Which is tougher JAIIB or CAIIB?

The banking sector in India offers various opportunities for professional development. Among these, the Junior Associate of Indian Institute of Bankers (JAIIB) and the Certified Associate of Indian Institute of Bankers (CAIIB) exams are crucial for career advancement. This article aims to discuss the differences between JAIIB and CAIIB exams, analyze which is tougher, and determine which certification is better for banking professionals.

Overview of JAIIB and CAIIB

The JAIIB (Junior Associate of Indian Institute of Bankers) exam helps new banking professionals learn the basics of banking operations and practices. On the other hand, the CAIIB (Certified Associate of Indian Institute of Bankers) exam is for experienced bankers, focusing on advanced topics and skills needed for managerial roles in the banking sector.

JAIIB (Junior Associate of Indian Institute of Bankers)

- Objective: JAIIB aims to equip banking professionals with foundational knowledge and skills necessary for banking operations.

- Eligibility: Candidates must be members of the Indian Institute of Banking and Finance (IIBF) and should have completed 12th grade.

- Subjects: The JAIIB exam covers three papers:

- Principles and Practices of Banking

- Accounting and Finance for Bankers

- Legal and Regulatory Framework

CAIIB (Certified Associate of Indian Institute of Bankers)

- Objective: CAIIB is designed for enhancing managerial skills and knowledge in banking operations at a higher level.

- Eligibility: Candidates must have cleared the JAIIB exam and be IIBF members.

- Subjects: The CAIIB exam consists of three compulsory papers:

- Advanced Bank Management

- Bank Financial Management

- Risk Management

Additionally, candidates can choose one elective subject from a list that includes:

- Retail Banking

- Information Technology

- Human Resource Management

Differences Between JAIIB and CAIIB

The JAIIB exam is designed for entry-level banking professionals to enhance their foundational knowledge of banking operations, while the CAIIB exam targets experienced bankers, covering advanced topics relevant to management and specialized areas in banking. Additionally, JAIIB focuses on practical banking skills, whereas CAIIB emphasizes strategic thinking and decision-making capabilities in a banking context.

| Feature | JAIIB | CAIIB |

| Level | Basic Level | Advanced Level |

| Eligibility | 12th pass, IIBF member | JAIIB cleared, IIBF member |

| Subjects | 3 Papers (Compulsory) | 3 Compulsory + 1 Elective |

| Focus | Operational Knowledge | Managerial Skills |

| Exam Frequency | Twice a year (May and November) | Twice a year (May and November) |

| Duration | 3 Hours per paper | 3 Hours per paper |

| Passing Criteria | Minimum 50% in each paper | Minimum 50% in each paper |

| Recognition | Entry-level certification | Recognized for managerial positions |

| Career Progression | Entry into banking operations | Promotion to managerial roles |

Which is Tougher – JAIIB or CAIIB?

CAIIB is generally considered tougher than JAIIB, as it covers advanced concepts and requires a deeper understanding of banking principles and practices. While JAIIB focuses on foundational knowledge for beginners, CAIIB challenges experienced bankers to apply their skills in complex scenarios and strategic decision-making.

Understanding Difficulty Levels

- JAIIB Difficulty:

- The JAIIB exam is considered less challenging compared to CAIIB. It covers fundamental banking principles and practices.

- Topics are relatively straightforward, focusing on day-to-day banking operations.

- CAIIB Difficulty:

- CAIIB is recognized for its higher difficulty level due to its advanced content and the requirement for deeper analytical and managerial skills.

- The topics require comprehensive knowledge and practical application in complex banking scenarios.

Factors Influencing Difficulty

- Content Complexity:

- CAIIB requires a deeper understanding of concepts such as risk management and financial management, making it more challenging.

- Previous Knowledge:

- Candidates with strong backgrounds in finance and banking may find CAIIB more manageable, while newcomers might struggle with its advanced topics.

- Exam Format:

- Both exams are structured similarly, but CAIIB’s elective choices add an additional layer of complexity, requiring candidates to select topics based on their career goals.

Conclusion on Difficulty

In general, CAIIB is considered tougher than JAIIB due to its advanced level, depth of content, and the practical application of knowledge required for managerial positions.

Which is Better – JAIIB or CAIIB?

The choice between JAIIB and CAIIB largely depends on the individual’s career goals and current position in the banking sector.

Reasons to Choose JAIIB

- Entry-Level Professionals: Ideal for those just starting their careers in banking.

- Basic Knowledge: Provides essential knowledge about banking operations and practices.

- Career Kickstart: A stepping stone to further certifications and career advancement.

Reasons to Choose CAIIB

- Career Advancement: Recommended for those seeking managerial roles within banks.

- In-Depth Knowledge: Offers specialized knowledge in advanced banking practices.

- Recognition: Enhances professional credibility and marketability in the banking sector.

Conclusion – Which is tougher JAIIB or CAIIB?

JAIIB is your basic banking education, it covers the essentials. It’s like learning the ABCs of banking. On the other hand, CAIIB is like going to college, it’s more advanced. It dives into complex topics like risk management and economics.

So, Which is tougher JAIIB or CAIIB? Requires a deeper understanding, but both certifications are important steps in your banking career. Success requires grasping JAIIB cutoff, solving JAIIB previous year papers, and striving for a 50% score across JAIIB Result.

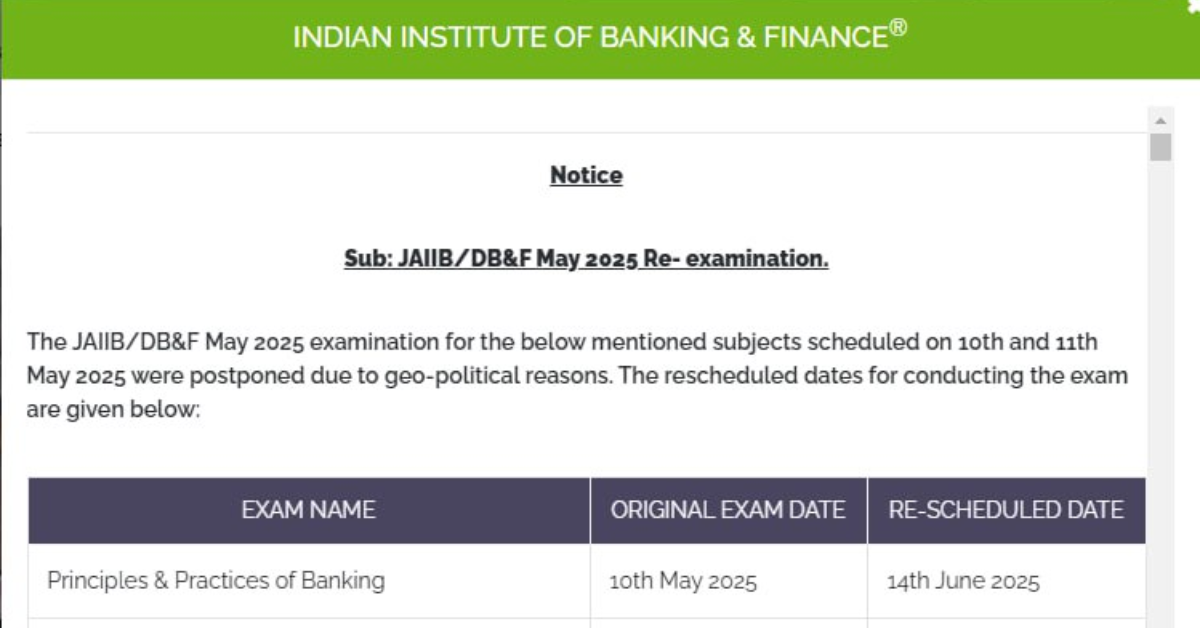

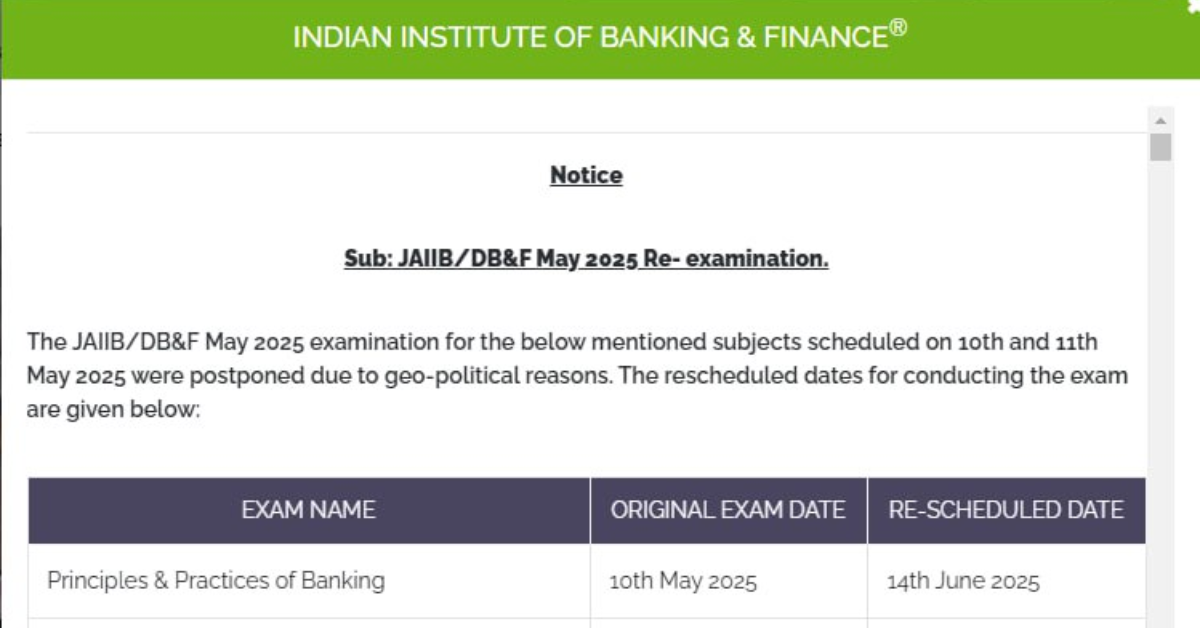

- JAIIB PPB and AFM New Exam Dates Out for Affected Areas, May Cycle

- JAIIB RBWM Exam 2025 Analysis for Shift 1, 2 & 3 – 18th May 2025

- JAIIB Exam Analysis 2025, May Cycle, All Shifts Covered

- JAIIB AFM Exam Analysis 2025, May All Shifts Review

- JAIIB PPB Exam Analysis 2025, May All Shifts Review

- JAIIB IE and IFS Exam Analysis 2025, 4th May 2025 Detailed Analysis

Frequently Asked Questions

Ans: CAIIB is tougher than JAIIB due to its advanced topics and complexity.

Ans: JAIIB focuses on foundational banking knowledge, while CAIIB requires a deeper understanding of advanced concepts.

Ans: Yes, JAIIB is designed for beginners, making it more accessible compared to the advanced CAIIB.

Ans: While not mandatory, having banking experience is beneficial for understanding CAIIB’s complex material.

Ans: It is advisable to attempt JAIIB first, as it lays the groundwork for the more challenging CAIIB.

- JAIIB PPB and AFM New Exam Dates Out for Affected Areas, May Cycle

- JAIIB RBWM Exam 2025 Analysis for Shift 1, 2 & 3 – 18th May 2025

- JAIIB Exam Analysis 2025, May Cycle, All Shifts Covered

- JAIIB AFM Exam Analysis 2025, May All Shifts Review

- JAIIB PPB Exam Analysis 2025, May All Shifts Review

- JAIIB IE and IFS Exam Analysis 2025, 4th May 2025 Detailed Analysis