The concept of National Income is one of the most basic topics in Economics and therefore it becomes pretty important to understand its fundamentals. Questions around the topics of National Income are frequently asked in Banking, SSC, Insurance & Other Govt. Exams like RBI Grade B, NABARD Grade A & B, SSC CGL, SEBI, SBI PO, RBI Assistant, SBI Clerk, etc. Therefore let us devote some time to this topic and understand the depth of it.

Concept of National Income

There are various concepts of National Income. These are the various metrics used to measure National Income in an Economy. These are explained below one by one:

1. Gross National Product (GNP).

2. Net National Product (NNP)/National Income.

3. Gross Domestic Product (GDP).

4. National Income at Factor Cost.

5. Personal Income.

6. Disposable Personal Income.

Let us start understanding them in detail one by one:

Targetting NABARD Grade A 2020? Clear it in your first attempt.

1. Gross National Product (GNP)

Definition and Explanation of GNP:

The concept of Gross National Product (GNP) is comprehensive. It enables us to measure and analyze as to how much is the aggregate economic production of a country in a given period. The gross national product of a country (GNP) is defined as:

“The total money value of all final goods and services produced by the residents of a country in one year period”.

In the words of W.C. Peterson:

“Gross National Product may be defined as the current market value of all final goods and services produced by the economy during an income period regardless of where the output is produced“.

Remember the following aspects of GNP:

GNP is a flow concept: GNP represents a flow. It is a quantity produced per unit of time. It is the value of final goods and services produced in a country during a given time period.

GNP measures final output: While calculating GNP, the market value of only final goods and services produced in a year are added up. Final goods are those goods that are purchased for final use in the market.

GNP is the output produced by the citizens of a country: Gross national product is the final output of goods and services produced by the citizens and businesses of a country during a given time period which is usually a year. For example, the economic activity carried out by the American citizens and businesses outside the country is counted in GNP. While the income of the residents who are not USA citizens is subtracted from GNP.

Components of Expenditures in GNP:

For measuring GNP at market price, the economists use the Expenditure Approach.

According to this approach, there are four categories of expenditures which are added together to measure Gross National Product (GNP) at Market Price,

(i) Consumption,

(ii) Investment

(iii) Government Expenditure and

(iv) Net exports.

These four types of expenditures are explained in brief:

(i) Consumption Expenditure (C): It includes all personal expenditures incurred by the citizens of a country on durable and non-durable goods in a period of one year.

(ii) Investment (I): It is the total expenditure incurred by firms or households on capital goods.

(iii) Govt. expenditures (G): It includes all types of expenditure incurred by Federal, Provincial, Local Councils on the purchases of goods and services such as national defense, law, and order, street lighting, etc.

(iv) Net Exports (X – M): Net exports of goods and services are the value of exports minus the value of imports.

The formula for Gross Profit:

GNP = C + I + G + (X – M)

Where:

C = Consumption, I = Investment, G = Government Expenditure and X – M = Net exports

How to Prepare for SBI PO and SBI Clerk from Home?

2. Gross Domestic Product (GDP)

“Gross domestic product (GDP) is defined as the total market value at current prices of all final goods and services produced within a year by the factors of production located within a country”.

The labour and the capital of a country working on its natural resources produce a certain aggregate of commodities, material, and non-material every year. In addition to this, there may be foreign firms producing goods in the various sectors of the economy like mining, electricity, manufacturing, etc.

If we add up the money value of all the final goods produced both by domestic and foreign-owned factors annually in the country and valued at market prices, it will be called gross domestic product (GDP).

Gross Domestic Product is the value of aggregate or total production of goods and services in a country in one year.

If we make a detailed list of all such commodities produced annually or measure the total goods produced during a year by weight or by volume, it will not give us any clear and concise impression about our total national output. So, what generally done is that the money value of all final goods and service produced during a year at current market prices is added up. This total current market value of all final goods and services produced in an economy in a year period is called gross domestic product (GDP).

In the words of Campbell:

“Gross Domestic Product is defined as the total value of all final goods and services produced in a country in one year”.

According to Shapiro:

“GDP is defined as a flow variable, measuring the quantity of final good and services produced” during a year”.

While calculating the gross domestic product (GDP), the value of only those goods are added which have reached their final stage of production and are available for consumption. The primary or intermediate goods are not counted in GDP.

Distinction Between GDP and GNP:

Here it is necessary to distinguish between Gross Domestic Product (GDP) and Gross National Product (GNP).

Gross Domestic Product (GDP) is the total market value of all final goods and services produced by factors of production within a nation’s border during a period of one year. In other words, GDP is a flow of products produced within the country by domestically located resources in a year.

Gross National Product (GNP) on the other hand, is the measure of all final goods and services produced by the citizens within their own country as well as outside the country during a period of one year. In other words, GNP expresses the money value of the flow of goods and services produced within the country and the net income received from abroad during a period of one year.

Thus when we move from GDP to GNP, we add factor income receipts from foreigners and subtract factor income payments to foreigners.

GDP = GNP – Net Foreign Income From Abroad

RBI Grade B Preparation – Complete Phase 1 & Phase 2

3. Net National Product (NNP)/National Income

Net National Product or National Income at Market Prices is the net market monetary value of all the final goods and services produced in a country during a year.

It is found out by subtracting the amount of depreciation of the existing capital in a year from the market value of all final goods and services.

If we deduct depreciation allowance from gross national product, we get Net National Product at current market price.

NNP at Market Price = GNP at Market Price – Depreciation

This fund which is set aside for covering the wear and tear, deterioration and obsolescence of the machinery is named as Depreciation Allowance.

NNP = GNP – Depreciation

4. National Income at Factor Cost

National Income can be estimated in terms of either output or total income. When national income is measured by adding together all income payments made to the factors of production in a year, it is called national income at factor cost.

National income thus is the sum total of all income payments made to the factors of production.

In the words of J. Sloman:

“National income (Nl) or national income at factor cost is the aggregate earning of the four factors of production (land, labour, capital and organization) which arise from the current production of goods and services by the nations’ economy”.

The main components of national income at factor cost are as follows:

The factor incomes are generally divided into four categories:

(i) Compensation to employees – It is the largest component of national income. It consists of wages and salaries paid by the firms to the workers for their labour services.

(ii) Interest – Interest is the payment for the use of funds in a year. The payment is made by private businesses to households who have lent money to them.

(iii) Rents – Rent is all income earned by individuals for the use of their real assets such as building, farms etc.

(iv) Profits – Profit is the amount which is left after compensation to employees, rent, interest has been paid out. The sum of compensation to. employees, interest, rent and profit is supposed to equal national income at factor cost.

Know-How to Clear SSC CGL 2019 Exam in First Attempt – Score 185+ in Tier 1

5. Personal Income

National income is the sum of factor income. In other words, it is the income which individuals receive for doing productive work in the form of wages, rent, interest and profits.

Personal Income, on the other hand, includes all income which is actually received by all individuals in a year. It includes income which is not directly earned but is received by individuals. For example, social security payments, welfare payments are received by households but these are not elements of national income because they are transfer payments.

In the same way, in national income accounting, individuals have attributed income which they do not actually receive. For example, undistributed profits, employee’s contribution to social security corporate income taxes etc. are elements of national income but are not received by individuals. Hence they are to be deducted from national income to estimate the personal income.

PI = Nl + Transfer Payments – Corporate retained earnings, income taxes, social security taxes.

6. Disposable Personal Income

Disposable Personal Income is the amount which is actually at the disposal of households/persons to spend as they like.

It is the amount which is left with the households/persons after paying personal taxes such as income tax, property tax, national insurance contributions etc.

Disposable personal income = Personal Income – Personal Taxes

DPI = PI – Personal Taxes

The concept of disposable personal income is very important for studying the consumption and saving behaviour of individuals. It is the amount which households can spend and save.

Disposable Income = Consumption + Saving

DI = C + S

RBI Assistant Study Plan 2019-20 – For Prelims Exam

We hope that your concepts about the National Income are pretty clear now and you are able to distinguish between GDP and GNP now. The concept of National Income is crystal clear in your head now.

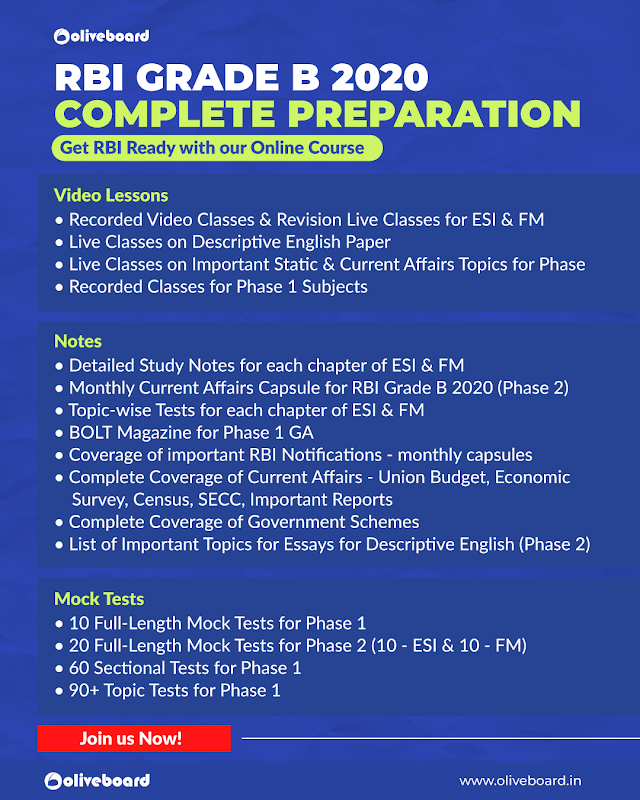

Study material for RBI Grade B 2020

If you are an RBI Grade B aspirant and also a working professional and find it difficult to find enough time for your RBI Grade B Preparations, do not worry at all.

Oliveboard has come up with RBI Grade B Online Cracker Course for RBI Grade B 2020 Exam. Oliveboard’s RBI Grade B Online Course 2020 will be your one-stop destination for all your preparation needs

What all the course offers you:

1. Course Details

RBI Grade B Cracker is designed to cover the complete syllabus for the 3 most important subjects: GA for Phase 1 and ESI + F&M for Phase 2 exam. Not just that, it also includes Mock Tests & Live Strategy Sessions for English, Quant & Reasoning for Phase 1. The course aims to complete your preparation in time for the release of the official notification.

1.1. Features:

Use Coupon Code ‘P30’ to avail a 30% discount on RBI Courses!

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!