Payment Systems and Electronic Banking – The world of banking and finance is rapidly evolving, and banks are utilising expertise and technology to provide clients with fresh services. Banks and technology are growing at such a quick pace that bank employees must constantly acquire new skills to enable them to adapt to change and develop competence in dealing with a variety of consumer inquiries. As a result, today’s bank personnel must remain up to speed with new skills and expertise. The Institute, as the leading supplier of banking education, periodically examines the curriculum for its affiliate examinations, such as the JAIIB/CAIIB and other tests, with the support of Expert Groups to ensure that the contents are current and relevant.

Download Payment Systems and Electronic Banking E-Book Here

How To Download The Free Payment Systems and Electronic Banking pdf for JAIIB?

Step 1: Click on the download link. You will be taken to Oliveboard’s FREE E-Books Page.

Step 2: Register/Login to the Free E-Books Page of Oliveboard (It is 100% free, You just enter your valid email ID and a password to be able to download the JAIIB Practice questions pdf.

Step 3: After Logging in, you will be able to download the free e-book by clicking on “click here” as shown in the snap below.

What’s there in the eBook of Payment Systems and Electronic Banking?

| Index |

| Introduction |

| Electronic Payment system |

| Automated Teller Machines (ATM) |

| HWAK: The Intelligent Auto-teller and Netware Management System |

| White Label ATMs (WLA) |

| Plastic Cards |

| Electronic Banking |

| Anytime Banking |

| Home Banking (Corporate and Personal) |

| Personal Banking |

| Electronic Commerce (E-Commerce) |

| Cheque Truncation |

| FAQs |

Sneak-Peak into Payment Systems and Electronic Banking

What’s there in the E-Book?

Electronic Payment system

E-payment is a method of conducting business or paying for products and services using an electronic medium rather than a cheque or cash.

Automated Teller Machines (ATM)

Automated Teller Machines (ATMs) are largely used for completing banking services such as cash withdrawals and depositing cash/cheques, among other things, using an ATM card. Dr C. Rangarajan’s committee suggested that ATMs be installed across India.

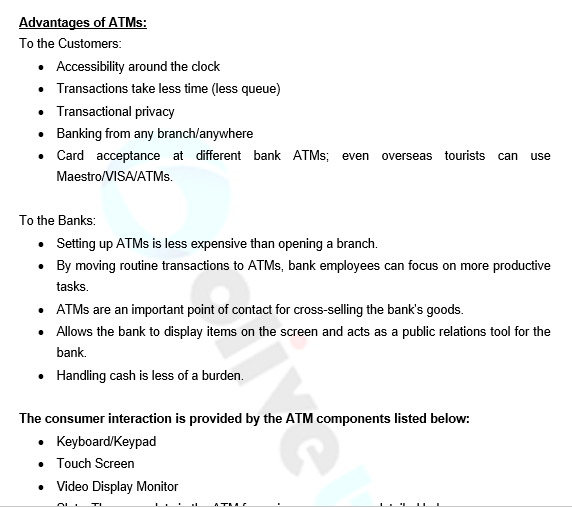

Advantages of ATMs:

To the Customers:

- Accessibility around the clock

- Transactions take less time (less queue)

- Transactional privacy

- Banking from any branch/anywhere

- Card acceptance at different bank ATMs; even overseas tourists can use Maestro/VISA/ATMs.

To the Banks:

- Setting up ATMs is less expensive than opening a branch.

- By moving routine transactions to ATMs, bank employees can focus on more productive tasks.

- ATMs are an important point of contact for cross-selling the bank’s goods.

- Allows the bank to display items on the screen and acts as a public relations tool for the bank.

- Handling cash is less of a burden.

The consumer interaction is provided by the ATM components listed below:

- Keyboard/Keypad

- Touch Screen

- Video Display Monitor

- Slots: There are slots in the ATM for various purposes as detailed below:

- Cash Dispenser

- Deposit Slot

- Envelope Dispenser

- Card Reader

HWAK: The Intelligent Auto-teller and Netware Management System

Smart auto-teller systems are a type of auto-teller machine that can think for themselves, which means they’re quick, put less strain on your financial systems, and treat consumers more like personal bankers than less sophisticated auto-teller machines. Even without the luxury of a dependable communication network, HWAK delivers excellent service.

Advantages of HWAK:

- Customer fulfilment.

- High accessibility

- Auto-recovery both online and offline

- Full banking service at any moment

- Low costs, shorter lines, and fewer tellers combined with ease of use

- Early and quick adoption

- Improved security and auditing

- Network administration

- Predictable ownership costs

- One-stop auto banking for shopping.

JAIIB Study Material Compilation

Also Read:

- 5-Important Tips To Crack JAIIB Exams| Check Here (oliveboard.in)

- JAIIB Frequently Asked Questions- 2022| Check Here (oliveboard.in)

- JAIIB Genius | JAIIB Weekly Quiz PDF – JAIIB Questions PDF (oliveboard.in)

- JAIIB Full Form – Junior Associate of the Indian Institute of Bankers (oliveboard.in)

- JAIIB and CAIIB Books- Exams Syllabus, Books, and more (oliveboard.in)

The most comprehensive online preparation portal for MBA, Banking and Government exams. Explore a range of mock tests and study material at www.oliveboard.in