Can I Clear JAIIB Exam in 2 Months?

The JAIIB (Junior Associate of the Indian Institute of Bankers), a significant exam for banking professionals, offers career growth and opportunities. Whether you’re a fresh entrant or an experienced banker, clearing JAIIB opens doors to career growth and better opportunities. But can you achieve the result in just two months? Let’s explore a strategic approach to your question “Can I Clear JAIIB Exam in 2 Months?”.

First, complete the JAIIB Registration on time and monitor the JAIIB exam date. Download your JAIIB admit card early.

JAIIB Syllabus

The JAIIB (Junior Associate of the Indian Institute of Bankers) exam syllabus is essential for candidates aspiring to qualify for this flagship course. Before stepping into the strategy, let’s know about the detailed JAIIB Syllabus.

1. Indian Economy and Indian Financial System (IE & IFS)

- Module A: Indian Financial System

- Structure and functions of financial institutions

- Banking systems and its regulations

- Financial markets (money, capital, forex)

- Financial services (insurance, mutual funds, pension funds)

- Financial inclusion and financial literacy

- Module B: Principles of Banking

- Banking basics

- Types of accounts

- Negotiable instruments

- Retail banking products and services

- Customer service and grievance redressal

2. Principles and Practices of Banking (PPB)

- Module A: Indian Banking System

- Evolution and structure of Indian banking

- Role of RBI and other regulatory bodies

- Banking technology and digital banking

- Financial inclusion initiatives

- Module B: Functions of Banks

- Deposit and credit operations

- Retail lending

- Priority sector lending

- Risk management in banking

3. Accounting and Financial Management for Bankers (AFM)

- Module A: Business Mathematics and Finance

- Time value of money

- Ratio analysis

- Working capital management

- Capital budgeting

- Module B: Balance Sheet Analysis

- Interpretation of financial statements

- Asset-liability management

- Capital adequacy and risk-weighted assets

4. Retail Banking and Wealth Management (RBWM)

- Module A: Retail Banking

- Retail lending products

- Customer relationship management

- Marketing of banking products

- Customer acquisition and retention

- Module B: Wealth Management

- Investment products

- Portfolio management

- Tax planning and insurance

Remember, thorough preparation along with understanding the syllabus is crucial for qualifying the JAIIB exam.

The 2-Month JAIIB Exam Timeline

Use JAIIB Previous Year Question Papers for preparation. After the exam, review the JAIIB results and JAIIB cutoff.

Month 1: Foundation Building

Assessment:

- Begin by assessing your existing knowledge.

- Identify your strengths and weaknesses.

- Understand the exam pattern and syllabus thoroughly.

Study Plan:

- Divide the syllabus into weeks.

- Allocate time for each topic.

- Focus on understanding concepts rather than rote learning.

Study Material:

- Gather relevant study material. You can refer to IIBF’s official books or other reliable sources.

- Make concise notes for quick revision.

Daily Routine:

- Dedicate at least 2-3 hours daily for focused study.

- Cover one subject each day.

Month 2: Revision and Practice

Revision:

- Review your notes regularly.

- Solve previous year question papers to reinforce your understanding.

Mock Tests:

- Take full-length mock tests.

- Analyze your performance and identify areas for improvement.

Time Management:

- Practice solving questions within the stipulated time.

- Work on your speed and accuracy.

Last Week:

- Revise all subjects.

- Stay calm and confident.

Being consistent with your study timing and a strategic approach is the key to success in the JAIIB exam.

JAIIB Study Plan: Can I Clear JAIIB Exam in 2 Months?

JAIIB (Junior Associate of the Indian Institute of Bankers) exam requires a well-structured study plan. Whether you’re a fresh entrant or an experienced banker, having a systematic approach is crucial. Also, consider JAIIB eligibility criteria and potential salary benefits. Let’s explore how to create an effective JAIIB study plan.

Month 1:

| Week | Days | Topics |

|---|---|---|

| Week 1 | Days 1-4 | Indian Economy Overview, Economic Planning, Sectors, Priority Sector, Infrastructure, Globalization, Economic Reforms, Foreign Trade, International Organizations, Climate Change, Issues |

| Week 2 | Days 5-9 | Fundamentals of Economics, Supply/Demand, Money Supply, Inflation, Interest Theories, Business Cycles, Monetary/Fiscal Policy, National Income, Union Budget, Indian Financial System Structure |

| Week 3 | Days 10-14 | Financial Markets Overview, Money/Capital Markets, Fixed Income Markets, Capital Markets/Stock Exchanges, Forex Markets, Derivatives, Mutual Funds, Insurance, Credit Rating, Para Banking |

| Week 4 | Days 15-21 | Banker-Customer Relationship, AML-KYC Guidelines, Account Opening, Deposit Handling, Clearing/Collection, NRI Business, Cash Management, Payment/Cheque Collection, Consumer Protection, Right to Information |

Month 2:

| Week | Days | Topics |

|---|---|---|

| Week 1: Banking Functions and Technology | Days 22-30 | Functions of Banks, Consumer Protection, Lending Principles, Priority Sector Advances, Government Schemes, Banking Technology Essentials, Payment Systems, IT Security, IT Act Overview |

| Week 2: Ethics and Financial Management | Days 31-37 | Ethics in Banking, Work Ethics, Financial Management Overview, Ratio Analysis, Financial Mathematics, Capital Structure, Investment Decisions, Working Capital Management, Derivatives |

| Week 3: Taxation and Costing | Days 38-44 | Taxation (Income Tax, GST), Cost/Management Accounting Overview, Costing Methods, Marginal Costing, Budgets/Budgetary Control |

| Week 4: Retail Banking and Wealth Management | Days 45-54 | Retail Banking Introduction, Product Development, Credit Scoring, Retail Products, Digitization, Recovery, Marketing Banking Services, Customer Relationship Management, Wealth Management, Investment/Tax Planning |

| Final Week: Revision and Mock Tests | Days 55-66 | Revision for Papers 1, 2, 3, 4 with Mock Tests and Analysis |

Conclusion – Can I Clear JAIIB Exam in 2 Months?

In conclusion, preparing for the JAIIB (Junior Associate of the Indian Institute of Bankers) exam requires dedication, consistency, and a well-structured study plan. Whether you’re a beginner or an experienced banker, following a strategic approach will help you navigate the syllabus effectively.

Frequently Asked Questions

Ans: Yes, it’s possible with a strategic approach and dedicated preparation. Please check the article for detailed strategic approach.

Ans: The syllabus includes Indian Economy and Financial System, Principles and Practices of Banking, Accounting and Financial Management, Retail Banking and Wealth Management.

Ans: Divide your study time into two months, covering foundational concepts in the first month and focusing on revision and practice tests in the second month.

Ans: Utilize official study materials provided by the Indian Institute of Bankers (IIBF) or other reliable sources. Make concise notes for quick revision.

Ans: Regular assessment of your knowledge, consistent study routine, thorough revision, and practicing mock tests within the stipulated time are crucial for success.

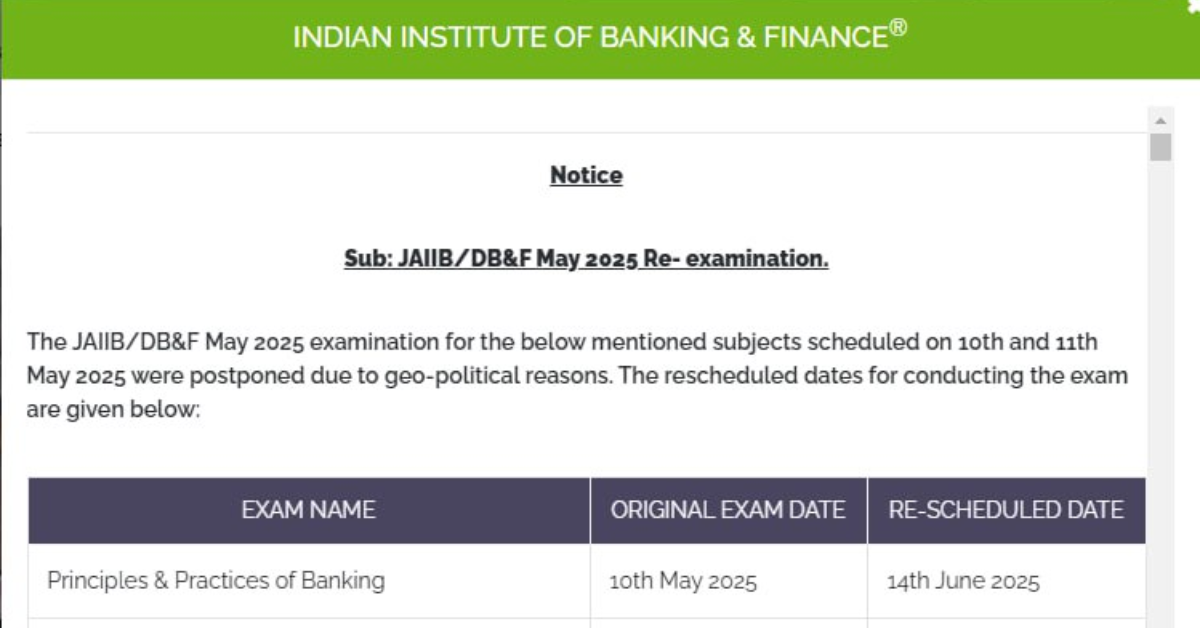

- JAIIB PPB and AFM New Exam Dates Out for Affected Areas, May Cycle

- JAIIB RBWM Exam 2025 Analysis for Shift 1, 2 & 3 – 18th May 2025

- JAIIB Exam Analysis 2025, May Cycle, All Shifts Covered

- JAIIB AFM Exam Analysis 2025, May All Shifts Review

- JAIIB PPB Exam Analysis 2025, May All Shifts Review

- JAIIB IE and IFS Exam Analysis 2025, 4th May 2025 Detailed Analysis