CAIIB Practice Questions

The CAIIB (Certified Associate of Indian Institute of Bankers) exam is one of the most sought-after certifications for banking professionals in India. It helps improve a banker’s knowledge in areas such as financial management, risk, and banking regulations. One of the best ways to prepare for the CAIIB Practice Questions 2024 is to solve practice questions that cover various topics in the syllabus. In this article, we will guide you through the importance of practice questions, share some valuable tips, and provide an overview of the most important topics for the upcoming exam.

Why CAIIB Practice Questions Are Important

Practicing with CAIIB Practice Questions is crucial for your exam success. Here’s why:

- Familiarization with Exam Pattern: Practicing with real-time questions helps candidates become familiar with the exam’s format and difficulty level. This boosts confidence and reduces exam anxiety.

- Improved Time Management: The CAIIB exam is time-bound, and practicing questions will help you manage your time effectively during the actual exam.

- Better Retention: Solving practice questions reinforces your understanding of important concepts and improves your ability to recall information during the exam.

- Identifying Weak Areas: Regular practice helps identify areas where you need improvement, allowing you to focus more on those topics during your revision.

By incorporating regular practice sessions into your study routine, you’ll be well-prepared for the CAIIB Practice Questions 2024 and increase your chances of success.

Download the CAIIB Practice Questions Ebook

CAIIB Practice Questions Ebook 2024 consists of the Important Questions on ABM – BFM. We have mentioned below the direct link to download the Free e-book for all the candidates.

Key Topics to Focus on for CAIIB 2024

The CAIIB 2024 exam covers a wide range of subjects, so it’s essential to focus on the right topics while practicing. The exam consists of three papers:

- Advanced Bank Management (ABM)

- Banking Regulations and Business Laws (BRBL)

- Financial Management (FM)

Here are the critical topics from each paper that you should focus on while practicing:

1. Advanced Bank Management (ABM)

- Risk Management: Understand the concepts of financial risk, including credit risk, market risk, and operational risk. Practice calculating risk metrics like Value at Risk (VaR) and credit ratings.

- Bank’s Financial Statements: Get familiar with analyzing balance sheets, income statements, and ratios. Practice interpreting key financial ratios used in banking, such as Return on Assets (ROA) and Return on Equity (ROE).

- Monetary Policy and Economic Environment: Study the role of RBI in regulating inflation and money supply. Practice solving questions related to economic indicators and monetary policy tools.

2. Banking Regulations and Business Laws (BRBL)

- Banking Regulation Act, 1949: Understand the provisions under this act, including the powers of the RBI, licensing requirements, and the duties of banks.

- Negotiable Instruments Act, 1881: Study the different types of negotiable instruments such as cheques, promissory notes, and bills of exchange, and practice solving questions based on their legal implications.

- Consumer Protection Act: Learn the rights of consumers in banking services and the role of the Banking Ombudsman. Practice questions on consumer dispute resolution mechanisms.

3. Financial Management (FM)

- Financial Planning and Analysis: Practice questions on financial analysis, including capital budgeting, financial ratios, and break-even analysis.

- Cost and Management Accounting: Learn the fundamentals of cost accounting and financial reporting. Practice calculating cost of goods sold (COGS), operating margins, and contribution margins.

- Corporate Finance: Study the concepts of equity, debt, and corporate valuation. Practice solving problems on capital structure and dividend policies.

How to Approach CAIIB Practice Questions 2024

Step 1: Start with the Basics

Before diving into solving CAIIB Practice Questions, ensure you have a solid understanding of the basic concepts. Read through the syllabus and identify the core subjects. Make a list of topics to cover and refer to textbooks, study materials, and online resources.

Step 2: Solve Topic-wise Practice Questions

Breaking down your preparation into topic-wise practice is an effective way to approach the exam. After studying each topic, solve related CAIIB Practice Questions to reinforce your learning. For example:

- After learning about financial ratios, practice calculating and interpreting various financial ratios.

- After understanding risk management, solve questions that involve calculating risk exposure and mitigation strategies.

Step 3: Take Timed Mock Tests

Once you have completed a topic and solved some practice questions, start taking timed mock tests. These will simulate the actual exam environment and help you improve your speed and accuracy. Mock tests also help you identify which areas you need to focus on more.

Step 4: Review and Revise

After taking a mock test, review your answers, especially the incorrect ones. Understand where you went wrong and why. Make sure to revise those areas before moving on to the next topic. Regular revision is key to retaining concepts.

Sample CAIIB Practice Questions

Here are some sample CAIIB Practice Questions for each paper:

Advanced Bank Management (ABM)

- Question: What is the primary objective of credit risk management in banks?

- Solution: The primary objective is to minimize the losses due to borrowers’ defaults while maintaining a healthy loan portfolio. This involves assessing creditworthiness and managing the risk of non-repayment.

- Question: Explain the concept of Value at Risk (VaR) in market risk management.

- Solution: VaR measures the potential loss in value of a portfolio over a defined period for a given confidence interval. It helps banks quantify market risk and set limits for trading activities.

Banking Regulations and Business Laws (BRBL)

- Question: What are the main provisions of the Banking Regulation Act, 1949 related to banking licenses?

- Solution: The act empowers the RBI to issue licenses for operating a bank in India, ensuring that only financially sound and well-managed banks are licensed.

- Question: What is the role of the Banking Ombudsman in resolving disputes?

- Solution: The Banking Ombudsman resolves customer complaints related to deficiencies in banking services. It offers an alternative dispute resolution mechanism without going to court.

Financial Management (FM)

- Question: What is the purpose of calculating the break-even point (BEP)?

- Solution: The BEP helps businesses determine the point at which total revenues equal total costs. It’s crucial for understanding how much sales volume is needed to avoid losses.

- Question: What is the capital asset pricing model (CAPM)?

- Solution: CAPM is used to determine the expected return on an asset based on its risk in comparison to the overall market. It is helpful in assessing the required return for an investment.

CAIIB Practice Questions E-books for ABM, HRM, and BFM

CAIIB examination consists of four mandatory papers and one elective paper. We have created separate practice questions PDF for each paper of the CAIIB for better understanding of the candidates. We have mentioned below the direct link to download the E-book for each paper separately.

| E-book Name | Download Link |

| Top 150 Questions for ABM | Click to Download |

| 50 CAIIB Practice Questions for ABM | Click to Download |

| 50 CAIIB Practice Questions for HRM | Click to Download |

| 50 CAIIB Practice Questions for BFM | Click to Download |

How to Download CAIIB Practice Questions Ebook for CAIIB?

Step 1: Click on the download link. You will be redirected to Oliveboard’s FREE E-Books Page.

Step 2: Create a free Oliveboard account or log in using your existing Oliveboard account details

Step 3: Download the book by clicking on the link presented on the page.

Tips for CAIIB Practice Questions 2024

- Stay Consistent: Dedicate a fixed amount of time daily to practice questions. Consistency will help you build a strong foundation.

- Focus on Weak Areas: After every mock test, identify the sections where you lost marks and work on improving them.

- Use Reference Material: While practicing, use textbooks, reference materials, and reliable online resources to clarify concepts.

- Stay Updated: Keep yourself updated with the latest changes in banking regulations and finance. Follow relevant news and updates related to CAIIB.

CAIIB Practice Questions

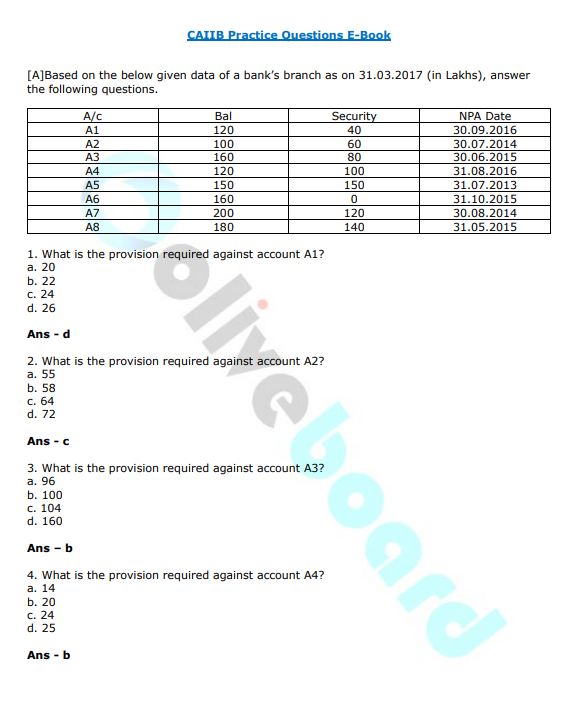

[A] Based on the below-given data of a bank’s branch as of 31.03.2017 (in Lakhs), answer the following questions.

| A/c | Bal | Security | NPA Date |

| A1 | 120 | 40 | 30.09.2016 |

| A2 | 100 | 60 | 30.07.2014 |

| A3 | 160 | 80 | 30.06.2015 |

| A4 | 120 | 100 | 31.08.2016 |

| A5 | 150 | 150 | 31.07.2013 |

| A6 | 160 | 0 | 31.10.2015 |

| A7 | 200 | 120 | 30.08.2014 |

| A8 | 180 | 140 | 31.05.2015 |

- What is the provision required against account A1?

a. 20

b. 22

c. 24

d. 26

Ans – d - What is the provision required against account A2?

a. 55

b. 58

c. 64

d. 72

Ans – c - What is the provision required against account A3?

a. 96

b. 100

c. 104

d. 160

Ans – b - What is the provision required against account A4?

a. 14

b. 20

c. 24

d. 25

Ans – b - What is the provision required against account A5?

a. 37.5

b. 60

c. 75

d. 150

Ans – b - What is the provision required against account A6?

a. 40

b. 64

c. 128

d. 160

Ans – d - What is the provision required against account A7?

a. 40

b. 64

c. 128

d. 160

Ans – c - What is the provision required against account A8?

a. 68

b. 75

c. 82

d. 96

Ans – b

Sneak Peek into CAIIB Practice Questions Free E-book

Conclusion

The CAIIB Practice Questions 2024 are an essential part of your preparation strategy for the CAIIB exam. By practicing regularly, you’ll become more confident, improve your speed, and better understand complex banking concepts. Remember to focus on core topics, take timed mock tests, and review your mistakes thoroughly. With consistent effort and smart preparation, you can easily pass the CAIIB 2024 exam and take your banking career to the next level.

CAIIB Practice Questions – FAQs

Ans. CAIIB Practice Questions 2024 are a set of sample questions designed to help candidates prepare for the CAIIB exam.

Ans. Using CAIIB Practice Questions helps improve exam readiness, strengthens concept understanding, and boosts confidence.

- CAIIB Electives Exam Analysis 2025, June All Shifts Review

- CAIIB BRBL Exam Analysis 2025, June All Shifts Review

- CAIIB ABFM Exam 2025 Analysis, Shift 1 & 2 – 22nd June 2025

- CAIIB BFM Exam Analysis 2025, All Shift Analysis Released

- CAIIB ABM Exam Analysis 2025, All Shifts, May-June Cycle

- CAIIB Admit Card 2025, Check Steps to Download Call Letter

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!