Calculation of Interest and Annuities: The Calculation of Interest and Annuities for the JAIIB Exam is one of the most important topics for JAIIB. JAIIB exam is conducted twice a year. So, here we are providing the Calculation of Interest and Annuities (Unit-1) – Basics of Business Mathematics notes for JAIIB.

Download Calculation of Interest and Annuities Here

How To Download The Free Calculation of Interest and Annuities pdf for JAIIB?

Step 1: Click on the download link. You will be taken to Oliveboard’s FREE E-Books Page.

Step 2: Register/Login to the Free E-Books Page of Oliveboard (It is 100% free, You just enter your valid email ID and a password to be able to download the JAIIB Practice questions pdf.

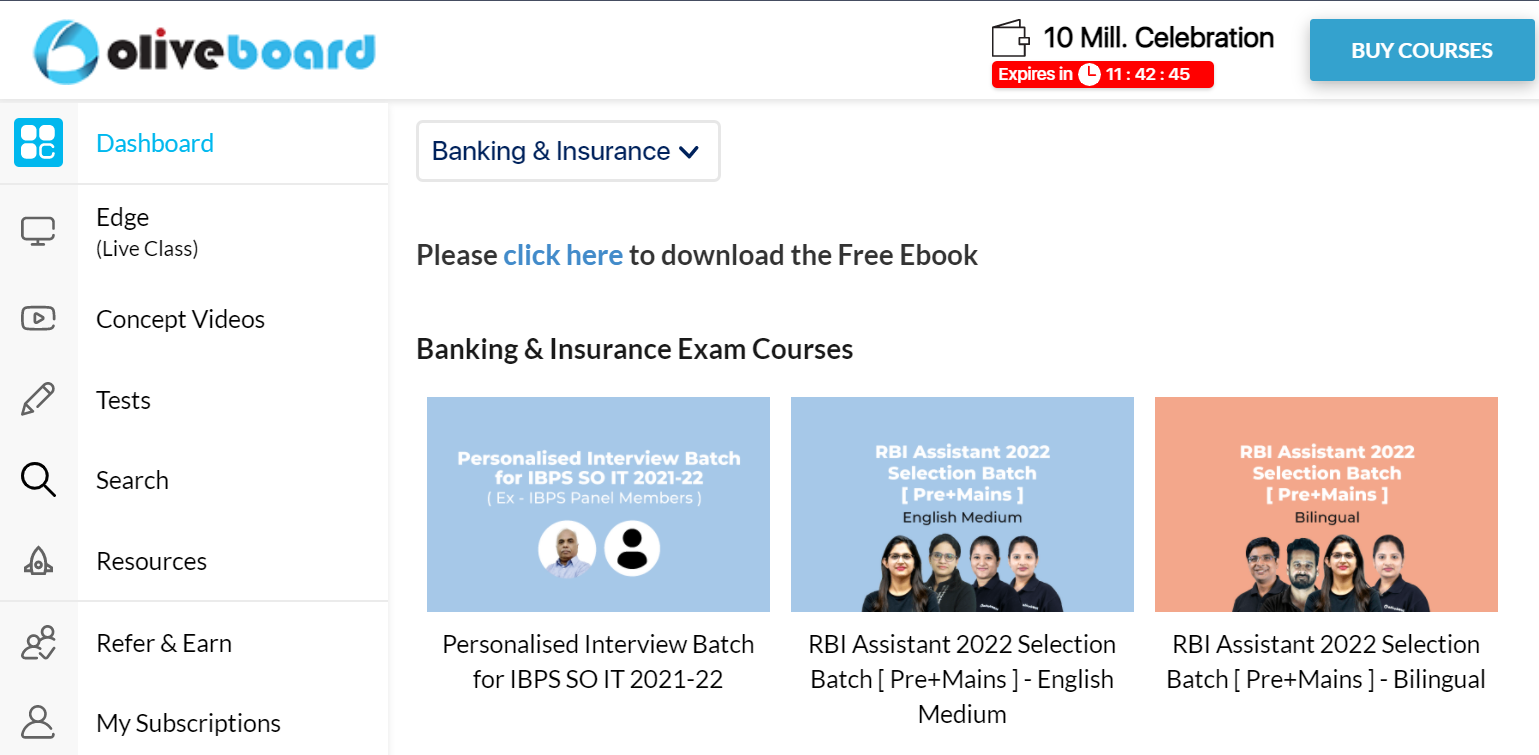

Step 3: After Logging in, you will be able to download the free e-book by clicking on “click here” as shown in the snap below.

What’s there in the ebook of Calculation of Interest and Annuities?

| Table of Content |

| Meaning of Interest |

| Reasons for Charging Interest |

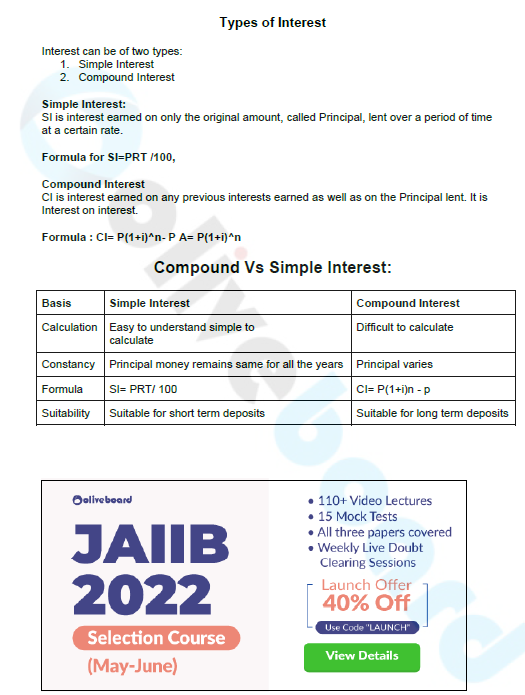

| Types of Interest |

| Types of Interest for Bank Deposits: |

| Daily Product Method |

| Equated Monthly Installment |

| Front-End and Back-End Interest Rates |

| Fixed and Floating Interest rates |

| Comparison between Fixed and Floating Interest Rate |

| Annuities |

Sneak-Peak into Calculation of Interest and Annuities:

What’s there in the ebook?

Calculation of Interest and Annuities: Unit-1

Apart from earning money for their livelihood, people also need money to meet additional expenses like marriage in the family, buying a car, house or starting a business. Most people have to borrow money to pay for such things, although some will manage with their own money.

What is the meaning of Interest:

Interest can be defined as the price paid by a borrower for the use of a lender’s money.

- It is excess of money paid or received on deposits or borrowings.

- Interest is the price paid by a borrower for the use of a lender’s money. If you borrow (or lend) some money from (or to) a person for a particular period you would pay (or receive) more money than your initial borrowing (or lending).

- It is compensation paid to the depositor.

Reasons for Charging Interest:

There are a variety of reasons for charging the interest, they are

Opportunity Cost:

- The lender has a choice between using his money in different investments. If he chooses one, he forgoes the return from all others.

- In other words, lending incurs an opportunity cost due to the possible alternative uses of the lent money.

Liquidity Preference:

- People prefer to have their resources available in a form that can immediately be converted into cash rather than a form that takes time or involves expenditure to realize

Time value of money:

- Time value of money means that the value of unity of money is different in different time periods. The sum of money received in the future is less valuable than it is today.

- Since a rupee received today has more value, rational investors would prefer current receipts to future receipts. If they postpone their receipts, they will certainly charge some money i.e. interest.

- In other words, the worth of rupees received after some time will be less than a rupee received today.

Inflation:

- Most economies generally exhibit inflation. Inflation is a fall in the purchasing power of money.

- Due to inflation, a given amount of money buys fewer goods in the future than it will now. The borrower needs to compensate the lender for this.

JAIIB Study Material Compilation

Also Read:

- 5-Important Tips To Crack JAIIB Exams| Check Here (oliveboard.in)

- JAIIB Frequently Asked Questions- 2022| Check Here (oliveboard.in)

- JAIIB Genius | JAIIB Weekly Quiz PDF – JAIIB Questions PDF (oliveboard.in)

- JAIIB Full Form – Junior Associate of the Indian Institute of Bankers (oliveboard.in)

- JAIIB and CAIIB Books- Exams Syllabus, Books, and more (oliveboard.in)

Also Check:

- JAIIB 2022 Exam -Notification Released (oliveboard.in)

- JAIIB Notification 2022 – Notification PDF, Eligibility, (oliveboard.in)

- JAIIB Apply Online – Application Form 2022, Fees, Instru (oliveboard.in)

- JAIIB Eligibility – Age, Degree, Nationality, Members (oliveboard.in)

- JAIIB Syllabus – Complete List of Papers, Modules (oliveboard.in)

- JAIIB Exam Pattern 2022 – Details of Pattern, Marking (oliveboard.in)

- JAIIB Admit Card November 2022 – Steps and Direct Download (oliveboard.in)

- JAIIB 2022 Cut Offs – Check JAIIB Minimum Cut Off (oliveboard.in)

Hi, I’m Tripti, a senior content writer at Oliveboard, where I manage blog content along with community engagement across platforms like Telegram and WhatsApp. With 3 years of experience in content and SEO optimization, I have led content for popular exams like SSC, Banking, Railways, and State Exams.