The Reserve Bank of India (RBI) has introduced a significant enhancement to the Unified Payments Interface (UPI) System, enabling users to conduct transactions using pre-sanctioned credit lines provided by banks. This development represents a substantial advancement in India’s digital payment ecosystem, offering consumers greater financial flexibility and convenience. With this expansion, individuals can access and utilize pre-approved credit limits to make transactions through the UPI platform, making digital payments even more accessible and versatile.

Earlier System

- Previously, the UPI System only allowed transactions using the deposited amount.

- However, on April 6, 2023, the Reserve Bank proposed an expansion of the Unified Payments Interface by permitting transfers to/from pre-sanctioned credit lines at banks.

- This change allows savings accounts, overdraft accounts, prepaid wallets, and credit cards to be linked to the UPI platform.

- The Reserve Bank’s circular on ‘Operation of Pre-Sanctioned Credit Lines at Banks through UPI’ outlines this expansion, which enables credit lines to serve as a funding source for UPI transactions, providing users with greater financial flexibility.

How does this new facility work for pre-sanctioned credit lines through UPI?

- With the individual customer’s prior consent, payments can now be conducted using a pre-sanctioned credit line provided by a Scheduled Commercial Bank through the UPI system.

- This means that individuals can utilize their pre-approved credit for UPI transactions.

- Banks have the flexibility to define the terms and conditions for the use of these credit lines, including factors like the credit limit, credit period, interest rates, and other relevant terms, as per their board-approved policies.

- This expansion offers consumers more options and convenience when making digital payments.

Reasons Behind the Decision

The RBI’s decision to incorporate credit lines into UPI transactions is a strategic move aimed at reducing the cost of financial services and fostering the development of innovative financial products in the Indian market. This initiative is part of an ongoing effort to enhance the capabilities of the UPI system, which is widely used in India for instant mobile-based money transfers.

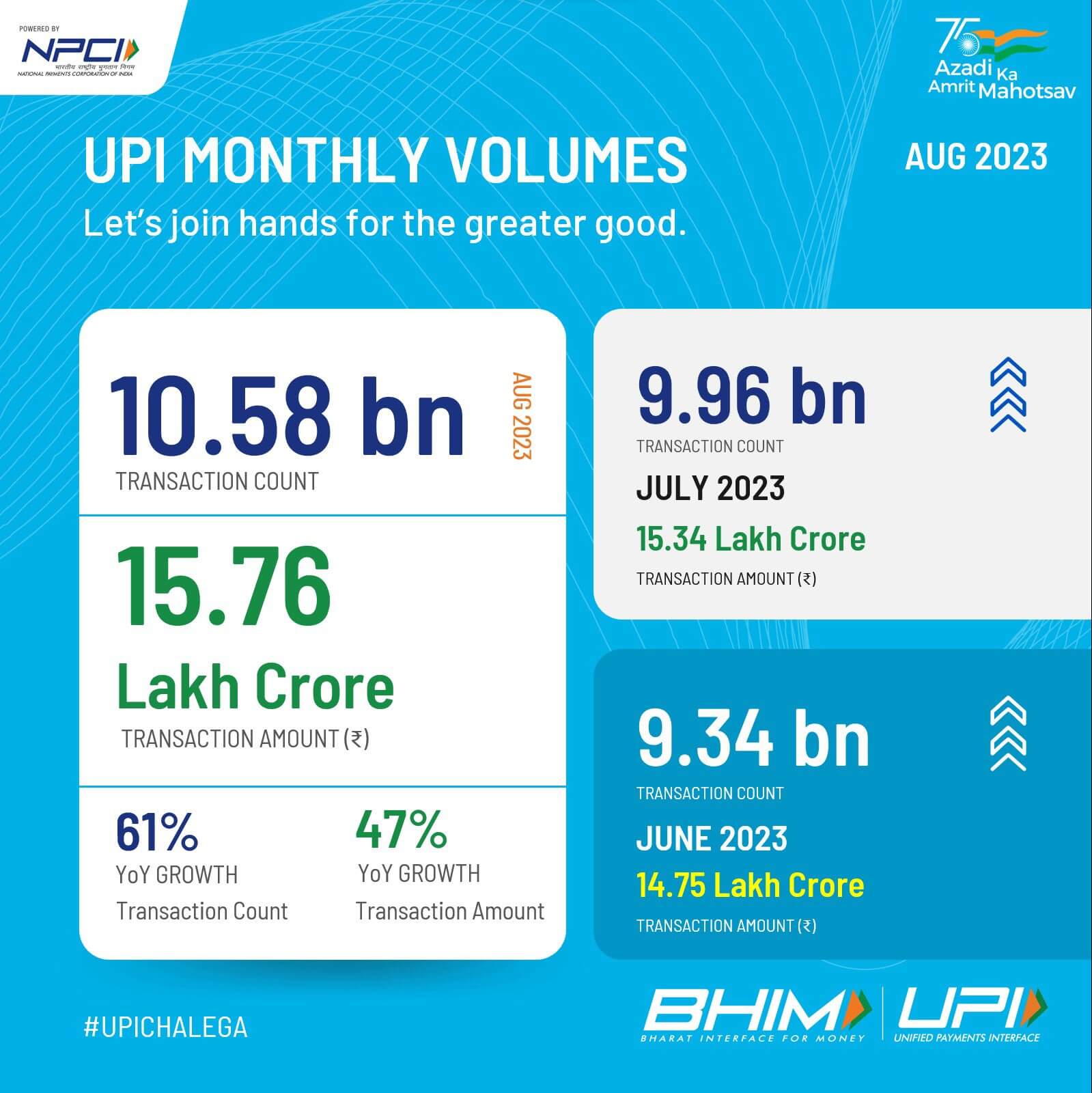

In August, UPI transactions exceeded the 10-billion milestone (100 crore). The number of UPI transactions in July was 9.96 billion (996.4 crores), and in June, it was 9.33 billion. The addition of credit lines to the UPI ecosystem is expected to benefit not only banks but also businesses and consumers. It democratizes access to credit, streamlines the process, and facilitates last-mile credit availability, making it more affordable, convenient, and transparent for all stakeholders. This expansion has the potential to significantly impact India’s digital payment landscape by increasing financial flexibility and accessibility.

Advantages in Assessing the Creditworthiness of Potential Borrower

The inclusion of credit lines in UPI transactions offers a host of advantages for both lenders and users, whether they are businesses or consumers. One key benefit is the rich and dependable data trail of transactions that UPI provides. This data can be leveraged by lenders to assess the creditworthiness of potential borrowers, taking into account their income, spending patterns, and repayment behavior. It streamlines the credit assessment process and reduces the need for lengthy application procedures.

Effects on Businesses and Consumers

For users, the initiative simplifies the payment experience by allowing them to make physical and digital purchases without relying on a physical card or point-of-sale (POS) machine. Instead, they can use their pre-sanctioned credit lines on UPI, ensuring a hassle-free and convenient payment process. This development is poised to enhance the overall efficiency and accessibility of digital payments in India.

Potential Impact on Banks

The expansion of UPI’s capabilities to include pre-sanctioned credit lines is a significant development for the banking industry in India. It allows banks to offer small credit limits more efficiently and cost-effectively through the UPI system. This means that credit can become more accessible to segments of the population that were previously underserved or had limited access to traditional banking services. By democratizing access to credit and simplifying the process, the inclusion of credit lines in UPI transactions is expected to benefit a wide range of users, including businesses and consumers, in India.

- Weekly Current Affairs 2025 PDF For Bank, SSC, UPSC Exams

- Unsung Heroes of India: 10 Unknown Freedom Fighters You Should Know

- 26 December Current Affairs 2023 in English

- Daily Current Affairs 2025, Check Today’s Current Affairs

- April Month Current Affairs 2024, Download PDF

- June Month Current Affairs 2024, Download PDF

Hello, I’m Aditi, the creative mind behind the words at Oliveboard. As a content writer specializing in state-level exams, my mission is to unravel the complexities of exam information, ensuring aspiring candidates find clarity and confidence. Having walked the path of an aspirant myself, I bring a unique perspective to my work, crafting accessible content on Exam Notifications, Admit Cards, and Results.

At Oliveboard, I play a crucial role in empowering candidates throughout their exam journey. My dedication lies in making the seemingly daunting process not only understandable but also rewarding. Join me as I break down barriers in exam preparation, providing timely insights and valuable resources. Let’s navigate the path to success together, one well-informed step at a time.