IE & IFS Easiest Way to Cover & Study Tips

The JAIIB (Junior Associate of Indian Institute of Bankers) exam is an important certification for banking professionals in India. It helps employees gain better knowledge about banking, finance, and the economy. The Indian Economy and Indian Financial System (IE & IFS) paper is a key subject in the exam. This article provides the easiest way to cover IE & IFS and offers practical study tips to help you prepare effectively.

What Is the IE & IFS Paper in JAIIB?

The IE & IFS paper focuses on the structure of the Indian economy and its financial system. It includes topics such as banking operations, regulatory systems, and financial markets. Mastering this paper is crucial for gaining a strong understanding of how India’s economy and financial systems work.

JAIIB Indian Economy & Indian Financial System – Overview

JAIIB Paper 1 focuses on Indian Economy and Indian Financial System (IFS), consisting of four crucial modules:

| Module | Topics Covered | Key Focus Areas |

| Module A | Indian Economic Architecture | Agriculture, Industry, Services, Government Policies |

| Module B | Economic Concepts Related to Banking | Inflation, Interest Rates, Monetary and Fiscal Policies |

| Module C | Indian Financial Architecture | Banks, NBFCs, Insurance Companies, Capital Markets |

| Module D | Financial Products and Services | Money Market, Forex, Stock Markets, Merchant Banking |

The total marks for Paper 1 are 100, and candidates have 2 hours to complete the exam. Understanding the structure of the exam and the syllabus is the first step toward success.

Also Check, JAIIB Notification 2025

JAIIB IE & IFS Module and Study Tips

Module A – Indian Economic Architecture

This module introduces the Indian economy, its sectors, and economic planning. Key chapters include:

- Indian Economy Overview: Evolution, pre-British economy, and changes post-2008.

- Economic Planning: 5-year plans, objectives, achievements, and resources.

- Sectors of the Indian Economy: Primary, secondary, tertiary, and emerging sectors.

Study Tip:

Focus on understanding the core concepts, such as the role of MSMEs, the impact of globalization, and India’s economic reforms. Use diagrams and charts to simplify complex topics like economic planning and sector contributions to GDP.

Module B – Economic Concepts Related to Banking

Module B deals with economic principles related to banking, such as:

- Supply and Demand: Understand shifts in demand, supply curves, and equilibrium.

- Inflation and Interest Rates: Causes, measures, and impact on the banking sector.

- Business Cycles: Phases and characteristics.

- Monetary and Fiscal Policy: Tools and responses to economic crises.

Study Tip:

Use real-world examples to understand inflation, business cycles, and the effects of fiscal and monetary policies on the banking sector. Practice solving problems related to supply, demand, and interest rates to improve conceptual clarity.

Module C – Indian Financial Architecture

This module focuses on India’s financial system and its key institutions. Topics include:

- Banking Structure: Functions, types of banks, and the evolution of India’s banking system.

- Regulations and Reforms: RBI guidelines, Banking Regulation Act, and financial reforms.

- Microfinance and NBFCs: Role of Non-Banking Financial Companies and Microfinance institutions.

Study Tip:

To grasp the complexities of India’s financial system, focus on key regulatory bodies like the RBI, SEBI, and IRDA. Make use of flowcharts to understand the banking structure and the role of NBFCs and insurance companies.

Module D – Financial Products and Services

Module D covers the various financial products and services available in India. Some important topics include:

- Money and Capital Markets: Treasury Bills, Commercial Paper, and Repo operations.

- Forex Markets: Characteristics of the forex market, FEMA, and LIBOR.

- Merchant Banking: Activities, regulations, and services offered.

Study Tip:

Pay special attention to market types and instruments like derivatives, money markets, and stock exchanges. It helps to practice with financial instruments and their usage in real-world scenarios to enhance understanding.

Tips for Effective Study

- Break Down the Syllabus:

Divide the syllabus into smaller sections. Focus on one module at a time and give it your undivided attention. - Use JAIIB Mock Tests:

Attempt JAIIB mock tests to familiarize yourself with the exam pattern and assess your readiness. Mock tests help in identifying weak areas and improving time management. - Revise Regularly:

Consistent revision is key to retaining information. Set aside time each week to review the concepts you have studied. - Use Simple Study Materials:

Stick to textbooks recommended by experts or trusted study guides. Make sure your study materials align with the JAIIB syllabus to avoid confusion. - Create a Study Schedule:

Prepare a study plan that suits your pace. Dedicate more time to challenging topics, and take breaks to refresh your mind. - Focus on Key Concepts:

Focus on understanding core concepts rather than rote learning. This is especially important for complex topics like macroeconomics and financial regulations.

High Weightage Topics for JAIIB IE & IFS

High weightage topics for JAIIB IE & IFS include important areas like Economic Reforms in India, Monetary Policy, and the Structure of the Financial System, which are important for understanding the core concepts of the Indian economy and financial system.

| Subject | Topic | Key Points to Focus | Importance |

| Indian Economy (IE) | Economic Reforms in India | – Liberalization, privatization, globalization – Impact on banking, agriculture, industry | High |

| Economic Planning | – Five-year plans – NITI Aayog’s role – Objectives of planning | High | |

| Inflation and Deflation | – Causes, effects, and control measures – WPI, CPI, and their impact on the economy | High | |

| Fiscal Policy | – Taxation, public expenditure – Revenue Deficit, Fiscal Deficit, Primary Deficit | Medium | |

| Monetary Policy | – Role of RBI – Repo rate, reverse repo rate, CRR – Management of monetary policy | High | |

| Agricultural Economics | – Role of agriculture in India’s economy – PM-KISAN and other schemes | Medium | |

| Indian Financial System (IFS) | Structure of the Financial System | – Financial institutions, markets, and instruments – Key institutions like RBI, SEBI, IRDAI | High |

| Banking System | – Public Sector, Private Sector, and Foreign Banks – Scheduled vs Non-Scheduled Banks | High | |

| Financial Markets | – Money Market, Capital Market, Forex Market – Role of NSE and BSE | Medium | |

| Types of Financial Products | – Shares, Bonds, Mutual Funds, Derivatives – Regulatory frameworks governing these products | Medium | |

| Functions of RBI and SEBI | – Role in regulation of financial markets – Ensuring financial stability | High | |

| Risk Management | – Credit risk, market risk, operational risk – Basel Norms in risk management | High |

Study Tips for High Weightage Topics:

- Prioritize Core Topics: Focus on core subjects like Economic Reforms, Monetary Policy, and Banking System that carry higher marks.

- Regular Revision: Keep revising high-weightage topics consistently for better retention.

- Solve Previous Papers: Go through past JAIIB exam papers to identify frequently asked questions from these topics.

- Time Allocation: Dedicate more study time to high-weightage areas but don’t neglect other sections.

JAIIB IE & IFS Exam Pattern

Before we get into the syllabus, let’s take a look at the question and mark distribution for IE & IFS.

| Subjects | No. of Questions | Total Marks | Duration |

| Indian Economy & Indian Financial System | 100 | 100 | 2 hours |

As you can see, the paper consists of 100 questions for a total of 100 marks. The paper is of a 2-hour duration. There is no negative marking and candidates require a minimum of 50 marks out of 100 to clear the paper.

Conclusion

The easiest way to cover the JAIIB May 2025 syllabus for Indian Economy and the Indian Financial System lies in consistent and structured preparation. By following the tips above, utilizing JAIIB mock tests, and focusing on understanding the core concepts in each module, you will improve your chances of success. Stay disciplined, manage your time effectively, and revise regularly to ensure you’re ready for the exam. Best of luck in your preparations.

IE & IFS Easiest Way to Cover & Study Tips – FAQs

Ans. Break the syllabus into smaller sections and focus on key topics like Indian Economy Overview, Economic Planning, and Banking Regulations.

Ans. Focus on high-weightage topics like Indian Economy Overview, Inflation, and Monetary Policies to strengthen your foundation.

Ans. Use quality study materials, online courses, JAIIB-specific textbooks, and regularly updated financial news sources

Ans. Conceptual clarity is crucial for answering application-based questions and solving complex problems effectively.

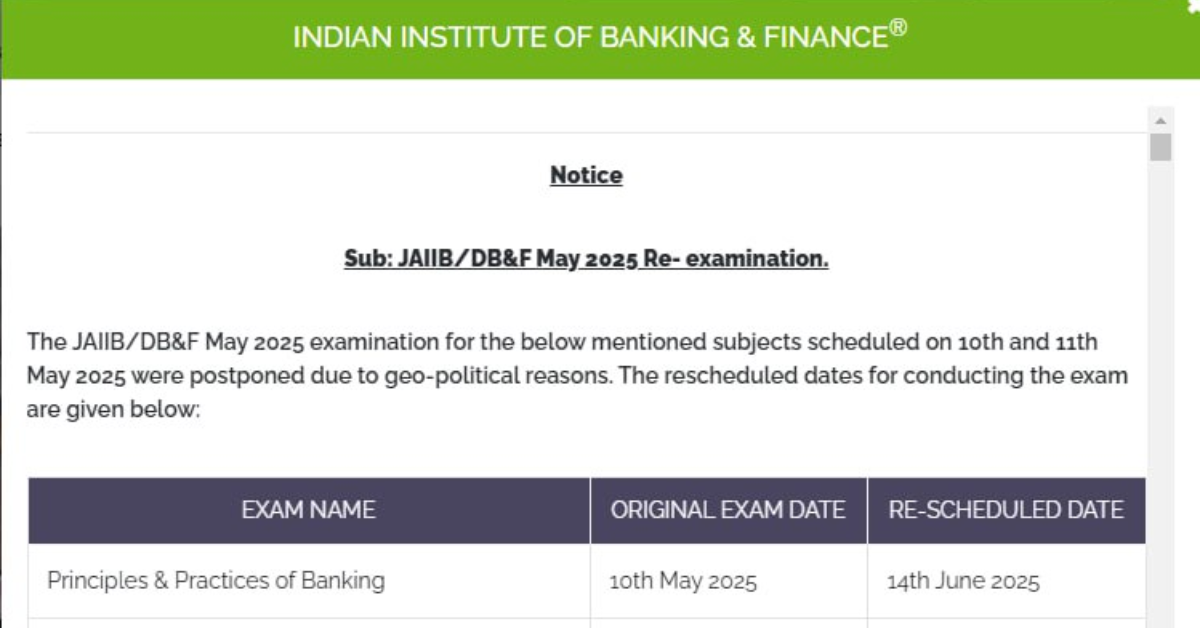

- JAIIB PPB and AFM New Exam Dates Out for Affected Areas, May Cycle

- JAIIB RBWM Exam 2025 Analysis for Shift 1, 2 & 3 – 18th May 2025

- JAIIB Exam Analysis 2025, May Cycle, All Shifts Covered

- JAIIB AFM Exam Analysis 2025, May All Shifts Review

- JAIIB PPB Exam Analysis 2025, May All Shifts Review

- JAIIB IE and IFS Exam Analysis 2025, 4th May 2025 Detailed Analysis

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!