What is the JAIIB Exam for?

In the realm of banking and finance, professional certifications play a pivotal role in enhancing career prospects and validating expertise. One such significant certification in India is the JAIIB (Junior Associate of the Indian Institute of Bankers) exam. Developed and conducted by the Indian Institute of Banking and Finance (IIBF), the JAIIB exam holds immense importance for individuals seeking to excel in the banking sector. Let’s delve into What is the JAIIB Exam for?

What is the JAIIB Exam?

The JAIIB exam is an essential certification program designed primarily for junior and middle-level banking professionals. It aims to provide them with a comprehensive understanding of various banking principles, practices, and regulations. The JAIIB syllabus of the exam covers three main areas:

- Principles and Practices of Banking: This section acquaints candidates with the fundamental concepts and practices prevalent in the banking industry. Topics include functions of banks, types of accounts, banking technology, customer service, and more.

- Accounting and Finance for Bankers: Here, candidates delve into the nuances of banking accounting and finance. They learn about balance sheets, financial ratios, accounting standards, and other financial aspects crucial for effective banking operations.

- Legal and Regulatory Aspects of Banking: This segment focuses on the legal and regulatory framework governing the banking sector in India. Candidates gain insights into various acts, regulations, and guidelines relevant to banking operations, such as the Banking Regulation Act, RBI Act, and Know Your Customer (KYC) norms.

Importance of the JAIIB Exam

1. Career Advancement:

Achieving the JAIIB certification opens up avenues for career growth within the banking industry. Many banks consider JAIIB qualification as a prerequisite for promotions to officer cadre positions. It demonstrates an individual’s commitment to continuous learning and professional development, making them suitable candidates for higher responsibilities.

2. Enhanced Knowledge and Skills:

Preparing for the JAIIB exam requires candidates to delve deep into banking concepts and regulations. As they study, they gain valuable insights and knowledge that prove beneficial in their day-to-day roles. Whether it’s understanding customer needs better, handling financial transactions efficiently, or ensuring compliance with regulatory requirements, JAIIB-certified professionals are equipped with the necessary skills to excel in their jobs.

3. Industry Recognition:

The JAIIB certification is widely recognized and respected within the banking fraternity. It signifies a candidate’s proficiency in essential banking areas and adherence to professional standards. Employers often value JAIIB-certified individuals for their expertise and commitment to excellence, which can lead to increased job opportunities and career advancement prospects.

4. Personal Development:

Beyond professional benefits, preparing for and clearing the JAIIB exam fosters personal development. Moreover, the sense of achievement upon successfully passing the exam boosts confidence and motivates individuals to pursue further educational and career goals, including considering potential JAIIB salary increments.

JAIIB Eligibility Criteria

The JAIIB eligibility criteria determine who can participate in this certification program by the Indian Institute of Banking and Finance (IIBF).

- The JAIIB examination is open only to ordinary members of the Indian Institute of Banking and Finance (IIBF).

- Eligible candidates include individuals working in the banking and finance industry whose employer is an institutional member of the IIBF.

- Candidates must have passed the 12th standard examination in any discipline or its equivalent.

- The IIBF may allow candidates from clerical or supervisory staff cadre of banks to appear for the examination even if they are not 12th standard pass, based on the recommendation of their bank manager or officer-in-charge.

- Subordinate staff of recognized Banking/Financial Institutions in India, who are members of the IIBF, are also eligible to appear for the examination if they have passed the 12th standard examination or its equivalent.

JAIIB Online Application

- Visit the official website of the Indian Institute of Banking and Finance.

- Select the “Examination/Courses” option on the home page.

- Click on “Flagship Courses” under the dropdown menu.

- Complete the JAIIB Registration

- Download JAIIB Admit Card

JAIIB Syllabus & Exam Pattern

- The JAIIB exam consists of four compulsory papers:

- Indian Economy and Indian Financial System (IE & IFS)

- Principles and Practices of Banking (PPB)

- Accounting and Financial Management for Bankers (AFM)

- Retail Banking and Wealth Management (RBWM)

- Each paper is further divided into different modules.

- The exam is conducted in an online medium, and each paper comprises 100 questions for 100 marks.

- The time allotted to complete each paper is 2 hours.

- There is no negative marking for wrong answers.

Preparation Strategy

Preparing effectively for the JAIIB exam, including understanding the syllabus, practicing mock tests, and managing time, is crucial for success. Keep an eye on the JAIIB exam date and stay focused!

- Indian Economy and Indian Financial System (IE & IFS):

- Focus on understanding the basics of the economy, financial architecture, and concepts related to banking.

- Memorize key definitions and features.

- Differentiate between economic and financial aspects.

- Principles and Practices of Banking (PPB):

- Thoroughly learn theoretical concepts related to banking operations.

- Understand banking practices, customer relations, and digital banking products.

- Practice solving case studies and real-world scenarios.

- Accounting and Financial Management for Bankers (AFM):

- Master accounting principles, financial statements, and management techniques.

- Understand financial ratios, risk management, and investment decisions.

- Practice solving numerical problems related to banking finance.

- Retail Banking and Wealth Management (RBWM):

- Learn about retail banking services, customer relationship management, and wealth management.

- Understand investment products, insurance, and financial planning.

- Stay updated on recent trends in retail banking.

Understanding JAIIB cutoff, practicing JAIIB previous year question papers, and aiming for a 50% JAIIB Result across subjects are essential for success.

Conclusion: What is the JAIIB Exam

In conclusion, the JAIIB exam serves as a cornerstone for individuals aspiring to build successful careers in the banking sector. It not only validates their knowledge and skills but also opens doors to new opportunities for career advancement and personal growth. By investing time and effort in preparing for the JAIIB exam, banking professionals set themselves on a path towards professional excellence and success in the dynamic world of banking and finance.

Frequently Asked Questions

Ans: The JAIIB exam, conducted by the Indian Institute of Banking and Finance (IIBF), aims to enhance the understanding of banking principles, practices, and regulations among junior and middle-level banking professionals.

Ans: The JAIIB certification is crucial for career advancement, enhanced knowledge, industry recognition, and personal development in banking.

Ans. Banking Professionals can only appear for the JAIIB Exam. Check the detailed criteria in the blog.

Ans: To apply for the JAIIB exam:

Visit the official website of the Indian Institute of Banking and Finance.

Navigate to the “Examination/Courses” section and select “Flagship Courses.”

Complete the online registration form before the specified deadline, which typically occurs annually.

Ans: The JAIIB exam includes four compulsory papers covering banking aspects: IE & IFS, PPB, AFM, and RBWM. Each paper has 100 questions, 2 hours duration, and no negative marking. Check the syllabus and exam pattern in the blog

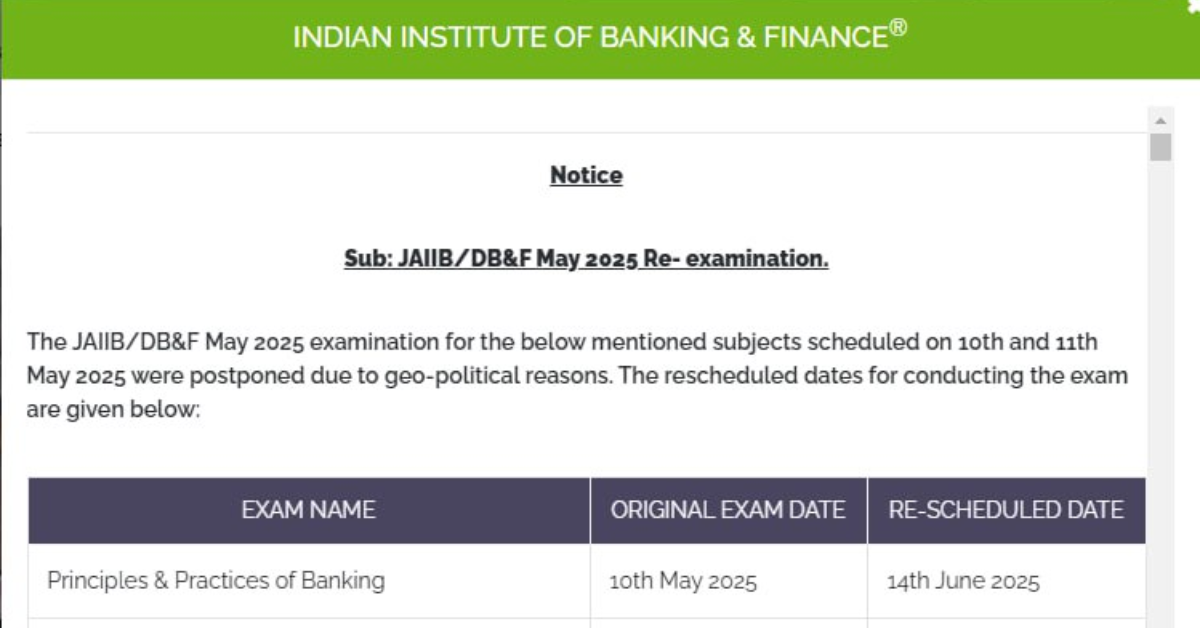

- JAIIB PPB and AFM New Exam Dates Out for Affected Areas, May Cycle

- JAIIB RBWM Exam 2025 Analysis for Shift 1, 2 & 3 – 18th May 2025

- JAIIB Exam Analysis 2025, May Cycle, All Shifts Covered

- JAIIB AFM Exam Analysis 2025, May All Shifts Review

- JAIIB PPB Exam Analysis 2025, May All Shifts Review

- JAIIB IE and IFS Exam Analysis 2025, 4th May 2025 Detailed Analysis