With the recent news of “The Reserve Bank of India initiated Prompt Corrective Action for the troubled Lakshmi Vilas Bank”, it is important that we know and learn about RBI’s PCA Framework in detail. It will helpful for RBI Grade B Exam.

Register for a Free RBI Grade B Mock Test Here

Prompt Corrective Action (PCA) Framework – Free eBook

Download the free PDF of the Prompt Corrective Action Framework – RBI” from the link provided below or you can click on this link:

Take a Free Oliveboard Grade B Phase 1 & FM Mock Test 2019

Steps to download the Free Ebooks

Follow the below-given steps to easily download the Prompt Corrective Action (PCA) Framework eBook.

1. Click on the download button given above.

2. Login using your Email id and Password.

3. If you are not a registered user, then go to the top right side of the screen and click on “Register”. It is a simple process. You would need to put up your email id, a password (of your choice), your mobile number and click on register.

4. You would be shown a list of all eBooks that are free to download.

5. Click on the “STATIC GK” menu option and you would be redirected to the Prompt Corrective Action (PCA) Framework eBook.

Prompt Corrective Action Framework (PCA)

Let us look at the situation of Lakshmi Vilas Bank in detail first.

1. The Reserve Bank has initiated Prompt Corrective Action (PCA) against Lakshmi Vilas Bank (LVB) on account of high net NPAs, insufficient Capital to Risk (Weighted) Assets Ratio (CRAR) and Common Equity Tier 1 (CET 1), negative return on assets for two consecutive years and high leverage.

2. For FY19, the bank’s net NPA stood at 7.49 per cent, capital adequacy ratio was at 7.72 per cent and its return on assets was (-) 2.32 per cent. It had reported a net loss of Rs 894.10 crore for 2018-19.

3. PCA is aimed at improving the performance of the bank and will not have any adverse impact on the day-to-day operations, including acceptance/repayment of deposits in the normal course.

4. Under PCA, banks are mandated to cut lending to corporates and focus on reducing the concentration of loans to certain sectors. They are also restricted from opening new branches and paying dividends.

5. Banks currently under PCA are United Bank of India, Indian Overseas Bank, Central Bank of India, IDBI Bank and UCO Bank.

Sample Questions:

Q. What is the full form of CRAR?

- Credit to Return -Weighted Assets Ratio

- Capital to Risk-Weighted Assets Ratio

- Credit to Risk-Weighted Assets Ratio

- Capital to Return-Weighted Assets Ratio

Answer: (2)

Q. When does the RBI initiates PCA framework against the Banks?

- When ROA is less than 0.25%

- When ROA is less than 0.35%

- When ROA is less than 0.50%

- When ROA is less than 1.25%

Answer: (1)

To read more download the Free ebook.

Source:

- https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/PCAFR060514_4.pdf

- Economic Times

- The HinduBusinessLine

Read More:

More Ebooks

- SEBI Grade A Officer Question Paper PDF

- Introduction to Costing

- Financial/Securities Markets

- Basics of Derivatives

- List of Sustainable Development Goals 2030

- Alternate Sources of Finance

- Financial / Accounting Ratios

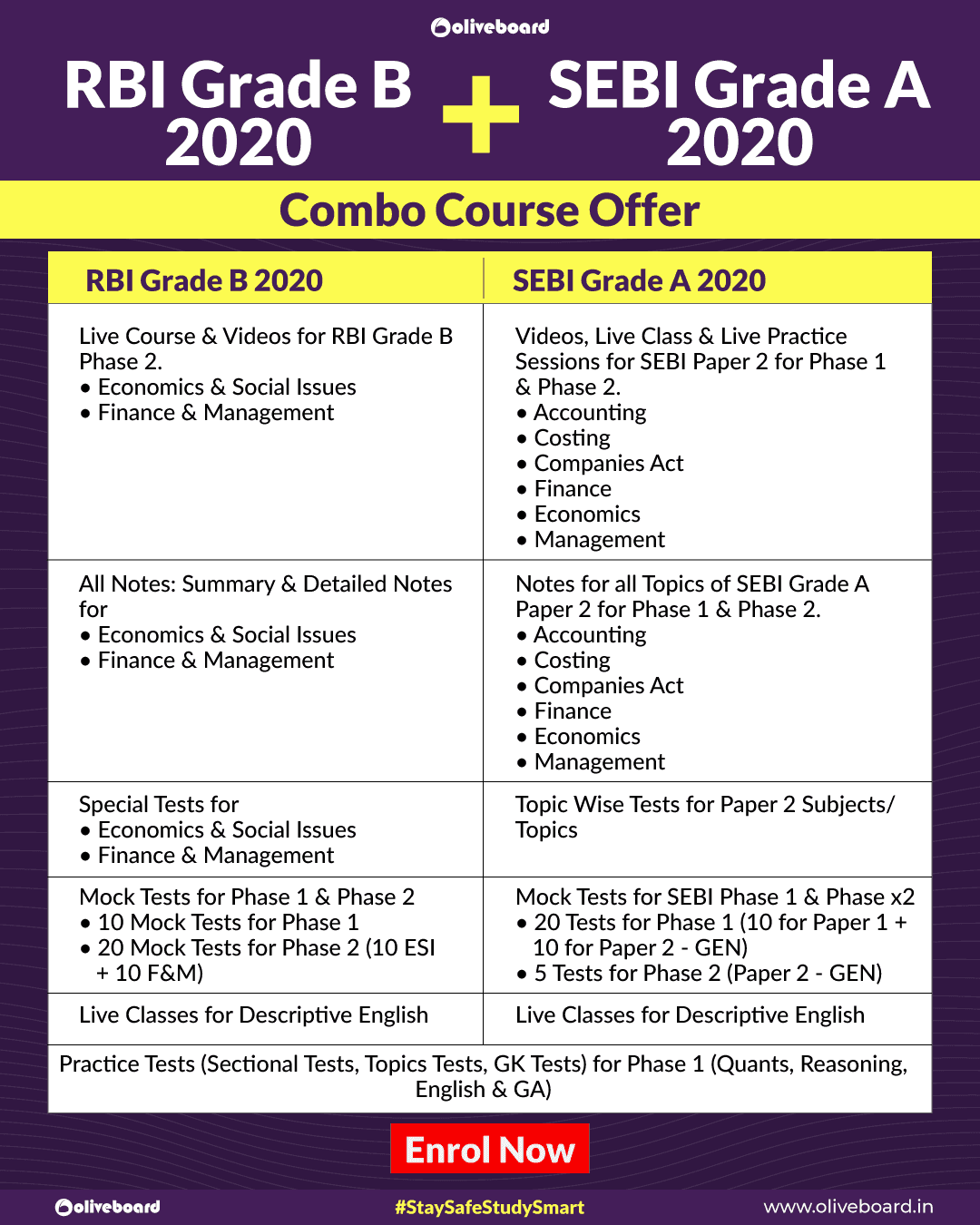

RBI Grade B + SEBI Grade A Combo Course 2020

Have a look at the provisions of the Online Course 2020

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!