Have applied for UPSC EPFO EO 2021 & looking for Accounting Cycle Topic? Then you are at the right pace. The accounting cycle topic is one of the important topics for the UPSC EPFO EO exam 2021. To help you in your preparations, we have brought you everything on UPSC EPFO EO Accounting Cycle. In this blog, we will provide the basic eight important steps in the Accounting Cycle.

Let’s start with the blog and know everything about the Accounting Cycle. Also, have a look at the types of questions asked in the UPSC EPFO EO examination for free. Register here to take up practice questions.

What is the Accounting Cycle?

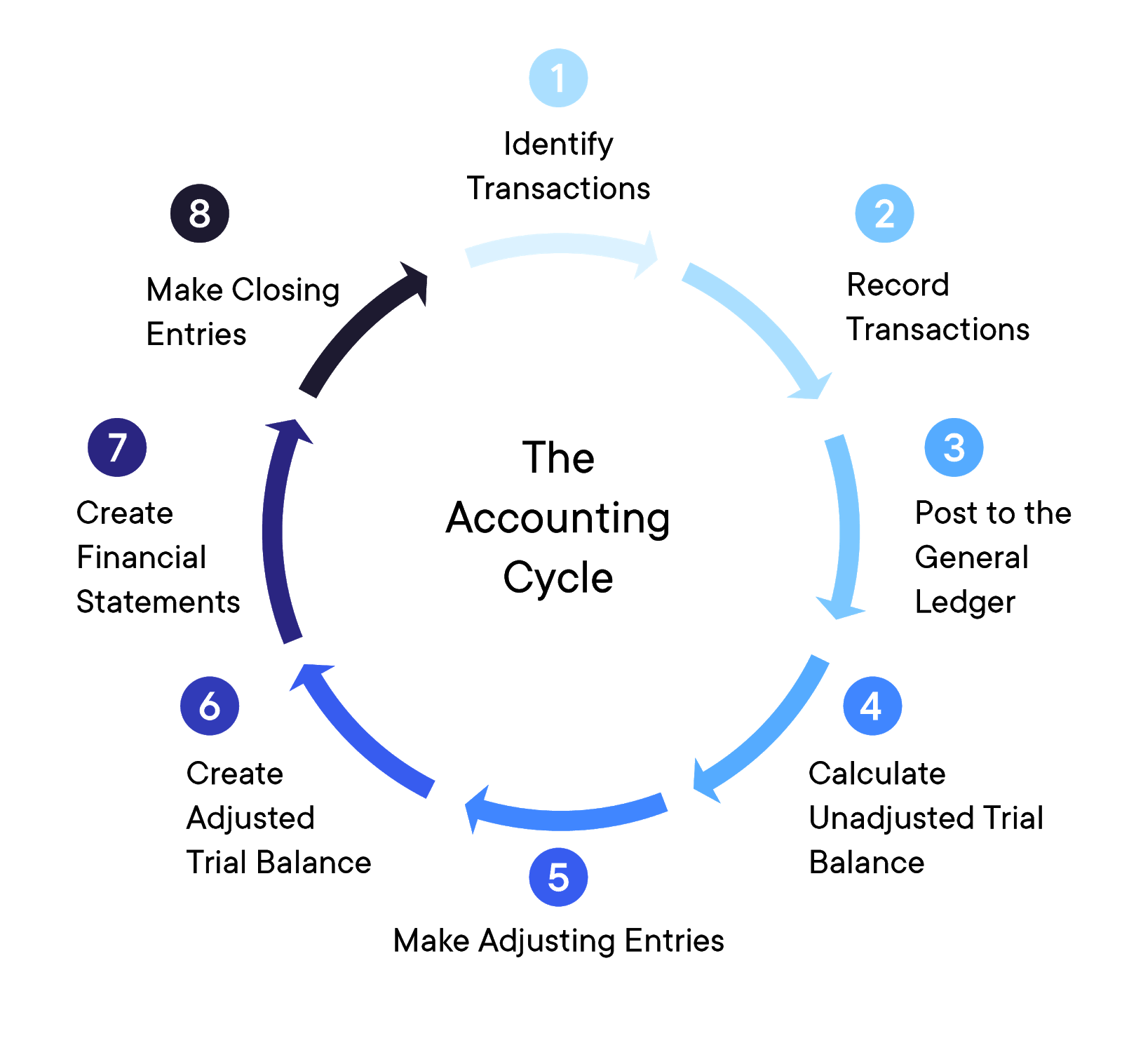

The accounting cycle is a basic, eight-step process for completing a company’s bookkeeping tasks. It provides a clear guide for the recording, analysis, and final reporting of a business’s financial activities.

Major Steps In Accounting Cycle?

The following are the major steps involved in the accounting cycle. We will use a simple example problem to explain each step.

Step 1: Analyzing and recording transactions via journal entries

Step 2: Posting journal entries to ledger accounts

Step 3: Preparing an unadjusted trial balance

Step 4: Preparing to adjust entries at the end of the period

Step 5: Preparing an adjusted trial balance

Step 6: Preparing financial statements

Step 7: Closing temporary accounts via closing entries

Step 8: Preparing a post-closing trial balance

For complete study notes. Register here with your email id, password, and mobile no.

Understanding the 8-Step Accounting Cycle

The eight-step accounting cycle starts with recording every company transaction individually and ends with a comprehensive report of the company’s activities for the designated cycle timeframe. Many companies use accounting software to automate the accounting cycle. This allows accountants to program cycle dates and receive automated reports.

The 8 Steps of the Accounting Cycle

The eight steps to the accounting cycle include the following:

Step 1: Identify Transactions

The first step in the accounting cycle is identifying transactions. Companies will have many transactions throughout the accounting cycle. Each one needs to be properly recorded on the company’s books.

Recordkeeping is essential for recording all types of transactions. Many companies will use point of sale technology linked with their books to record sales transactions. Beyond sales, there are also expenses that can come in many varieties.

Step 2: Record Transactions in a Journal

The second step in the cycle is the creation of journal entries for each transaction. Point of sale technology can help to combine Steps 1 and 2, but companies must also track their expenses. The choice between accrual and cash accounting will dictate when transactions are officially recorded. Keep in mind, accrual accounting requires the matching of revenues with expenses so both must be booked at the time of sale.

Cash accounting requires transactions to be recorded when cash is either received or paid. Double-entry bookkeeping calls for recording two entries with each transaction in order to manage a thoroughly developed balance sheet along with an income statement and cash flow statement.

With double-entry accounting, each transaction has a debit and a credit equal to each other. Single-entry accounting is comparable to managing a checkbook. It gives a report of balances but does not require multiple entries.

Step 3: Posting

Once a transaction is recorded as a journal entry, it should post to an account in the general ledger. The general ledger provides a breakdown of all accounting activities by account. This allows a bookkeeper to monitor financial positions and statuses by account. One of the most commonly referenced accounts in the general ledger is the cash account which details how much cash is available.

Register Now & take Free Mock test To Assess Your preparations

Step 4: Unadjusted Trial Balance

At the end of the accounting period, a trial balance is calculated as the fourth step in the accounting cycle. A trial balance tells the company its unadjusted balances in each account. The unadjusted trial balance is then carried forward to the fifth step for testing and analysis.

Step 5: Worksheet

Analyzing a worksheet and identifying adjusting entries make up the fifth step in the cycle. A worksheet is created and used to ensure that debits and credits are equal. If there are discrepancies then adjustments will need to be made.

In addition to identifying any errors, adjusting entries may be needed for revenue and expense matching when using accrual accounting.

Step 6: Adjusting Journal Entries

In the sixth step, a bookkeeper makes adjustments. Adjustments are recorded as journal entries where necessary.

Get Study Notes On UPSC EPFO EO Now! Click Here

Step 7: Financial Statements

After the company makes all adjusting entries, it then generates its financial statements in the seventh step. For most companies, these statements will include an income statement, balance sheet, and cash flow statement.

Step 8: Closing the Books

Finally, a company ends the accounting cycle in the eighth step by closing its books at the end of the day on the specified closing date. The closing statements provide a report for analysis of performance over the period.

After closing, the accounting cycle starts over again from the beginning with a new reporting period. At closing is usually a good time to file paperwork, plan for the next reporting period, and review a calendar of future events and tasks.

Source: Investopedia

Register Now & take Free Mock test To Assess Your preparations

UPSC EPFO EO Study Notes

1. 10 Mock Tests for EPFO EO in the latest pattern with detailed solutions

2. Summary Notes for all sections (except Quant, Eng)

- Indian Freedom Struggle (Click Here For Notes)

- Indian Polity and Economy (Click Here For Notes)

- General Accounting Principles (Click Here For Notes)

- Industrial Relations and Labor Laws (Click Here For Notes)

- General Science and Knowledge of Computer Applications (Click Here For Notes)

- Social Security in India (Click Here For Notes)

UPSC EPFO EO Study Material | Preparation Strategy

For topic-wise EPFO EO preparation strategy and preparation tips click on the blog link given below.

UPSC EPFO EO preparation strategy and preparation tips

Grab Free eBooks On Our Platform

Hi, I’m Tripti, a senior content writer at Oliveboard, where I manage blog content along with community engagement across platforms like Telegram and WhatsApp. With 3 years of experience in content and SEO optimization, I have led content for popular exams like SSC, Banking, Railways, and State Exams.