JAIIB Important Topics

JAIIB Important Topics: The Junior Associate of Indian Institute of Bankers (JAIIB) exam is an essential certification for banking professionals in India. It helps bankers enhance their knowledge and improve career prospects. Preparing for the JAIIB exam requires a clear understanding of the syllabus and focus on important topics. In this article, we will cover the JAIIB Important Topics for each subject such as Indian Economy & Indian Financial System (IE & IFS), Principles and Practices of Banking (PPB), Accounting and Financial Management for Bankers (AFM), and Retail Banking and Wealth Management (RBWM).

JAIIB Exam Syllabus

The JAIIB syllabus is as prescribed by IIBF. It has been recently updated to reflect and adapt to the changing skills requirements among banking professionals. Each of the papers is further divided into 4 modules, the details of which are presented below in a tabular format.

| Module | Paper I- Indian Economy & Indian Financial System | Paper II- Principles & Practices of Banking | Paper III- Accounting & Financial Management for Bankers | Paper IV- Retail Banking & Wealth Management |

| A | Indian Economic Architecture | General Banking Operations | Accounting Principles and Processes | Introduction to Retail Banking |

| B | Economic Concepts Related to Banking | Functions of Banks | Financial Statements and Core Banking Systems | Retails Products and Recovery |

| C | Indian Financial Architecture | Banking Technology | Financial Management | Support Services – Marketing of Banking Services / Products |

| D | Financial Products and Services | Ethics in Banks and Financial Institutions | Taxation and Fundamentals of Costing | Wealth Management |

JAIIB IE & IFS Important Topics 2025

This subject focuses on the economic environment and the financial system in India. Key topics include:

Economic Environment:

- Basics of Microeconomics and Macroeconomics

- Inflation, Deflation, and Stagflation

- Role of Monetary and Fiscal Policy

- National Income and Related Concepts

Indian Financial System:

- Structure and Functions of RBI

- Financial Markets (Money Market, Capital Market)

- Payment and Settlement Systems

- Financial Inclusion and Digital Banking

Additional Topics:

- Role of NITI Aayog

- Public Finance (Budgeting and Taxation)

- International Economic Institutions (IMF, World Bank, WTO)

Core Economy

These are the topics about the basic economic concepts and data that are necessary for the JAIIB exam.

| Topic | Marks |

| An Overview of the Indian Economy | 2 marks |

| Sectors of the Indian Economy | 2-3 marks |

| Economic Planning in India and NITI Aayog | 2 marks |

| Infrastructure including social infrastructure | 2 marks |

| Globalization – Impact on India | 2 marks |

| Economic Reforms | 2 marks |

| Foreign Trade Policy, Foreign Investments, and Economic Development | 3 marks |

| International Economic Organisations (World Bank, IMF, etc.) | – |

| Climate change and Sustainable Development Goals (SDGs) | 2 marks |

| Issues faced by the Indian Economy | 3 marks |

| Total Marks | 18 marks |

Economic Concepts

These are more specific to Paper 1, ie. IE & IFS. However, these are straightforward and will not take much time to learn.

| Topic | Marks |

| Fundamentals of Economics, microeconomics, macroeconomics, and Types of Economies | 2 marks |

| Supply and demand | 2 marks |

| Money supply and inflation | 2 marks |

| Theories of interest | – |

| Business cycle | 2 marks |

| Monetary policy and fiscal policy | 1-2 marks |

| System of National Accounts and GDP Concepts | 1-2 marks |

| Union Budget | 1-2 marks |

| Indian Financial System – An Overview | 2 marks |

| Indian Banking Structure | 2 marks |

| Banking Laws – Reserve Bank of India Act, 1934, and Banking Regulation Act 1949 | 4 marks |

| Total Marks | 19 marks |

By covering these topics, you will be prepared for questions worth 19 marks.

Miscellaneous Topics

These are topics to cover once you have covered the abovementioned topics. These contain some higher-level topics that you may skip if you cannot cover them properly.

| Topic | Marks |

| Financial Markets | 1-2 marks |

| Money Markets | 2 marks |

| Capital Markets and Stock Exchanges | 2 marks |

| Fixed Income Markets – Debt and Bond Markets | 3 marks |

| Foreign Exchange Markets – FEMA | 3 marks (Priority) |

| Interconnectedness and Market Dynamics | 3-5 marks (Priority) |

| Merchant Banking Services | 2-3 marks |

| Total Marks | 20 marks |

Topics Common with PPB

Certain topics are included in IE & IFS and in PPB. These topics will be covered in the PPB section below.

- NPCI Product

- Alternate

- e-Rupee

- NPS/SHG

- PMJDY, APY

- Mudra Scheme

- Suraksha Bhima Yojana, Jeevan Jyoti Bhima Yojna

JAIIB PPB Important Topics 2025

The Principles and Practices of Banking paper focuses on the functioning of banks and their relationship with customers.

Banking Operations:

- Types of Accounts (Savings, Current, Term Deposits)

- KYC Norms and Anti-Money Laundering (AML)

- Credit Management (Types of Loans, Priority Sector Lending)

- Basics of Risk Management

Banking Technology:

- Core Banking Solutions

- E-Banking and Payment Systems (NEFT, RTGS, UPI)

- Cybersecurity in Banking

Legal Framework:

- Important Banking Laws (RBI Act, Banking Regulation Act)

- SARFAESI Act and DRT

- Ombudsman Scheme

Next, we come to the topics you need to cover to secure the second paper of JAIIB, Principles and Practices of Banking. These are listed below with the number of marks they can earn you.

| Topic | Marks |

| Banker-Customer Relationship | 2 marks |

| Operational Aspects of KYC | 2-3 marks |

| The Right to Information Act, 2005 | 2 marks |

| Operational Aspects of Deposit Accounts | 2-3 marks |

| Banker’s Special Relationship | 2-3 marks |

| Financial Inclusion and Financial Literacy | 3 marks |

| Grievance Redressal and RBI Integrated Ombudsman Scheme 2021 | 2 marks |

| Types of Collaterals and their Characteristics | 2-3 marks |

| Different modes of Charging securities | 2-3 marks |

| Non-performing Assets/Stressed Assets | 3 marks |

| Important Laws Relating to Recovery of Dues | 3 marks |

| Priority Sector Advances | 2-3 marks |

| Micro, Small, and Medium Enterprises in India | 1 mark |

| Government Sponsored Schemes | 3 marks |

| Self-Help Groups | 2 marks |

| Essentials of Bank Computerisation | 2 marks |

| Operational Aspects of CBS Environment | 2 marks |

| Alternative Delivery Channels – Digital Banking | 3 marks |

| Data Communication Network and EFT Systems | 3 marks |

| Digital Payment Systems – NPCI | 3 marks |

| Impact of Technology Adoption and Trends in Banking Technology | 3 marks |

| Security Considerations and Mitigation Measures in Banks | 3 marks |

| Operational Aspects of Cyber Crimes/ Fraud Risk Management in Cyber Tech | 3 marks |

| Technology trends in Banking, e-RUPI, Fintech, etc. | 2-3 marks |

A few more topics that would give you a solid edge over the cut-off:

- Negotiable Instruments Act 1881, Sections – 181, 85, 83, etc. – 5 marks

With this, you’ll be able to get almost 63 marks.

JAIIB AFM Most Important Topics 2025

Accounting and Financial Management for Bankers focuses on financial statements, accounting principles, and financial decision-making.

Accounting Basics:

- Journal Entries, Ledger, and Trial Balance

- Bank Reconciliation Statement

- Depreciation Accounting

- Ratio Analysis

Financial Management:

- Time Value of Money

- Capital Budgeting and Cost of Capital

- Working Capital Management

- Risk and Return Analysis

Other Important Topics:

| Topic | Marks |

| Bank Reconciliation Statement | 3 marks |

| Accounting Concepts | 2 marks |

| – Business Entity | |

| – Money measurement | |

| – Going concern | |

| – Accounting period | |

| – Objectivity | |

| – Materiality | |

| – Conservatism | |

| – Consistency | |

| – Full disclosure | |

| – Matching | |

| – Revenue recognition | |

| – Dual aspect | |

| – Cost concept | |

| Rectification of errors | 2 marks |

| – Before trial balance | |

| – After trial balance before final accounts | |

| – After final accounts (next period) | |

| Audit | 3 marks |

| Depreciation | 3 marks |

| Balance Sheet formula | 3 marks |

| – Total assets = total shareholder’s equity + total liabilities | |

| Corporate accounting | 3-4 marks |

| Cash flow statement | 3-4 marks |

| Accounts of Banking Companies | 3-4 marks |

| Ratio analysis | 3-4 marks |

| Yield to maturity | 4 marks |

| Forex trading | 2-3 marks |

| Cost of capital | 4 marks |

| – Cost of equity = risk-free rate x β + risk premium | |

| – Debt cost = average debt x tax shield | |

| Capital budgeting | 4 marks |

| Operating cycle (Raw material procurement -> Work in progress -> Finished Goods -> Receivables -> Cash) | 2 marks |

| Income tax | 5 marks |

| GST | 5 marks |

| Marginal costing | 6-8 marks |

| Standard cost | 3-4 marks |

| Zero-based budgeting | 2 marks |

Just covering these topics thoroughly will get you over 70 marks. So make sure you don’t leave any of these important topics out.

JAIIB RBWM Important Topics 2025

The fourth paper, Retail Banking and Wealth Management is a more recent addition to the JAIIB syllabus, introduced in the JAIIB June 2023 cycle. Based on the June and October 2023 cycles, we have compiled these topics as the important ones you need to cover to achieve at least 50 marks.

- Module A

- 1: Retain Banking Introduction – 1 to 2 marks

- 2: Retail Banking Role within the Bank Operations – 2 to 4 marks

- 3: Applicability of Retail Banking Concepts and Distinction between Retail and Corporate/Wholesale Banking – 2 to 3 marks

- 4: Branch Profitability – 2 to 3 marks

- Module B

- 5: Customer requirements

- 6: Product Development process

- 7: Credit scoring

- 8: Important retail liability products

- 9: Important retail asset products

- 10: Credit and debit cards

- 11: Remittance products

- 14: Recovery of retail loans

- 16: Securitization

- Module C

- 18: Delivery Channels in Retail Banking

- 19: Delivery Models

- 21: Service Standards for Retail Banking

- Module D

- 23: Importance of Wealth Management

- 24: Investment Management

- 25: Tax Planning

- Module E – Additional reading material on Home Loans, important for case study

- 27: Lender’s Appraisal Procedure

- 28: Housing Finance and Tax Planning

- 29: Mortgage Advice

- 30: Valuation of Real Property

Total number of units to cover in RBWM = 22. Covering these units and their MCQs with take you over 70 marks.

Importance of Important Topics

Understanding the important topics for JAIIB is important for aspirants looking to succeed in the 2025 exam.

- Focusing on important topics in JAIIB helps streamline preparation, making it more efficient.

- Mastering key topics boosts exam confidence and reduces anxiety.

- Understanding high-yield topics ensures effective time management during the exam.

- Prioritizing important areas enhances conceptual clarity and problem-solving skills.

- Regular practice on critical topics improves accuracy in answering questions.

- Key topics make revision focused, ensuring efficient coverage before the exam.

- Emphasizing practical application and current affairs boosts performance in relevant sections.

- Focusing on important topics ensures thorough preparation and maximizes exam success chances.

JAIIB Study Material Compilation

- CAIIB Electives Exam Analysis 2025, June All Shifts Review

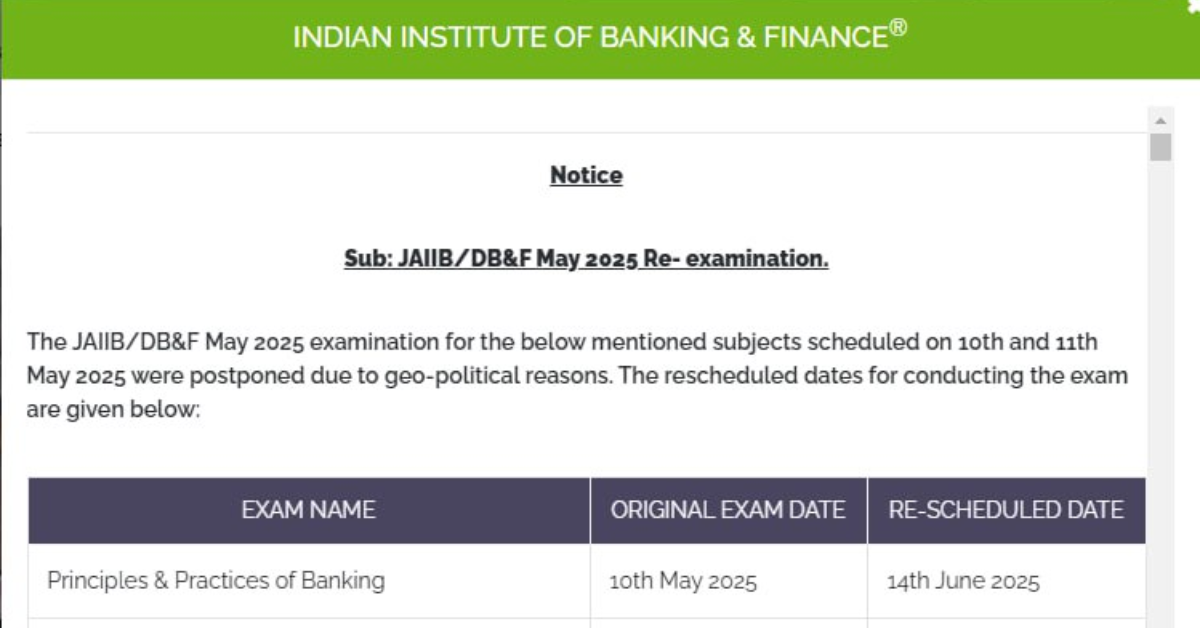

- JAIIB PPB and AFM New Exam Dates Out for Affected Areas, May Cycle

- JAIIB RBWM Exam 2025 Analysis for Shift 1, 2 & 3 – 18th May 2025

- JAIIB Exam Analysis 2025, May Cycle, All Shifts Covered

- JAIIB AFM Exam Analysis 2025, May All Shifts Review

- JAIIB PPB Exam Analysis 2025, May All Shifts Review

- JAIIB IE and IFS Exam Analysis 2025, 4th May 2025 Detailed Analysis

- JAIIB Memory Based Paper, Download IE&IFS, PPB, AFM, RBWM PDF

- JAIIB Result Calculator 2025, Calculate Your JAIIB Marks

Hello, I’m Aditi, the creative mind behind the words at Oliveboard. As a content writer specializing in state-level exams, my mission is to unravel the complexities of exam information, ensuring aspiring candidates find clarity and confidence. Having walked the path of an aspirant myself, I bring a unique perspective to my work, crafting accessible content on Exam Notifications, Admit Cards, and Results.

At Oliveboard, I play a crucial role in empowering candidates throughout their exam journey. My dedication lies in making the seemingly daunting process not only understandable but also rewarding. Join me as I break down barriers in exam preparation, providing timely insights and valuable resources. Let’s navigate the path to success together, one well-informed step at a time.