Calculation of YTM(Yield to Maturity): The Calculation of YTM(Yield to Maturity ) for the JAIIB Exam is one of the most important topics for JAIIB. JAIIB exam is conducted twice a year. So, here we are providing the notes of Calculation of YTM(Yield to Maturity )– Basics of Business Mathematics notes for JAIIB.

Download Calculation of YTM(Yield to Maturity) Here

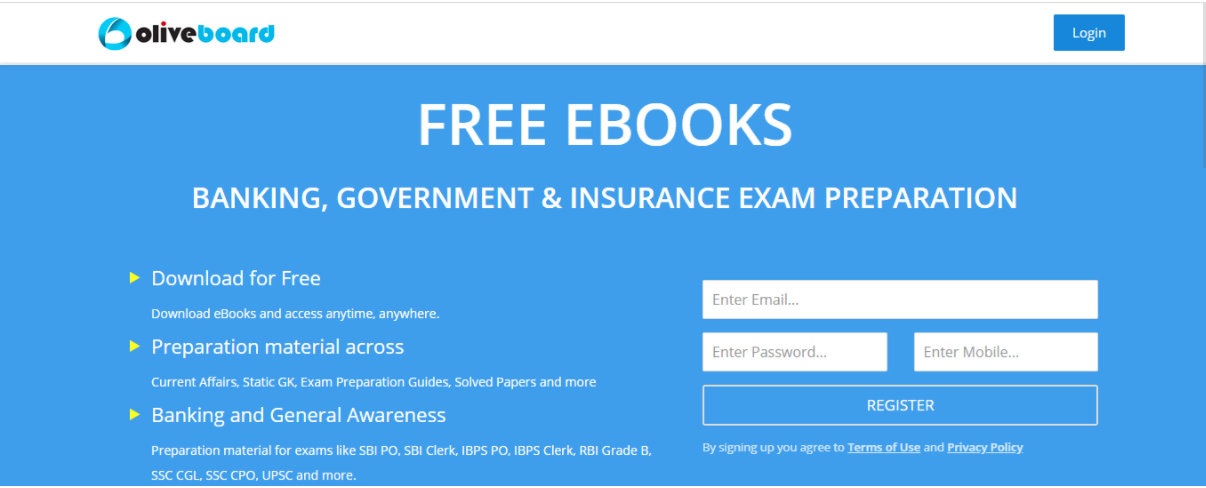

How To Download The Free Calculation of YTM(Yield to Maturity) pdf for JAIIB?

Step 1: Click on the download link. You will be taken to Oliveboard’s FREE E-Books Page.

Step 2: Register/Login to the Free E-Books Page of Oliveboard (It is 100% free, You just enter your valid email ID and a password to be able to download the Calculation of YTM(Yield to Maturity) pdf.

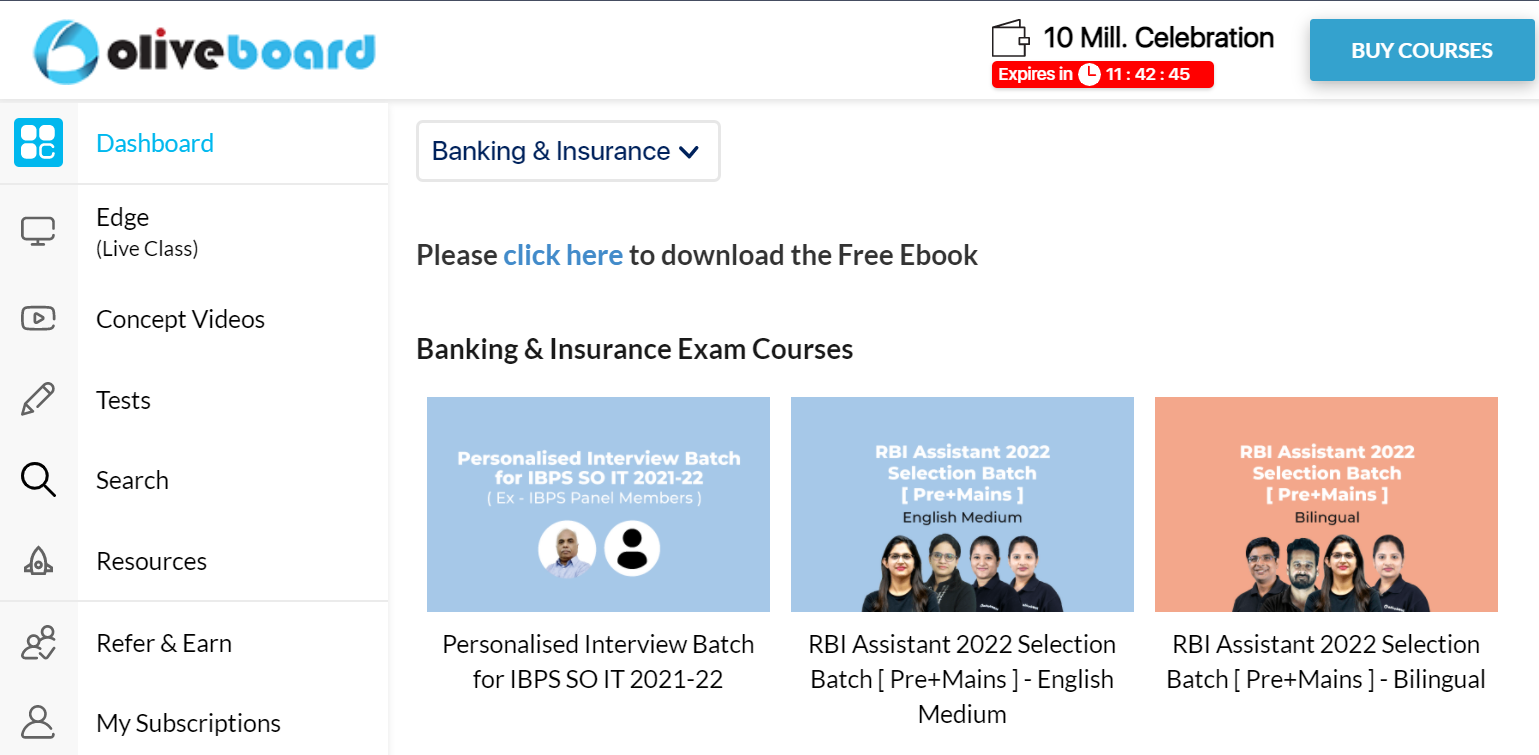

Step 3: After Logging in, you will be able to download the free e-book by clicking on “click here” as shown in the snap below.

What’s there in the ebook of Calculation of YTM(Yield to Maturity)?

| Table of Content |

| Meaning of Debt |

| What are Bonds? |

| Why Investment is Important? |

| Characteristics of a Bond |

| Types of Bonds |

| Valuation of Bonds |

| Bond Value with Semi-Annual Interest |

| Current Yield on Bond |

| Yield-To-Maturity of Bond |

| Duration of Bond |

| Bond Price Volatility |

Sneak-Peak into Calculation of YTM(Yield to Maturity):

What’s there in the ebook?

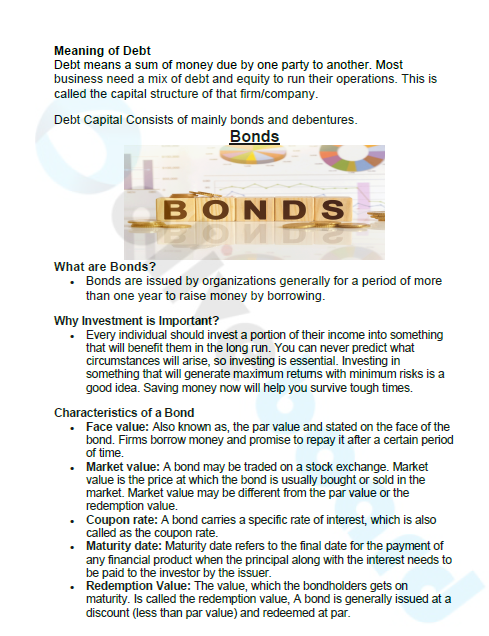

Meaning of Debt

Debt means a sum of money due by one party to another. Most businesses need a mix of debt and equity to run their operations. This is called the capital structure of that firm/company.

Debt Capital Consists of mainly bonds and debentures.

Bonds

What are Bonds?

- Bonds are issued by organizations generally for a period of more than one year to raise money by borrowing.

Why Investment is Important?

- Every individual should invest a portion of their income into something that will benefit them in the long run. You can never predict what circumstances will arise, so investing is essential. Investing in something that will generate maximum returns with minimum risks is a good idea. Saving money now will help you survive tough times.

Characteristics of a Bond

- Face value: Also known as, the par value and stated on the face of the bond. Firms borrow money and promise to repay it after a certain period of time.

- Market value: A bond may be traded on a stock exchange. Market value is the price at which the bond is usually bought or sold in the market. Market value may be different from the par value or the redemption value.

- Coupon rate: A bond carries a specific rate of interest, which is also called as the coupon rate.

- Maturity date: Maturity date refers to the final date for the payment of any financial product when the principal along with the interest needs to be paid to the investor by the issuer.

- Redemption Value: The value, which the bondholders gets on maturity. Is called the redemption value, A bond is generally issued at a discount (less than par value) and redeemed at par.

Types of Bonds:

Fixed Rate Bonds:

In Fixed Rate Bonds, the interest remains fixed through out the tenure of the bond. Owing to a constant interest rate, fixed rate bonds are resistant to changes and fluctuations in the market.

Floating Rate Bonds

Floating rate bonds have a fluctuating interest rate (coupons) as per the current market reference rate.

Zero Interest Rate Bonds

Zero Interest Rate Bonds do not pay any regular interest to the investors. In such types of bonds, issuers only pay the principal amount to the bondholders.

Inflation Linked Bonds

Bonds linked to inflation are called inflation-linked bonds. The interest rate of Inflation-linked bonds is generally lower than fixed-rate bonds.

Perpetual Bonds

Bonds with no maturity dates are called perpetual bonds. Holders of perpetual bonds enjoy interest throughout.

Subordinated Bonds

Bonds which are given less priority as compared to other bonds of the company in cases of a close down are called subordinated bonds. In cases of liquidation, subordinated bonds are given less importance as compared to senior bonds which are paid first.

Bearer Bonds

Bearer Bonds do not carry the name of the bond holder and anyone who possesses the bond certificate can claim the amount. If the bond certificate gets stolen or misplaced by the bond holder, anyone else with the paper can claim the bond amount.

War Bonds

War Bonds are issued by any government to raise funds in cases of war.

Serial Bonds

Bonds maturing over a period of time in installments are called serial bonds.

Climate Bonds

Climate Bonds are issued by any government to raise funds when the country concerned faces any adverse changes in climatic conditions.

Bearer Bonds

Bearer Bonds do not carry the name of the bond holder and anyone who possesses the bond certificate can claim the amount. If the bond certificate gets stolen or misplaced by the bond holder, anyone else with the paper can claim the bond amount.

Covered bond

Covered bond are backed by cash flows from mortgages or public sector assets. Contrary to asset-backed securities the assets for such bonds remain on the issuers balance sheet.

JAIIB Study Material Compilation

Also Read:

- 5-Important Tips To Crack JAIIB Exams| Check Here (oliveboard.in)

- JAIIB Frequently Asked Questions- 2022| Check Here (oliveboard.in)

- JAIIB Genius | JAIIB Weekly Quiz PDF – JAIIB Questions PDF (oliveboard.in)

- JAIIB Full Form – Junior Associate of the Indian Institute of Bankers (oliveboard.in)

- JAIIB and CAIIB Books- Exams Syllabus, Books, and more (oliveboard.in)

Also Check:

- JAIIB 2022 Exam -Notification Released (oliveboard.in)

- JAIIB Notification 2022 – Notification PDF, Eligibility, (oliveboard.in)

- JAIIB Apply Online – Application Form 2022, Fees, Instru (oliveboard.in)

- JAIIB Eligibility – Age, Degree, Nationality, Members (oliveboard.in)

- JAIIB Syllabus – Complete List of Papers, Modules (oliveboard.in)

- JAIIB Exam Pattern 2022 – Details of Pattern, Marking (oliveboard.in)

- JAIIB Admit Card November 2022 – Steps and Direct Download (oliveboard.in)

- JAIIB 2022 Cut Offs – Check JAIIB Minimum Cut Off (oliveboard.in)