Finance & Management is one of the three papers (F&M, ESI, and Descriptive English) that appear in the RBI Grade B Phase-2 examination. Given that this paper is applicable to only RBI Grade B and other bank examinations, in general, do not focus on this subject specifically, students may find it difficult to prepare for this section. Hence this blog focuses on how you can prepare for FM as a part of the preparation for RBI Grade B Phase-2. We can break down the F&M section into two parts: Finance and Management. You need to equally focus on both these sub-sections. AS per the trend observed in the past year’s papers, 50% of the F&M paper comprises management questions. Let us begin with the approach for Finance & Management Preparation.

How to Approach Finance & Management Preparation?

This is one of the toughest parts of the exam owing to its technical nature. Most people do not have a background in finance and management, so this is the paper you need to prepare for the most. The difficulty level of the 2017 paper was very high.

The topics to be prepared for F&M are listed below:

Financial System

- Regulators of Banks and Financial Institutions

- Reserve Bank of India- functions, and conduct monetary policy

- Banking System in India – Structure and concerns, Financial Institutions – SIDBI, EXIM Bank, NABARD, NHB, etc, Changing landscape of banking

- Impact of the Global Financial Crisis of 2007-08 and the Indian response

Financial Markets

- Primary and Secondary Markets (Forex, Money, Bond, Equity, etc.), functions, instruments, recent developments.

General Topics

- Risk Management in Banking Sector

- Basics of Derivatives

- Global financial markets and International Banking – broad trends and the latest

- Financial Inclusion

- Alternate source of finance, private and social cost-benefit, Public-Private Partnership

- Corporate Governance in the Banking Sector, the role of e-governance in addressing issues of corruption and inefficiency in the government

- The Union Budget – Concepts, approach, and broad trends

- Inflation: Definition, trends, estimates, consequences, and remedies (control): WPI, CPI – components and trends; striking a balance between inflation and growth through monetary and fiscal policies.

- FinTech

Management

Fundamentals of Management & Organizational Behaviour:

- Introduction to management;

- Evolution of management thought: Scientific, Administrative, Human Relations, and Systems approach to management;

- Management functions and Managerial roles;

- Nudge theory

Meaning & concept of organizational behaviour;

- Personality: meaning, factors affecting personality, Big five model of personality;

- the concept of reinforcement;

- Perception: concept, perceptual errors.

- Motivation: Concept, importance, Content theories (Maslow’s need theory, Alderfer’s ERG theory, McCllelands’ theory of needs, Herzberg’s two-factor theory) & Process theories (Adams equity theory, Vroom’s expectancy theory).

Leadership:

- Concept, Theories (Trait, Behavioural, Contingency, Charismatic, Transactional and Transformational Leadership;

- Emotional Intelligence: Concept, Importance, Dimensions.

- Analysis of Interpersonal Relationship: Transactional Analysis, Johari Window;

- Conflict: Concept, Sources, Types, Management of Conflict;

- Organizational Change: Concept, Kurt Lewin Theory of Change;

- Organizational Development (OD): Organisational Change, Strategies for Change, Theories of Planned Change (Lewin’s change model, Action research model, Positive model).

Ethics at the Workplace and Corporate Governance:

- Meaning of ethics, why ethical problems occur in business.

- Theories of ethics: Utilitarianism: weighing social cost and benefits, rights and duties, Justice and fairness, ethics of care, integrating utility, rights, justice and caring,

- An alternative to moral principles: virtue ethics, teleological theories, egoism theory, relativism theory, Moral issues in business:

- Ethics in Compliance, Finance, Human Resources, Marketing, etc. Ethical Principles in Business: introduction, Organization Structure, and Ethics, Role of Board of Directors, Best Practices in Ethics Programme, Code of Ethics, Code of Conduct, etc.

Corporate Governance:

- Factors affecting Corporate Governance;

- Mechanisms of Corporate Governance

Communication:

- Steps in the Communication Process;

- Communication Channels;

- Oral versus Written Communication;

- Verbal versus non-verbal Communication; upward, downward and lateral communication;

- Barriers to Communication, Role of Information Technology.

Explore Finance & Management Notes & Video Lessons Here

I. Finance & Management Preparation Tips (F&M)

1. General Tips

» Finance

- Get your concepts strong.

- Cover all the topics given in the syllabus.

- Follow current affairs related to the topics in the Finance syllabus.

» Management

Cover all the chapters given in the syllabus and have a clear understanding of the concepts to be able to write descriptive as well as objective answers.

II. Important Chapters for Objective Paper

- Primary & Secondary Markets (Forex, Money, Bond, Equity, etc); functions, instruments, recent development

- Risk management in the Banking sector – Types of risks, Basel norms

- Basics of Derivatives – Forwards, Futures, Options (call & put option)

- Inflation: Definition, CPI & WPI

- Miscellaneous – Capital budgeting & break-even leverage (only concept)

- Current Affairs – Starting from August 2020 (Finance in news)

Take ESI and F&M Topic Tests Here

III. Important Chapters for Descriptive Paper

- Corporate Governance in the Banking sector – Recent developments & Important committees

- PPP model (Alternate Sources of Finance)

- Impact of Global Financial Crisis of 2007-08 and the Indian response

- Financial Inclusion and financial technology

- Changing landscape in the banking sector – the merger of banks; privatisation; disinvestment; new types of banks (payment & finance banks); views on large corporate houses getting banking license (RBI license).

IV. Approach for Finance & Management (F&M) Descriptive Paper

Step-01: Start with the Management section. The desc. ques. from this section would be static in nature. Be thorough with the concepts.

Step-02: While reading each chapter, note down key words for each chapter (as part of various theories/concepts).

Step-03: For the Finance section, make a list of current affairs-related topics (in news lately) and static topics and write down keywords for each one.

Step-04: While writing the answers, make sure you are building your answers around these keywords.

Step-05: Practice at least 12-15 answers before you go for the examination.

Start out by Practising Free Descriptive Tests for F&M

Download free eBook: RBI Grade B Sample Descriptive Questions for ESI & FM

We hope that you liked the content given in this blog post and are now clear about the approach for Finance & Management Preparation?

Do not let the length of the above-mentioned list of preparation resources intimidate you. You do not have to read them cover to cover, as that is going to take plenty of time. You need to be smart and selective in your preparation and be selective about reading.

The best way to find out what you need to prepare from these resources is by referring to the RBI Grade B preparation material prepared by experts in the industry after thorough research. This is where RBI Grade B Mock Tests come in handy.

The Mock Tests are created by exam toppers and experts who have extensive knowledge about the exam, its pattern, and syllabus. Taking RBI Grade B Mock Tests will:

- Familiarize yourself with the pattern, nature, and difficulty level of the exam

- Help you figure out exactly what you need to focus on for the exam from your study material so you can be smart & selective and save time

- Determine your speed & accuracy

- Identify your strengths & weaknesses

Try it yourself! Take Free RBI Grade B Phase 2 Mock Tests.

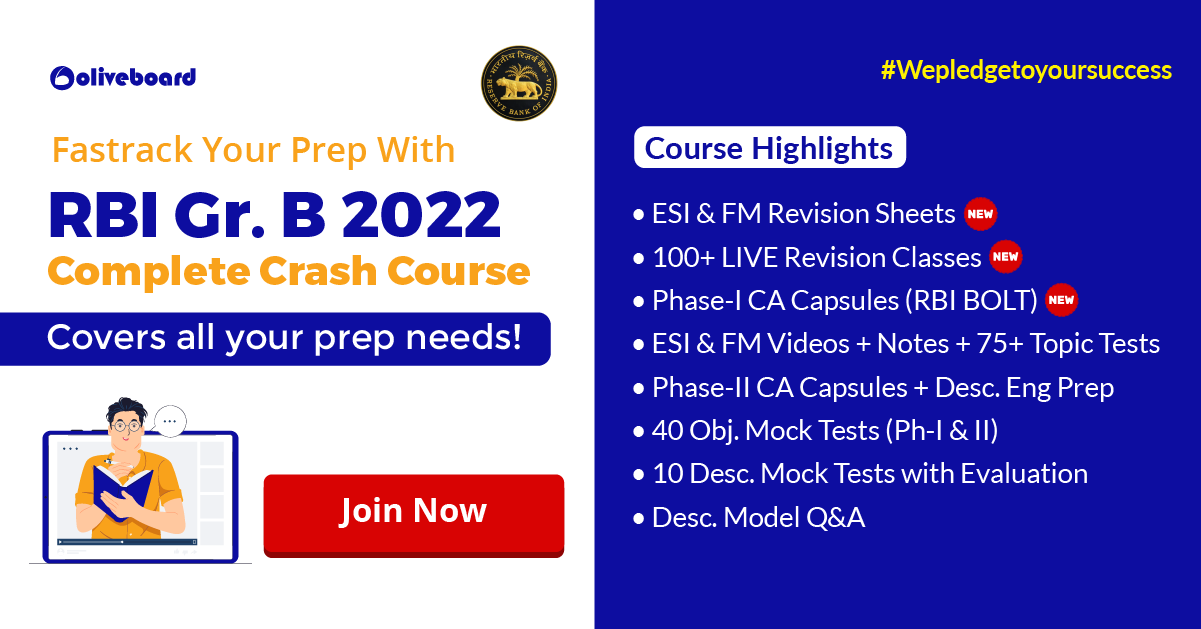

RBI Grade B Crash Course 2022 by Oliveboard

If you are someone who is aiming to crack RBI Grade B Exam and are confused about how to go about the preparation, Oliveboard has come up with RBI Grade B Online Crash Course to help you ace the RBI Grade B exam for sincere aspirants. Read below what is included in the Course.

Oliveboard offers the best RBI Grade B Online Coaching that can help you prepare comprehensively for the exam. Oliveboard’s RBI Grade B Online Crash Course 2022 will be your one-stop destination for all your preparation needs.

Go through free RBI Grade B study materials PDFs and take up RBI Grade B Free mock tests online.

1. Course Details

RBI Grade B Cracker is designed to cover the complete syllabus for the 3 most important subjects: GA for Phase 1 and Objective + Descriptive portions of ESI + F&M for Phase 2 exam.

Not just that, it also includes Mock Tests & Live Strategy Sessions for English, Quant & Reasoning for Phase 1. The course aims to complete your preparation in time for the release of the official notification.

1.1. Features:

RBI Grade B 2022 Cracker Course Offerings:

- ESI & FM Revision Sheets

- 100+ LIVE Revision Classes

- Phase-I CA Capsules (RBI BOLT)

- ESI & FM Videos + Notes + 75+ Topic Tests

- Phase-II CA Capsules + Desc. Eng Prep

- 40 Obj. Mock Tests (Ph-I & II)

- 10 Descriptive Mock Tests with Evaluation

- Descriptive Model Q&A

1.2. How to Enroll for the RBI Grade B Online Course 2022?

Sign up or log in using the link given below. You will be redirected to the payments page. Read the course offerings and subscribe to RBI Grade B 2022 Cracker Course.

Now that you are aware of the RBI Grade B Online Classes, why wait?

Get Started with RBI Grade B 2022 Online Crash Course comprising LIVE Classes, Video Lessons, Detailed Study Notes & All-India Mock Tests for Phase 1 & Phase 2.

Use Coupon Code ‘LAUNCH’ & Get 30% off on RBI Courses

Connect with us on:

The most comprehensive online preparation portal for MBA, Banking and Government exams. Explore a range of mock tests and study material at www.oliveboard.in

Oliveboard Live Courses & Mock Test Series

- Monthly Current Affairs 2024

- Download RBI Grade B PYQ PDF

- Download IFSCA Grade A PYQs

- Download SEBI Grade A PYQs

- Attempt Free SSC CGL Mock Test 2024

- Attempt Free IBPS Mock Test 2024

- Attempt Free SSC CHSL Mock Test 2024

- Download Oliveboard App

- Follow Us on Google News for Latest Update

- Join Telegram Group for Latest Govt Jobs Update