be set up and if so, how it can be operationalised. In this regard, the Commission intends to constitute an expert group comprising representatives of the Ministries of Defence, Home Affairs, and Finance.

The Commission noted that the Ministry of Defence proposed following measures for this purpose: (i) setting up of a non-lapsable fund, (ii) levy of a cess, (iii) monetisation of surplus land and other assets, (iv) tax-free defence bonds, and (v) utilising proceeds of disinvestment of defence public sector undertakings. The expert group is expected to examine these proposals or alternative funding mechanisms.

Final FFC Report

1. The term of the N.K. Singh-headed FFC was extended by a year in November and the panel is expected to present the final report covering financial years 2021-22 to 2025-26 by October 2020.

2. The commission deferred taking a call on the contentious defence and internal security fund proposed by the Centre in the additional ‘Terms of Reference’.

3. The report acknowledges that there is merit in ensuring a predictable and stable flow of funds for defence and internal security and this will be considered in the final report.

Some Relevant Definitions

1. Income distance:

Income distance is the distance of the state’s income from the state with the highest income.

The income of a state has been computed as average per capita GSDP during the three-year period between 2015-16 and 2017-18. States with lower per capita income would be given a higher share to maintain equity among states.

2. Demographic performance:

The Terms of Reference (ToR) of the Commission required it to use the population data of 2011 while making recommendations. Accordingly, the Commission used only 2011 population data for its recommendations.

The Demographic Performance criterion has been introduced to reward efforts made by states in controlling their population. It will be computed by using the reciprocal of the total fertility ratio of each state, scaled by 1971 population data.

States with a lower fertility ratio will be scored higher on this criterion. The total fertility ratio in a specific year is defined as the total number of children that would be born to each woman if she were to live to the end of her child-bearing years and give birth to children in alignment with the prevailing age-specific fertility rates.

3. Forest and ecology

This criterion has been arrived at by calculating the share of a dense forest of each state in the aggregate dense forest of all the states.

4. Tax effort:

This criterion has been used to reward states with higher tax collection efficiency. It has been computed as the ratio of the average per capita own tax revenue and the average per capita state GDP during the three-year period between 2014-15 and 2016-17.

Other Related Articles:

- Download Economic Survey Summary 2019-20 – Volume 1 & 2

- Union Budget 2020 Live Updates & Key Highlights

This was all from us in this blog of “Report of the 15th Finance Commission for FY 2020-21”. We will update the upcoming final report with recommendations for the 2021-26 period here in this same article. Till then stay tuned to Oliveboard.

Study Material for RBI Grade B 2021

If you are an RBI Grade B aspirant and also a working professional and find it difficult to find enough time for your RBI Grade B Preparations, do not worry at all.

Oliveboard has come up with RBI Grade B Online Cracker Course for RBI Grade B 2020 Exam. Oliveboard’s RBI Grade B Online Course 2021 will be your one-stop destination for all your preparation needs

What all the course offers you:

1. Course Details

RBI Grade B Cracker is designed to cover the complete syllabus for the 3 most important subjects: GA for Phase 1 and ESI + F&M for Phase 2 exam. Not just that, it also includes Mock Tests & Live Strategy Sessions for English, Quant & Reasoning for Phase 1. The course aims to complete your preparation in time for the release of the official notification.

1.1. Features:

Use Coupon Code ‘P30’ to avail a 30% discount on RBI Courses!

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!