Preparing for the JAIIB exam requires a clear and organized approach. Start by understanding the complete syllabus for all the four papers. Identify the topics you find most challenging and begin studying them first. Use textbooks, online resources, and educational videos to strengthen your understanding of the core concepts.

JAIIB Exam Pattern 2026

The JAIIB exam consists of four papers, each focused on different aspects of banking. Here’s a breakdown of the exam pattern:

| Paper | Subject | No. of Questions | Total Marks | Duration |

| Paper-I | Indian Economy & Financial System | 100 | 100 | 2 hours |

| Paper-II | Accounting & Financial Management for Bankers | 100 | 100 | 2 hours |

| Paper-III | Principles & Practices of Banking | 100 | 100 | 2 hours |

| Paper-IV | Retail Banking & Wealth Management | 100 | 100 | 2 hours |

The exam is online and consists entirely of multiple choice questions (MCQs). You have 2 hours to complete each paper, and each paper carries 100 marks. There is no negative marking for wrong answers, making it essential to attempt every question you can.

What is the paper-wise IIBF JAIIB 2026 exam dates?

The IIBF JAIIB 2026 exam will be conducted in two cycles May and November in online mode, covering four compulsory papers: Indian Economy & Indian Financial System, Principles & Practices of Banking, Accounting & Financial Management for Bankers, and Retail Banking & Wealth Management. The May cycle is scheduled from 3rd May 2026 to 17th May 2026, while the November cycle will be held between 1st November 2026 and 29th November 2026. Candidates will receive the exact exam timings through their admit cards.

| Exam Paper | May 2026 Exam Date | November 2026 Exam Date |

| Indian Economy & Indian Financial System | 3rd May 2026 | 1st November 2026 |

| Principles & Practices of Banking | 9th May 2026 | 22nd November 2026 |

| Accounting & Financial Management for Bankers | 10th May 2026 | 28th November 2026 |

| Retail Banking & Wealth Management | 17th May 2026 | 29th November 2026 |

Also Check: JAIIB Complete 2026 Exam Schedule

What should be the paper-wise exam preparation strategy for JAIIB?

Preparing for the JAIIB exam works best with a clear understanding of the exam pattern and section-wise syllabus details. Since each paper covers different topics, having a strategy for every section is important. Here’s a simple, section-wise guide to help you prepare effectively and score well in the JAIIB IE and IFS exams.

Paper 1: Indian Economy and Financial System

This paper focuses on understanding the fundamentals of the economy, financial systems, and how banks play a role in the financial architecture. The Indian Economy & Indian Financial System (IE & IFS) paper requires a combination of theoretical knowledge and current affairs awareness.

| Topic | Strategy |

| Preparation Sequence (Beginners) | Concept Learning: Module A is followed by Module B, then Module C, and finally Module D. |

| Concept Learning Steps | 1. Understand Economic Frameworks: Study historical and contemporary economic trends, including liberalization and globalization. 2. Analyze Financial Ecosystem: Dive into topics like financial markets, regulators, and monetary policies with case studies. 3. Explore Banking Transformation: Research the evolution of banking in India, from traditional banking to digital and fintech innovations. 4. Revise concepts 5. Take topic-wise tests 6. Analyze your performance 7. Repeat the same steps for each unit. 8. Stay Updated: Follow economic surveys, RBI bulletins, and financial journals for practical insights. |

| Daily Routine | 1–1.5 hours for concept reading (self-study or class) 15–20 mins revision of the same concepts Weekends: Practice MCQs of the week’s units + revision |

| Flexibility Tip | Use small free time slots (5–30 mins) to revise or take mini-tests. Focus on consistency rather than long continuous sessions. |

| Time Allocation | Give more time to weak areas. Perform strength & weakness analysis via practice tests. |

| Test Strategy | Focus on accuracy first in topic-wise tests. Time management can be practiced later. Attempt all questions, analyze answers after test. |

| Question Pattern | – One-liners: 5 marks – Fill in the blanks / Match the following – Statement-based / Case study: 2 marks – Numerical: 1–2 marks – Emphasis on case studies for practical understanding |

Check out the detailed JAIIB IE and IFS Syllabus

Paper 2: Principles and Practices of Banking

The Principles & Practices of Banking (PPB) paper focuses on operational banking, ethics, and risk management. This paper is designed to assess your knowledge of banking operations, banking products, and general banking laws.

| Strategy | Description |

| 1. Conceptual clarity first | PPB is now a concept-based paper. Focus on understanding every concept deeply. Strong conceptual command ensures you can tackle case studies, numerical-based questions, and statement-based questions efficiently. 1. Master Operational Banking: Learn about different banking channels, digital banking frameworks, and service delivery models. 2. Focus on Ethics & Governance: Understand banking ethics, corporate governance practices, and customer rights. |

| 2. Analyze past papers (PYQs) | Study previous years’ questions to understand the exam pattern. Majority of questions are conceptual, with a mix of case studies, statement-based, and numerical questions. Traditional MCQs carry minimal weight. |

| 3. Limit resources | Avoid multiple books and faculties. Stick to one trusted resource/mentor to prevent confusion and save time. |

| 4. Handwritten notes & charts | From day one, summarize every concept into handwritten notes and conceptual charts. This makes revision faster and organized. |

| 5. Multiple revisions | Revise each unit 2–3 times through classes and notes. Consistent revision ensures proper understanding of every concept. |

| 6. Daily practice & analysis | Theory alone isn’t enough. Solve daily practice questions (DPQs) after completing each unit. Analyze mistakes, track performance, and strengthen weak areas. 1. Strengthen Compliance Knowledge: Go beyond regulations to explore real-life compliance challenges and fraud case studies. 2. Practical Application: Solve scenario-based problems to reinforce understanding of legal and regulatory aspects. |

| 7. Mock tests | After completing the syllabus, attempt two to three full-length mock tests to understand the exam structure better. Then evaluate your performance and identify gaps before the JAIIB 2026 exam. |

| 8. Consistency & patience | Make preparation a daily habit. Consistent effort is far more effective. Patience and discipline are key to success. For a detailed study plan, check out JAIIB PPB Study Plan. |

| 9. Self-reliance | Rely on your understanding and practice. Confidence in your preparation translates into better performance during the exam. |

Paper 3: Accounting and Financial Management for Bankers

The Accounting & Financial Management for Bankers (AFM) paper requires conceptual clarity and practical application of financial principles. This paper deals with accounting principles, financial statements, and management in the banking context.

| Module | Preparation Tips |

| Module A: Accounting Principles and Procedures | – Focus on Accounting Standards, Golden Rules of Accounting, Bank Reconciliation, Types of Errors. – Practice numericals on trial balance, rectification, depreciation, capital/revenue expenditure, and bills of exchange. – Understand audit types and back-office procedures. – Build a Strong Foundation: Learn core concepts like double-entry bookkeeping, profit & loss accounting, and financial statement analysis. |

| Module B: Final Accounts & Corporate Accounting | – Focus on cash flow components and company account formats.- Learn preparation of final accounts step by step. – Understand advantages/disadvantages of computerized accounting. – Solve practical problems regularly. – Interpret Financial Reports: Develop skills to analyze balance sheets, cash flow statements, and annual reports of banks. |

| Module C: Financial Management | – Focus on ratio calculations, interest & bond problems. – Learn WACC, YTM formulas and practice numerical problems. – Revise working capital cycle and capital investment techniques. – Understand types of leases and derivative basics. – Understand Banking-Specific Finance: Study banking financial ratios, Basel norms, and risk-adjusted return methodologies. – Utilize Practical Tools: Use spreadsheet software to practice financial modeling and calculations. |

| Module D: Taxation & Cost & Management Accounting | – Focus on TDS, TCS, GST concepts. – Practice costing methods with numerical examples. – Revise budget preparation & control techniques. |

| Weightage & Strategy | – Modules A & C: ~60% of marks – Modules B & D: ~40% of marks – Aim for 60+ marks by balancing theory and numerical practice. – Use module-wise DPPs, mock tests, and doubt sessions for efficient preparation. |

For a detailed preparation strategy, visit JAIIB AFM Preparation.

Paper 4: Retail Banking and Wealth Management

The Retail Banking & Wealth Management (RBWM) paper covers financial planning, customer engagement, and risk profiling. This paper focuses on retail banking products and services, as well as wealth management principles.

| Step | Strategy & details |

| 1. Understand the paper structure | The paper has 5 models (A–E) and 30 chapters in total. Module A: 4 chapters, easy, gives insights into retail banking, 10–15 marks. Module B: 12 chapters, most important, 30–35 marks. Module C: 6 chapters, important topics: 17, 18, 19, 20, 20–25 marks. Module D: 4 chapters, complex topics like portfolio management, investment, taxation, must cover. Model E: Additional material on home loans, numerical-focused, linked with Paper 3 AFM. |

| 2. Focus areas | Prioritize Module B and Module D, covering 16 chapters for almost 80% of marks in the exam. Module A and C can be completed quickly, with Module E for numerical practice. Key concepts: branch profitability, customer understanding, product & risk management. |

| 3. Build strong foundations | Spend 2 months strengthening core concepts. Daily 1–2 hours (morning + evening) for focused learning. Concept clarity is more important than solving many questions. |

| 4. Practice rigorously | Solve MCQs, case studies, and numerical problems repeatedly. Practice reveals weak areas that can be improved in revision. |

| 5. Revision | Conduct model-wise revision using class notes. Final 15 days: Focus on important and crisp concepts, multiple practice rounds. |

| 6. Smart preparation mantra | Understand customer needs, products, and risks thoroughly. Concept clarity prevents traps in tricky questions. |

Paper 4 is not very difficult if approached the right way. Focus on understanding the key concepts, give more attention to the important chapters in Models B and D, and practice regularly. Revise your topics systematically, and follow a clear JAIIB RBWM study plan.

How should you prepare for JAIIB 2026 effectively?

Preparing for JAIIB 2026 can be easier if you follow the right approach. Focusing on concepts, practicing regularly, and revising smartly can help you study efficiently and build confidence for the exam.

- Focus on Concepts: Understand the theory behind each topic instead of just memorizing.

- Use Videos: Watch YouTube and IIBF videos to grasp difficult concepts quickly.

- Take Notes: Summarize key points for easy and quick revision later.

- Practice Mock Tests: Regular practice improves time management and exam skills.

- Revise Often: Revise regularly to reinforce learning and retain concepts.

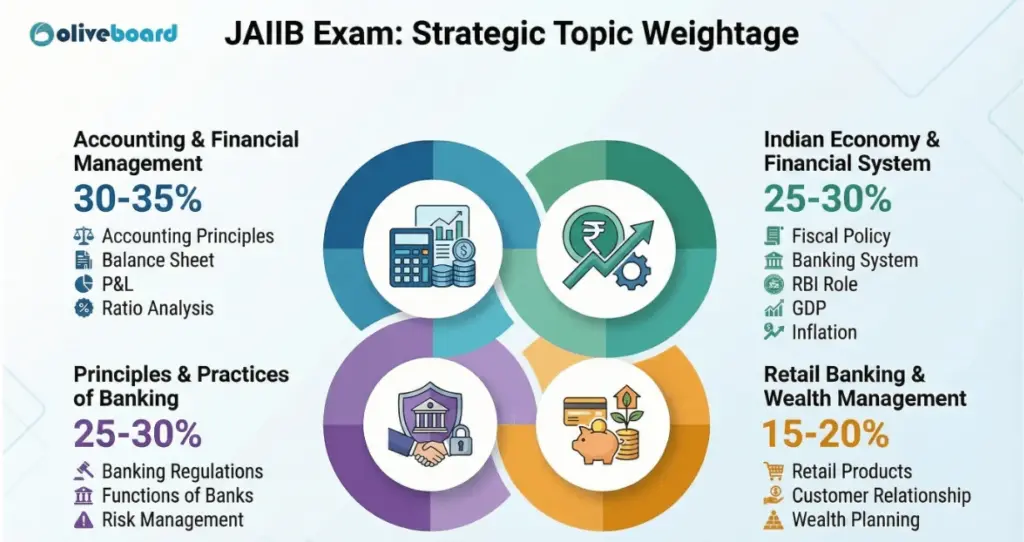

What is the topic-wise weightage of each of the 4 papers in the JAIIB exam?

In this section, we have provided the approximate percentage weightage of the important topics under each subject. It will help candidates focus on important topics and study smarter for better results.

Why are setting monthly and weekly goals important?

It is important to understand why setting monthly and weekly goals is important for the aspirants. The reasons are as follows:

- Improves Focus: Small goals make it easier to concentrate on one task at a time.

- Boosts Motivation: Achieving small targets builds confidence and keeps you motivated.

- Reduces Stress: Breaking big tasks into smaller steps makes them less overwhelming.

- Tracks Progress: Regular goal-setting helps you see how far you’ve come and what needs adjustment.

- Increases Productivity: Clear, smaller goals help prioritize tasks and work more efficiently.

FAQs

The best way to prepare for JAIIB is by understanding the concepts, watching helpful YouTube lectures, and practicing with mock tests.

Mock tests are crucial as they help improve time management, boost confidence, and provide insights into the exam pattern.

Revision is most effective when you create short notes, focus on weak areas, and regularly test yourself using mock exams.

Focus on understanding the fundamentals of banking topics and apply real-life examples to reinforce your learning.

- 50 Most Repetitive Questions for JAIIB RBWM 2026, Download PDF

- 50 Most Repetitive Questions for JAIIB AFM 2026, Download PDF

- 50 Most Repetitive Questions for JAIIB PPB 2026, Download PDF

- 50 Most Repetitive Questions for JAIIB IE and IFS 2026, Download PDF

- JAIIB 1000+ Practice MCQs, Download Free eBook

- PPB Memory Based Questions for JAIIB 2026, Download PDF

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exam categories like Regulatory Bodies, Banking, SSC, State PSCs, and more. I am on a mission to provide you with all the details you need, conveniently in one place. When I am not writing and marketing, you will find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!